Bank of America Certified Check Fee: A Deep Dive into Those Pesky Charges

Ah, certified checks. They're like the slightly more official older sibling of a regular check. You know, the one who actually went to college and has a "real job." But just like anything else in the financial world, that extra bit of security comes with a price: the dreaded certified check fee. And if you're a Bank of America customer, you might be wondering just how much that little piece of paper is going to set you back.

Let's be real, nobody likes hidden fees. It's like finding out you have to pay extra for guac at Chipotle – totally annoying and slightly infuriating. But alas, the world of banking is built on them. So, before you waltz into your local Bank of America branch, demanding a certified check and then clutching your pearls at the fee, let's take a deep dive into the why, the how much, and the what-to-do about it.

First off, why even bother with a certified check? In this digital age of Venmo and Apple Pay, they seem about as relevant as a flip phone. But here's the thing: sometimes, you need that extra level of assurance. Think large purchases like a car or a down payment on a house. A certified check is like a warm, fuzzy blanket of financial security for the recipient. It basically screams, "This check is legit, and you *will* get your money!"

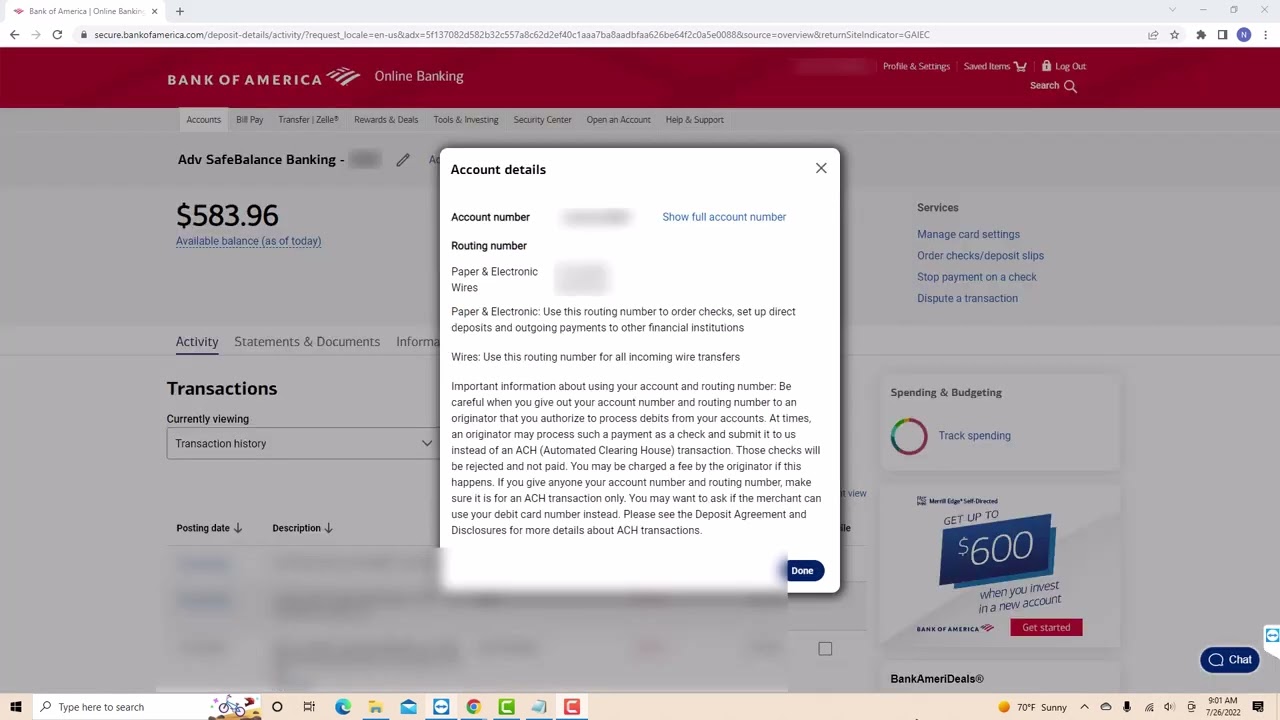

But how does it actually work? Well, when you get a check certified, Bank of America (or any bank, really) verifies you have the funds available in your account and then sets that money aside. They're essentially vouching for you, guaranteeing that the check will clear. And for this service, they charge a fee. Makes sense, right? They're putting their neck on the line, after all.

Now, for the million-dollar question (or perhaps, in this case, the ten-dollar question): how much does Bank of America charge for this certified check extravaganza? Typically, you're looking at a fee around $15. But hold your horses before you start protesting! Fees can vary slightly depending on your account type and the specific branch you visit. It's always best to check with your local branch or hop onto their website for the most up-to-date pricing.

Advantages and Disadvantages of Bank of America Certified Checks

| Advantages | Disadvantages |

|---|---|

| Provides a higher level of security than a personal check | Involves a fee, typically around $15 |

| Guaranteed by the bank, ensuring the recipient will receive their funds | Can be less convenient than electronic payment methods |

| Often required for large purchases, such as real estate transactions | Requires a trip to the bank to obtain |

While a certified check might seem like a relic of the past, it still serves an important purpose in certain financial transactions. Understanding the fees associated with them is just part of being a savvy consumer in the ever-evolving landscape of personal finance.

Bank Of America Cashier's Check Template | Kennecott Land

1937 Farmers Bank Of Carson Valley | Kennecott Land

Why does Bank of America charge a fee for certified checks? | Kennecott Land

Pin by Evan Michael on Quick Saves | Kennecott Land

Chase Cashier's Check Template | Kennecott Land

What Is Cashier's Check | Kennecott Land

Bardy Cole/Mark Dowell's fake | Kennecott Land

bank of america certified check fee | Kennecott Land

Chase Bank Wiring Fee | Kennecott Land

Parts Of A Bank Account Number at Judith Comerford blog | Kennecott Land

Chase Cashier's Check Template | Kennecott Land

bank of america certified check fee | Kennecott Land

bank of america certified check fee | Kennecott Land

However second financial is apparently usual in the says you to | Kennecott Land

Bank Of America Cuts Me A 1¢ Check I Don | Kennecott Land