Bank of America eChecking: Your Questions Answered

Remember those days when you'd physically write a check, find a stamp (who even has stamps anymore?), and then walk to the mailbox to pay bills? Yeah, me neither. Okay, maybe I remember it vaguely, like a hazy dream from the dark ages. But seriously, technology has revolutionized banking, and Bank of America eChecking is a prime example. But what exactly is it, and how can it make your life easier?

Bank of America eChecking is basically the digital age's answer to the traditional checking account. Think of it as the cool, tech-savvy cousin who shows up with a smartphone while everyone else is still rocking flip phones. Instead of paper checks and bank lines, you get online and mobile banking, making managing your money as easy as ordering takeout.

The shift towards e-banking began a while back, gaining serious traction with the rise of the internet. People craved convenience and speed, and let's be honest, waiting in line at the bank is about as fun as a root canal. Bank of America, always one to adapt, hopped onto this digital express train and introduced eChecking as a solution for the modern user. No more frantic searches for the checkbook or last-minute trips to the ATM – eChecking put you in the driver's seat of your finances, accessible with a few clicks or taps.

But like any technological leap, it's not just about shiny new features. Bank of America eChecking brought with it a whole slew of benefits. Think environmental friendliness with reduced paper waste, increased security with advanced fraud protection, and let's not forget the sheer joy of paying bills at 2 AM in your pajamas – because who needs sleep when you can manage your money?

Of course, with any new system, there can be hiccups. Security concerns were initially a major issue for people. The thought of your financial information floating around in the digital ether was enough to give anyone pause. However, Bank of America invested heavily in security measures, implementing robust encryption and multi-factor authentication to ensure that your hard-earned cash stays, well, yours. This helped build trust and paved the way for the widespread adoption we see today.

Advantages and Disadvantages of Bank of America eChecking

| Advantages | Disadvantages |

|---|---|

| Convenience of online and mobile banking | Potential security risks if proper precautions are not taken |

| Environmentally friendly with reduced paper usage | Reliance on technology and internet access |

| Enhanced security features like fraud monitoring | Limited access to physical branches for some transactions |

While the digital age has brought a tidal wave of change, the essence of banking remains the same: managing your money securely and conveniently. Bank of America eChecking simply provides a modern, efficient way to do so. It's about empowering you, the customer, with tools and information to make smarter financial decisions, all from the comfort of your couch (or wherever you happen to be when that bill reminder pops up).

e checking bank of america | Kennecott Land

Where do I find my routing number? | Kennecott Land

Reopen Bank Account Bank Of America | Kennecott Land

e checking bank of america | Kennecott Land

Checking Account Check Registers 1 Answers at Linda Greenfield blog | Kennecott Land

Pdf Printable Fake Bank Statement | Kennecott Land

:max_bytes(150000):strip_icc()/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_20202-5d1e68ee4bba4714baace78ea019ee12.jpg)

What Is a Bank Account Number? | Kennecott Land

Mailing A Check To Bank at Floyd Gartner blog | Kennecott Land

Fake bank of america statements | Kennecott Land

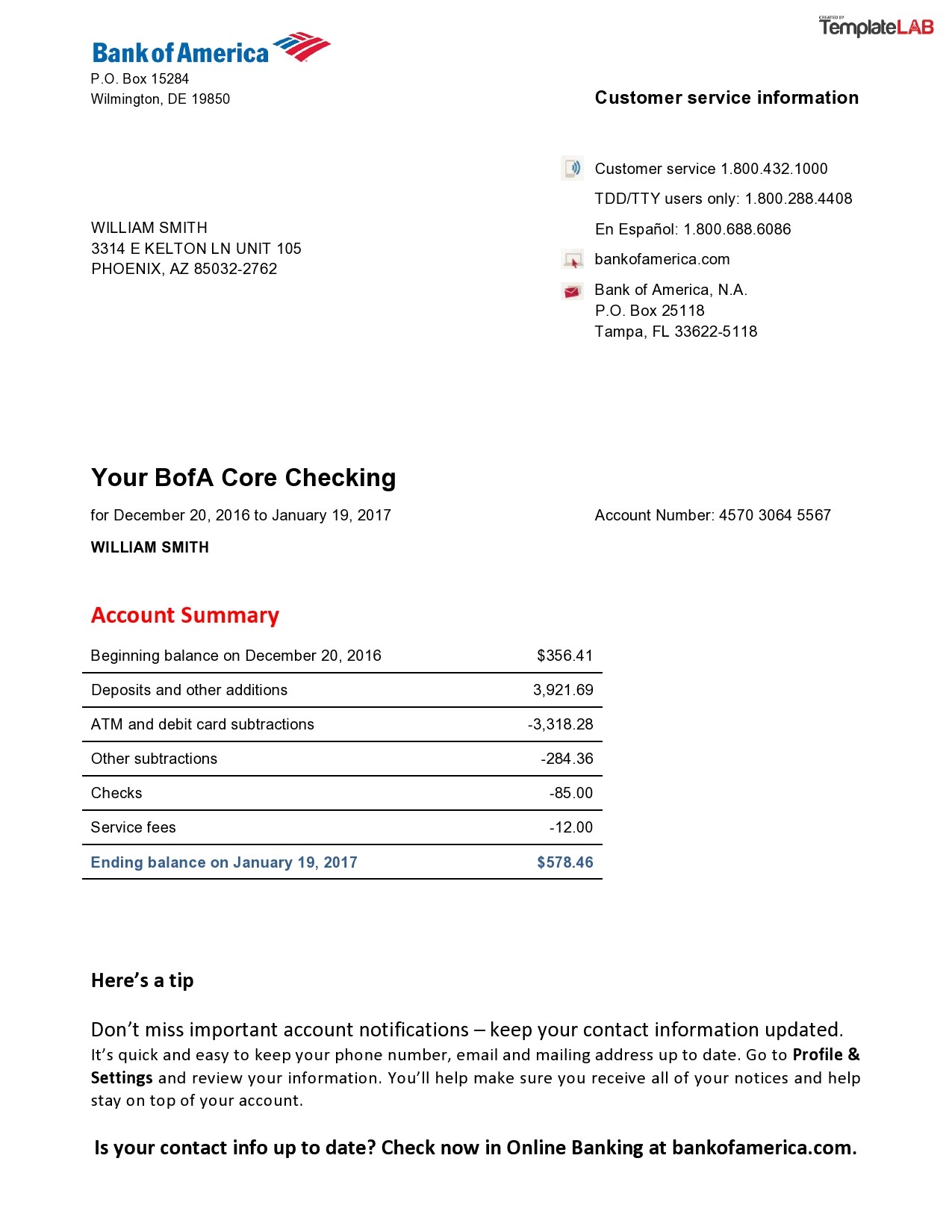

Bank Of America Statement Template Beautiful 023 Bank America Statement | Kennecott Land

Bank, Statement, Fifth Third, Template, Proof of Income, Earnings | Kennecott Land

Premier Bank Routing Number Michigan at George Askew blog | Kennecott Land

Checking Account Check Registers 1 Answers at Linda Greenfield blog | Kennecott Land

How To Order Checks From Chase | Kennecott Land

Bank Of America Statement Template Lovely Best S Of Sample Statement | Kennecott Land