Can You Deposit a Third-Party Check? Navigating the Financial Maze

In today's digital age, where financial transactions happen at lightning speed, it's easy to forget about the enduring relevance of the humble check. But what happens when that check has a few extra names on it? Welcome to the world of third-party checks, where navigating the rules and regulations can feel like solving a financial puzzle.

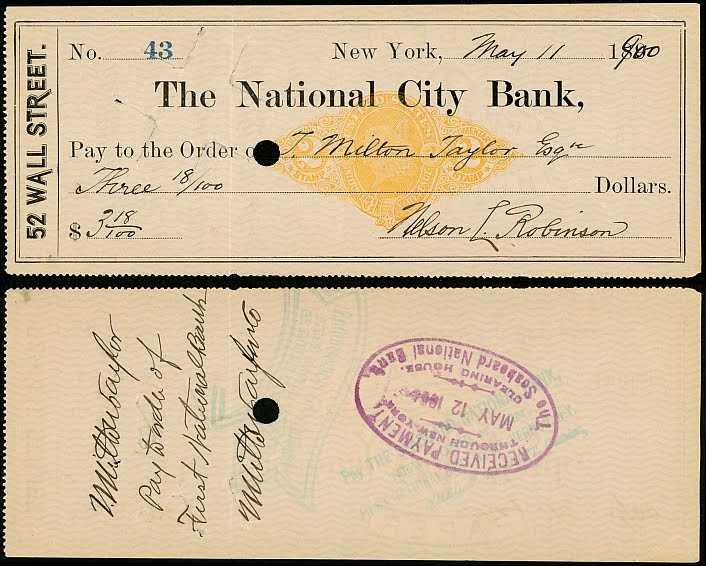

Imagine this: your friend owes you money, but instead of sending it directly, they give you a check made out to them by someone else. This, my friend, is a third-party check – a financial instrument that often raises eyebrows and prompts questions.

The world of third-party checks is shrouded in a mix of caution and confusion. Banks, naturally wary of fraud, tend to approach them with a heightened sense of scrutiny. Meanwhile, consumers, faced with unfamiliar terminology and procedures, might feel a sense of uncertainty.

But fear not, intrepid financial explorer! In this comprehensive guide, we'll demystify the realm of third-party checks. We'll delve into the reasons behind their existence, the challenges they present, and the steps you can take to navigate this financial terrain with confidence.

Whether you're a seasoned check-casher or a digital native encountering this financial relic for the first time, understanding the ins and outs of third-party checks is essential for safeguarding your finances and avoiding potential pitfalls. So, grab your magnifying glass and your detective hat, and let's embark on this journey together.

Banks That Accept Third-Party Checks: A Mixed Bag

Here's the thing about third-party checks: there's no one-size-fits-all answer. Some banks might accept them with open arms, while others might slam the vault door shut. It often depends on the bank's policies, the check amount, and your relationship with the bank.

For instance, your own bank, where you have an established history and trust, might be more willing to cash a third-party check for you. However, they might impose restrictions, such as limits on the amount or holding funds for an extended period. On the other hand, trying to cash a third-party check at a bank where you're not a customer is like walking into a stranger's party and asking for the birthday cake – the chances are slim.

Instead of playing financial roulette, it's always wise to contact your bank directly and inquire about their specific policies on third-party checks. This way, you'll be armed with the right information and can avoid any unwelcome surprises.

Navigating the Third-Party Check Maze: Tips and Tricks

Dealing with third-party checks can feel like traversing a financial minefield, but with a few savvy strategies, you can emerge unscathed. Here are some tips to keep in mind:

- Communication is Key: Before you even lay hands on a third-party check, have a frank conversation with the payee (the person it's made out to). Understand the source of the check, the reason for using a third-party check, and any potential issues that might arise.

- Endorsement Etiquette: When endorsing a third-party check, make sure both you and the original payee sign it. This creates a clear chain of ownership and reduces the risk of complications.

- Documentation is Your Friend: Keep records of all transactions related to the third-party check, including dates, times, and any communication with the bank or the original payee. This documentation can be invaluable if any disputes or issues arise later.

Conclusion:

The world of third-party checks might seem like a relic from a bygone era, but these financial instruments are still very much in circulation. While they can present challenges, understanding the nuances, risks, and best practices can empower you to navigate this financial landscape with confidence. Remember to communicate openly, prioritize documentation, and always err on the side of caution when dealing with third-party checks. After all, in the world of finance, knowledge is power, and a cautious approach is always your best bet.

What are Third Party Checks? (Example & Explanation) | Kennecott Land

What Banks Cash Third Party Checks | Kennecott Land

Everything You Need to Know About Cashing a Third Party Check | Kennecott Land

Finance Tips: Where Can I Cash a Third | Kennecott Land

How To Cash A Third Party Government Check | Kennecott Land

Where can I cash a third party check | Kennecott Land

Banks That Accept Third | Kennecott Land

Does Wells Fargo Accept Third Party Checks? Exploring the Pros and Cons | Kennecott Land

13 Banks That Accept Third | Kennecott Land

Can I Sign Over a Check to a Third Party? | Kennecott Land

How to Cash Third Party Check: A Beginner | Kennecott Land

![Does Walmart Cash Third Party Checks In 2023? [Guide]](https://i2.wp.com/querysprout.com/wp-content/uploads/2021/04/How-Much-Does-It-Cost-To-Cash-A-Check-At-Walmart_-768x384.jpg)

Does Walmart Cash Third Party Checks In 2023? [Guide] | Kennecott Land

![Who Cashes Third Party Checks Near Me? [+Endorsing]](https://i2.wp.com/bucksandcents.com/wp-content/uploads/2021/05/Third-Party-Checks.jpg)

Who Cashes Third Party Checks Near Me? [+Endorsing] | Kennecott Land

does walmart cash third party checks | Kennecott Land

![Instantly Cash 3rd Party Checks Easily [Guide]](https://i2.wp.com/greeneryfinancial.com/wp-content/uploads/2022/05/Instantly-Cash-3rd-Party-Checks-Easily-Guide.jpg)

Instantly Cash 3rd Party Checks Easily [Guide] | Kennecott Land