Cara Kira Gaji Per Jam: Unlocking the Secrets of Hourly Wages

In today's dynamic work landscape, understanding the intricacies of your paycheck is more crucial than ever. Whether you're a freelancer taking on gigs, a part-timer juggling multiple jobs, or simply curious about how hourly wages are calculated, "cara kira gaji per jam" holds the key to unlocking this financial mystery. This phrase, meaning "how to calculate hourly wages" in Malay, is more than just a technical term; it represents financial awareness and empowerment.

Navigating the world of hourly pay can feel like traversing a labyrinth of numbers and regulations. The allure of a seemingly simple hourly rate can quickly become complicated when factoring in overtime, bonuses, and deductions. "Cara kira gaji per jam" acts as your compass, guiding you through this maze and empowering you to take control of your earnings.

Imagine this: you're offered a lucrative-sounding hourly rate, but without a clear understanding of how your final paycheck is determined, you risk being caught off guard by hidden deductions or missed earning opportunities. This is where the power of "cara kira gaji per jam" comes into play. By grasping the fundamentals of hourly wage calculation, you transform from a passive recipient of a paycheck into an active participant in your financial well-being.

The concept of hourly pay has been woven into the fabric of the labor market for decades, reflecting a shift towards more flexible work arrangements. As the gig economy continues to flourish and remote work opportunities expand, understanding "cara kira gaji per jam" becomes even more critical. It enables both employers and employees to navigate this evolving landscape with transparency and fairness.

However, the seemingly straightforward world of hourly wages is not without its complexities. Discrepancies in pay rates, confusion surrounding overtime regulations, and the rise of gig platforms with varying payment structures underscore the importance of "cara kira gaji per jam." By equipping yourself with this knowledge, you can confidently advocate for fair compensation and ensure you're being remunerated accurately for your valuable time and effort.

Advantages and Disadvantages of Hourly Wages

While hourly wages offer flexibility and transparency, they also come with their own set of advantages and disadvantages. Let's delve into these to gain a comprehensive understanding:

| Advantages | Disadvantages |

|---|---|

| Flexibility for both employees and employers | Potential for income instability |

| Transparency in earnings calculation | Limited access to certain benefits (e.g., paid time off) |

| Opportunity for overtime pay | Susceptibility to fluctuations in work hours |

Best Practices for Implementing Hourly Wages

Implementing hourly wages effectively requires transparency, clear communication, and adherence to labor regulations. Here are some best practices:

- Establish Clear Pay Rates and Overtime Policies: Ensure employees are aware of their hourly rate, how overtime is calculated, and when it applies.

- Implement Accurate Time-Tracking Systems: Utilize reliable time-tracking methods to monitor employee hours worked, ensuring accurate compensation.

- Provide Regular Pay Stubs: Issue detailed pay stubs outlining hours worked, deductions, and gross/net pay to promote transparency.

- Stay Updated on Labor Laws: Remain informed about minimum wage requirements, overtime regulations, and other relevant labor laws.

- Foster Open Communication: Encourage open dialogue with employees regarding any questions or concerns they may have about their pay.

Common Questions and Answers About Cara Kira Gaji Per Jam

Navigating the world of hourly wages often comes with a slew of questions. Here are some common queries and their answers:

- Q: How do I calculate my hourly wage?

- A: Divide your total earnings by the number of hours worked.

- Q: What is overtime pay?

- A: Overtime pay is typically 1.5 times your regular hourly rate, earned for hours worked beyond a certain threshold (e.g., 40 hours per week).

- Q: Are there any deductions from my hourly wage?

- A: Yes, common deductions include taxes, social security contributions, and health insurance premiums.

Conclusion

Mastering the art of "cara kira gaji per jam" is not merely about crunching numbers; it's about empowering yourself with the knowledge to navigate the financial landscape of hourly employment. By understanding how to calculate your earnings, recognize potential pitfalls, and advocate for fair compensation, you gain control over your financial well-being. As the lines between traditional employment and flexible work arrangements continue to blur, "cara kira gaji per jam" becomes an indispensable tool for navigating the evolving world of work, ensuring you're fairly compensated for your valuable time and contributions.

Cara Menghitung Gaji Karyawan Di Excel | Kennecott Land

Rumus Cara Menghitung Uang Lembur Karyawan Dengan Excel | Kennecott Land

Waktu Bekerja & Cara Kira Gaji Lebih Masa | Kennecott Land

Cara Kira Gaji Per Jam, Per Hari Dan Per Bulan Pekerja | Kennecott Land

Cara Kira OT? Guna CALCULATOR INI ( Update 2023 ) | Kennecott Land

Waktu Bekerja & Cara Kira Gaji Lebih Masa | Kennecott Land

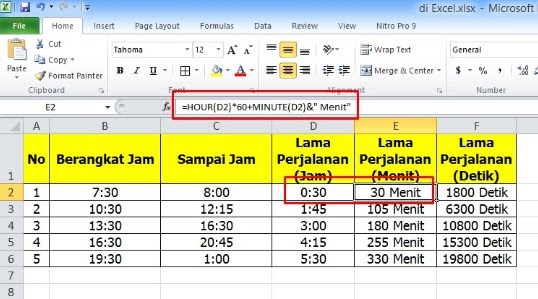

Cara Menghitung Jam ke Menit di Excel dengan Mudah | Kennecott Land

Senarai Cuti Am Yang Wajib Diambil Majikan & Cara Kira Overtime | Kennecott Land

Waktu Bekerja & Cara Kira Gaji Lebih Masa | Kennecott Land

Cara menghitung gaji harian 2021 | Kennecott Land

Cara Kira Gaji Per Hari | Kennecott Land

Cara Menghitung Gaji Per Jam Menurut UU Terbaru | Kennecott Land

Timesheet Excel Kira Jumlah Jam Kerja Lebih Masa (OT) | Kennecott Land

cara kira gaji per jam | Kennecott Land

Cara Kira Gaji Pekerja Sambilan | Kennecott Land