Decoding Medicare Plan B Costs: Your Guide

Let's be real, navigating the world of Medicare can feel like trying to find the perfect vintage denim – overwhelming and a little confusing. But unlike that perfect pair of jeans, understanding your Medicare Plan B costs is crucial. It's about securing your healthcare future, and who doesn't want that peace of mind? So, grab your metaphorical magnifying glass, because we're about to dissect the Medicare Plan B cost landscape.

Medicare Plan B, also known as medical insurance, covers services like doctor visits, outpatient care, and some preventive services. Think of it as the essential building block of your Medicare coverage. But, like any good building block, it comes with a price tag. Understanding the Medicare Plan B cost structure, including premiums, deductibles, and co-insurance, is key to budgeting and making informed healthcare decisions.

Historically, Medicare Plan B costs have been subject to adjustments, influenced by factors like inflation and healthcare spending. These fluctuations highlight the importance of staying updated on the current Medicare Plan B cost schedule. Resources like the official Medicare website and other reputable sources provide detailed information about the latest pricing, ensuring you're always in the know.

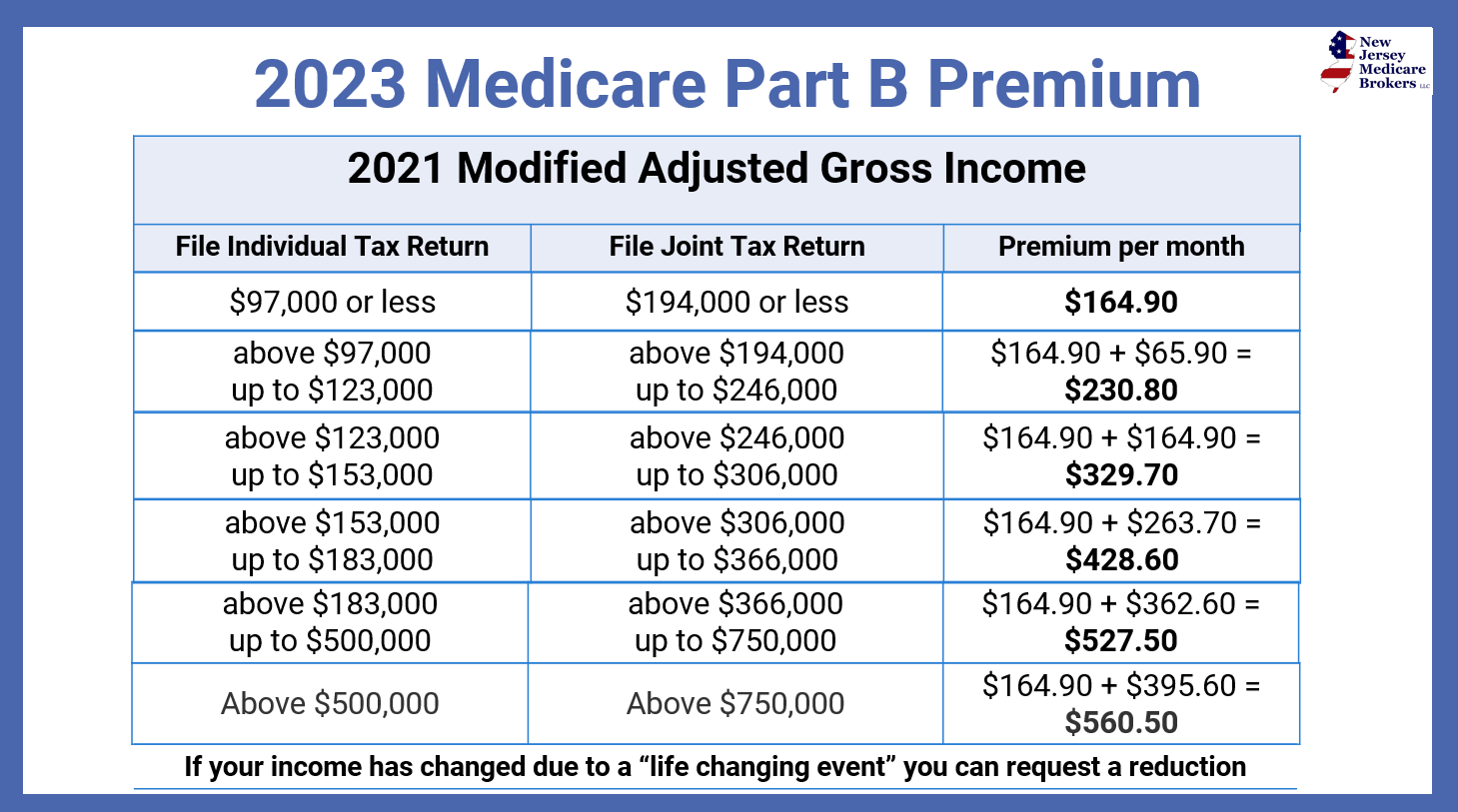

Navigating the nuances of Medicare Plan B pricing can be tricky. There are different premium categories based on income, and understanding which one applies to you is essential. It's also important to be aware of potential late enrollment penalties, which can significantly impact your overall costs. Being proactive and informed is your best strategy for managing your Medicare Plan B expenses effectively.

Understanding your Medicare Plan B expenses isn't just about crunching numbers; it's about empowering yourself to make smart decisions about your health and financial well-being. By taking the time to research and understand the different aspects of Medicare Plan B costs, you're investing in your future health and peace of mind. Think of it as curating your own personalized healthcare plan, tailored to your individual needs and budget.

Medicare Plan B helps cover medically necessary services and preventive services like annual wellness visits and specific screenings. Understanding the current Medicare Plan B cost schedule involves familiarizing yourself with the standard monthly premium, the annual deductible, and the coinsurance, which is typically 20% of the Medicare-approved amount for most services after you meet the deductible.

One benefit of understanding the Medicare Plan B cost structure is better budgeting. Knowing the expected costs allows you to plan your healthcare spending and avoid unexpected financial surprises. Another benefit is informed decision-making. With a clear understanding of your coverage and costs, you can make more informed decisions about your healthcare choices. Lastly, avoiding penalties is a key benefit. Understanding the rules about late enrollment penalties helps you avoid unnecessary costs and maintain affordable coverage.

A simple action plan involves regularly reviewing the official Medicare publications and website for updates on Medicare Plan B costs. Comparing your current coverage with other options during the annual Medicare Open Enrollment period can also help you optimize your plan. Talking to a Medicare advisor can provide personalized guidance and answer specific questions about your individual situation.

Advantages and Disadvantages of Understanding Medicare Plan B Costs

| Advantages | Disadvantages |

|---|---|

| Better budgeting and financial planning | Requires time and effort to stay informed |

| Empowered decision-making regarding healthcare choices | Can be complex to understand initially |

| Avoidance of late enrollment penalties | Information can change annually |

FAQs

1. What is Medicare Plan B? (Answer: Medical insurance covering doctor visits, outpatient care, and some preventive services.)

2. How much does Medicare Plan B cost? (Answer: Costs vary based on income and include a monthly premium, annual deductible, and coinsurance.)

3. Where can I find the current Medicare Plan B cost chart? (Answer: The official Medicare website provides up-to-date cost information.)

4. Are there penalties for late enrollment in Medicare Plan B? (Answer: Yes, late enrollment can result in higher premiums.)

5. How can I learn more about my specific Medicare Plan B costs? (Answer: Contact Medicare directly or speak with a qualified Medicare advisor.)

6. What is the difference between Medicare Plan B and Medicare Advantage? (Answer: Medicare Plan B is supplemental medical insurance, while Medicare Advantage is an alternative way to get Medicare benefits.)

7. Does Medicare Plan B cover all medical expenses? (Answer: No, it covers a portion of expenses, and there are cost-sharing components like deductibles and coinsurance.)

8. When can I make changes to my Medicare Plan B coverage? (Answer: Typically during the annual Medicare Open Enrollment Period.)

Tips for navigating Medicare Plan B costs: Stay organized by keeping records of your medical expenses and Medicare statements. Utilize online resources and tools provided by Medicare to access information and manage your plan. Don't hesitate to seek professional guidance from a Medicare advisor if you have questions or need assistance.

In conclusion, understanding your Medicare Plan B costs is like mastering the art of a perfectly curated wardrobe – essential for your well-being and peace of mind. By familiarizing yourself with the pricing structure, staying updated on changes, and utilizing available resources, you can take control of your healthcare expenses and make informed decisions about your future. Just like choosing the right outfit for any occasion, selecting the right Medicare plan requires careful consideration and knowledge. Empower yourself with information, seek guidance when needed, and remember that investing in your healthcare knowledge is an investment in your overall well-being. Don't wait, start exploring your options and take charge of your Medicare journey today!

Devoted Health Advantage Plans 2024 List | Kennecott Land

Open Enrollment 2024 Medicare Part B | Kennecott Land

Fica And Medicare Rates 2024 | Kennecott Land

Medicare Part B Irmaa 2024 Table | Kennecott Land

What Is Medicare Supplement Plan G Plus at Patricia Roberts blog | Kennecott Land

Medicare Supplement Plans Comparison Chart 2023 | Kennecott Land

2024 Irmaa Brackets For Medicare Premiums 2024 | Kennecott Land