Decoding Texas Workforce Commission Tax Filing

In the buzzing hive of Texas business, understanding the nuances of state-specific regulations is crucial. One vital aspect that demands attention is Texas Workforce Commission (TWC) tax filing. It's the lifeblood that sustains unemployment benefits for eligible Texans, a safety net in times of job loss. But navigating this system can sometimes feel like traversing a digital labyrinth. This guide illuminates the path, breaking down the complexities of TWC tax requirements.

Imagine a system that supports workers facing unexpected unemployment. That's the core function of the TWC tax system. Businesses in Texas contribute to this crucial fund, ensuring a resource exists for those navigating job transitions. These contributions, governed by specific regulations, form the bedrock of unemployment insurance in the Lone Star State. Understanding the intricacies of these regulations is essential for every Texas employer.

The history of the TWC tax system is intertwined with the broader evolution of unemployment insurance in the United States. Born out of the Great Depression, unemployment insurance emerged as a critical safety net, a mechanism to mitigate the devastating impacts of widespread job loss. In Texas, the TWC administers this system, collecting taxes and distributing benefits, ensuring the continued support of the state's workforce. Staying compliant with TWC tax filing requirements isn't just a legal obligation; it's a contribution to the well-being of the Texas community.

TWC tax filings are generally handled quarterly. Employers report wages paid and calculate the unemployment tax due. This information flows into the TWC system, fueling the unemployment insurance fund. Accurate and timely filings are paramount, as inaccuracies can lead to penalties and complications. Understanding the filing process, deadlines, and required documentation is essential for maintaining compliance and contributing to the health of the unemployment insurance system.

Several online resources provide tools and information to assist with TWC tax filing. The TWC website itself offers a wealth of information, including forms, instructions, and FAQs. Third-party payroll software often integrates with the TWC system, streamlining the reporting process and minimizing errors. Leveraging these resources can significantly simplify TWC tax filings, allowing businesses to focus on their core operations.

One benefit of accurate and timely TWC tax filing is avoiding penalties. Late filings or incorrect information can result in fines and interest charges. Another advantage is contributing to a vital safety net for Texas workers. By fulfilling their tax obligations, businesses play a key role in supporting those experiencing unemployment. Finally, proper TWC tax filing demonstrates corporate responsibility and strengthens the overall economic health of the state.

Begin by registering your business with the TWC. Then, determine your tax rate and understand the reporting requirements. Gather necessary payroll information, including employee wages and hours. Utilize online resources, like the TWC website or payroll software, to submit your filings accurately and on time.

Advantages and Disadvantages of Efficient TWC Tax Filing

| Advantages | Disadvantages |

|---|---|

| Avoids Penalties | Time Commitment for Accurate Reporting |

| Supports Unemployment Insurance Fund | Complexity of Regulations |

| Demonstrates Corporate Responsibility | Potential for Errors if Not Careful |

Best practice: Use payroll software. Best practice: File on time. Best Practice: Maintain accurate records. Best Practice: Stay informed about changes in regulations. Best Practice: Consult with a tax professional if needed.

FAQ: What is the TWC tax rate? FAQ: When are TWC tax filings due? FAQ: What are the penalties for late filing? FAQ: How do I register my business with the TWC? FAQ: What information is required for TWC tax filing? FAQ: Where can I find assistance with TWC tax filing? FAQ: What is the purpose of TWC tax? FAQ: How does TWC tax filing benefit Texas workers?

One tip for simplifying TWC tax filing is to leverage automation through payroll software. This helps ensure accuracy and timely submissions. Another trick is to set reminders for filing deadlines to avoid late penalties.

In conclusion, navigating the landscape of Texas Workforce Commission tax filing is a critical responsibility for all Texas employers. This system, financed by employer contributions, provides a crucial safety net for individuals facing unemployment. Understanding the requirements, leveraging available resources, and implementing best practices ensures compliance and contributes to the well-being of the Texas workforce. By staying informed, utilizing online tools, and prioritizing accurate reporting, businesses can seamlessly navigate the TWC tax system, fulfilling their legal obligations while contributing to a vital support system for Texas workers. Taking the time to understand and effectively manage TWC tax filing not only avoids potential penalties but also demonstrates a commitment to the overall economic health of the state. Embracing these practices empowers businesses to operate efficiently and contribute to the strength and resilience of the Texas community.

Texas Workforce Commission expands hours to help those filing for | Kennecott Land

texas workforce commission tax filing | Kennecott Land

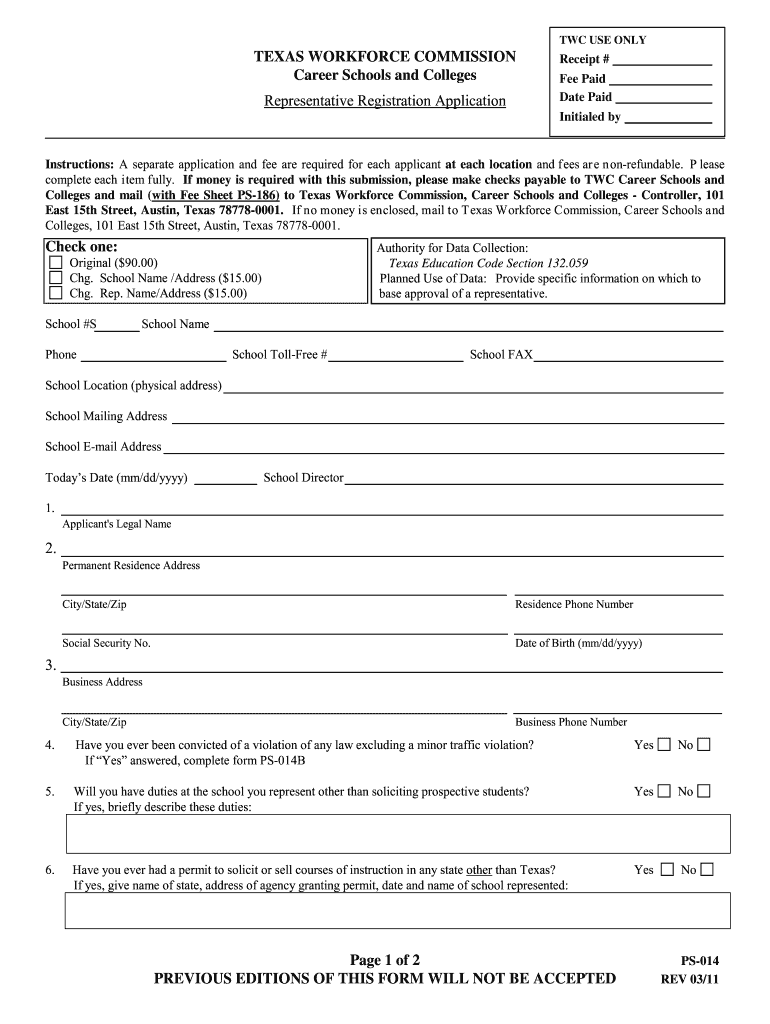

Blank Texas Workforce Commission Report | Kennecott Land

texas workforce commission tax filing | Kennecott Land

texas workforce commission tax filing | Kennecott Land

texas workforce commission tax filing | Kennecott Land

texas workforce commission tax filing | Kennecott Land