Decoding Your Paycheck: A Guide to Salary Tax Calculations

Let’s be real, the thrill of a new job or a raise can quickly fade when you realize a chunk of your earnings disappears before it even hits your bank account. It's like that moment you spot the perfect pair of shoes online, only to find out they're sold out in your size – a total buzzkill. But unlike those elusive fashion finds, understanding your salary tax calculations is entirely within your control.

Think of it this way: figuring out your taxes is like mastering the art of layering different necklaces – it might seem complicated at first, but once you get the hang of it, it becomes second nature. This knowledge empowers you to budget effectively, plan for the future, and avoid any nasty surprises come tax season.

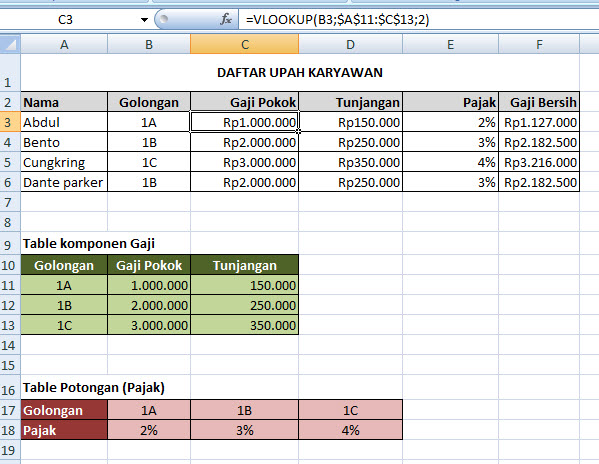

So, what exactly are we talking about here? In a nutshell, salary tax calculation, or "cara menghitung pajak gaji" in Indonesian, refers to the process of determining the amount of income tax deducted from your salary. This involves understanding your tax bracket, allowances, deductions, and other factors that might impact your tax liability. It's basically a financial puzzle, and we're here to help you solve it.

Now, you might be thinking, "This sounds like something my accountant should handle." And while seeking professional advice is always a good idea, having a basic understanding of how your salary taxes are calculated can be incredibly empowering. It allows you to have more informed conversations with your accountant, ensure the accuracy of your tax deductions, and plan your finances more effectively.

Imagine this: you're at a restaurant with friends, and the bill arrives. Wouldn't you want to understand how the total was calculated, instead of blindly splitting it evenly? The same principle applies to your salary. By grasping the basics of income tax calculations, you gain a clearer picture of your finances and make more informed decisions about your money.

While the specific rules and regulations governing salary tax calculations can vary from country to country, the fundamental principles remain relatively consistent. These calculations typically involve determining your taxable income, applying the relevant tax rates, and factoring in any applicable deductions or credits.

Historically, tax systems have evolved significantly, transitioning from simpler forms of taxation to more complex structures we see today. This evolution reflects the changing needs of societies, aiming to create fairer and more equitable systems for revenue collection. Understanding these historical developments provides valuable context for appreciating the complexities of modern tax calculations.

In conclusion, while deciphering the intricacies of salary tax calculations might seem as daunting as finding the perfect pair of vintage jeans, it’s a challenge worth conquering. By equipping yourself with the knowledge and understanding of “cara menghitung pajak gaji”, you take control of your finances and pave the way for a more secure and empowered financial future. After all, knowledge is power, and in the world of personal finance, that power lies in understanding your taxes.

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land

cara menghitung pajak gaji | Kennecott Land