Does Bank of America Accept Endorsed Checks? What You Need to Know

In today's digital age, where online transactions and mobile payments reign supreme, you might find yourself holding a tangible check and wondering, "Can I still deposit this?" If you're a Bank of America customer or considering becoming one, you might be specifically curious about their policies on endorsed checks. Let's delve into the world of endorsed checks at Bank of America.

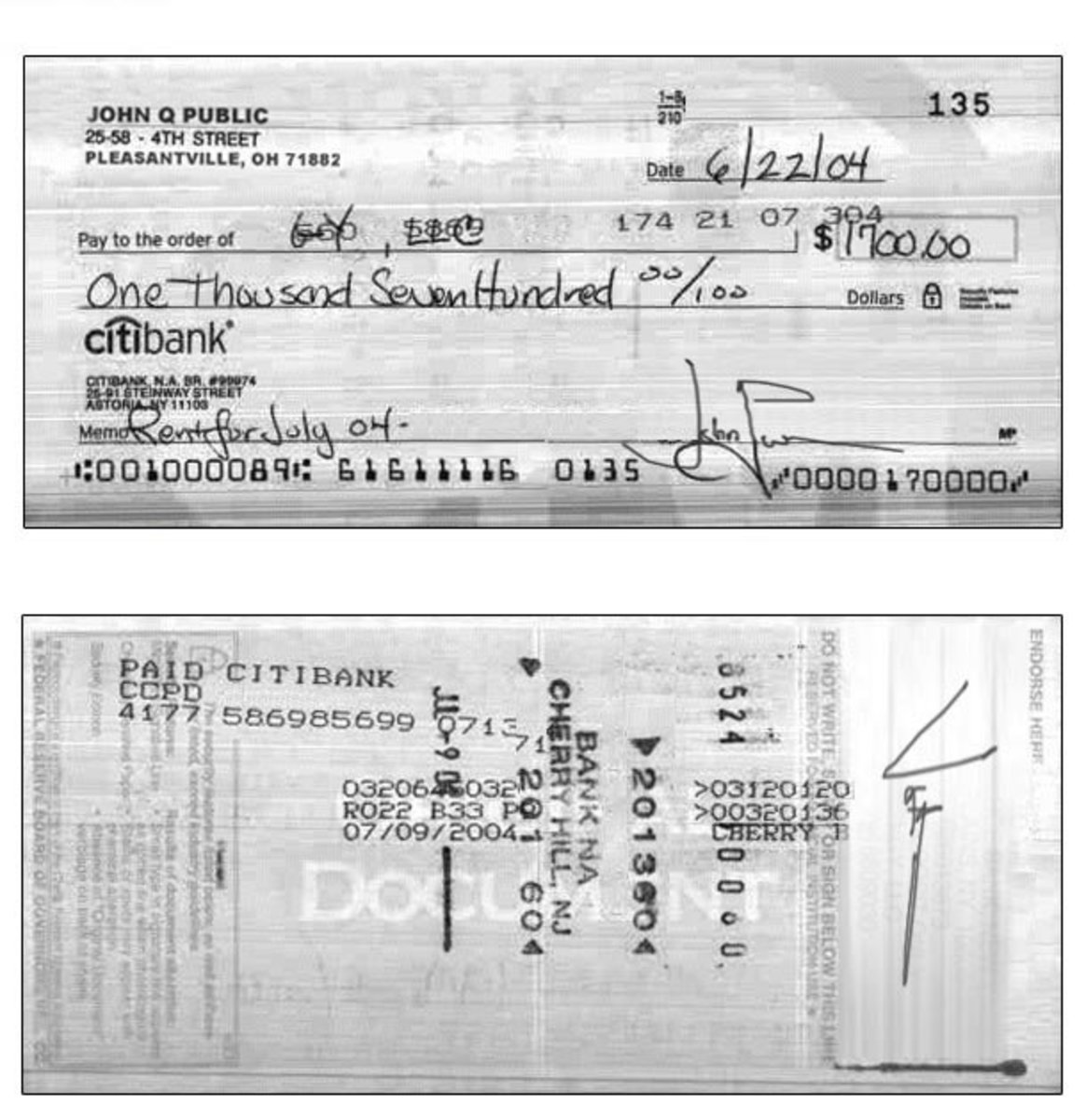

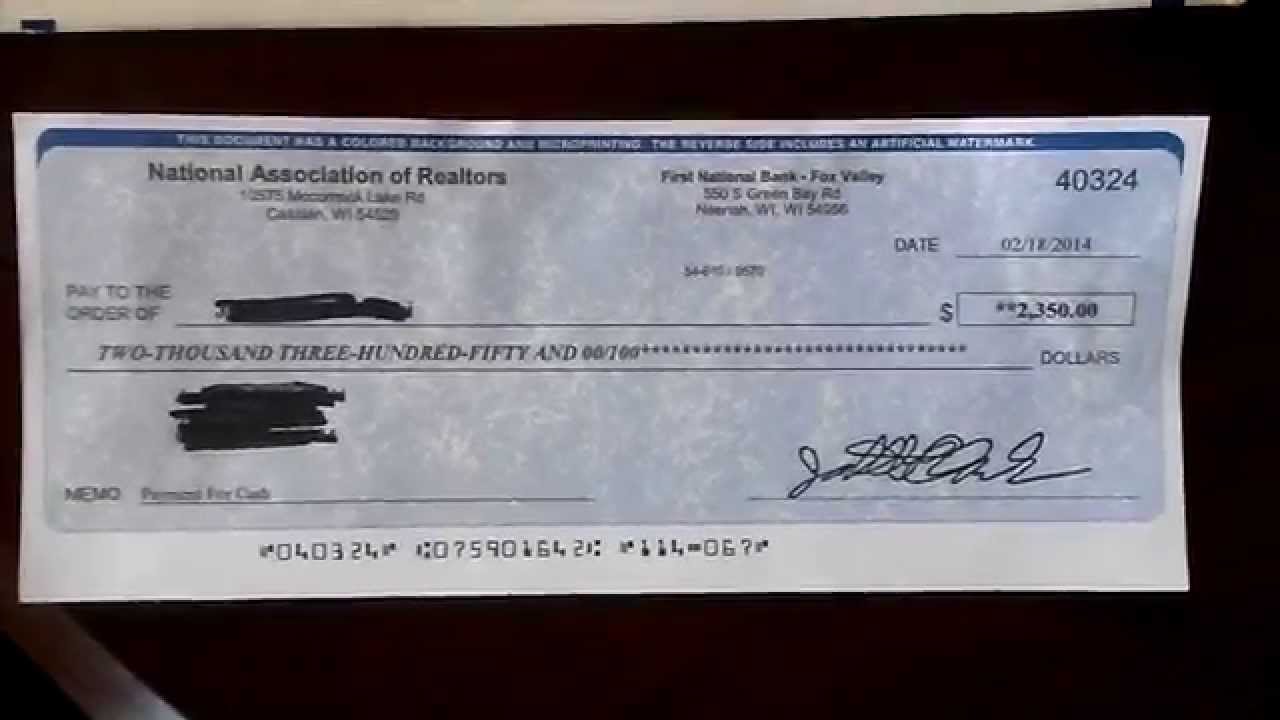

First and foremost, it's essential to understand what an endorsed check is and its significance in the banking world. An endorsed check is simply a check that has been signed on the back by the payee (the person or entity to whom the check is made payable). This signature signifies the payee's intent to cash or deposit the check.

Now, to answer the burning question: Yes, Bank of America generally accepts endorsed checks for deposit. They understand that while the financial landscape evolves, paper checks still hold relevance for many individuals and businesses.

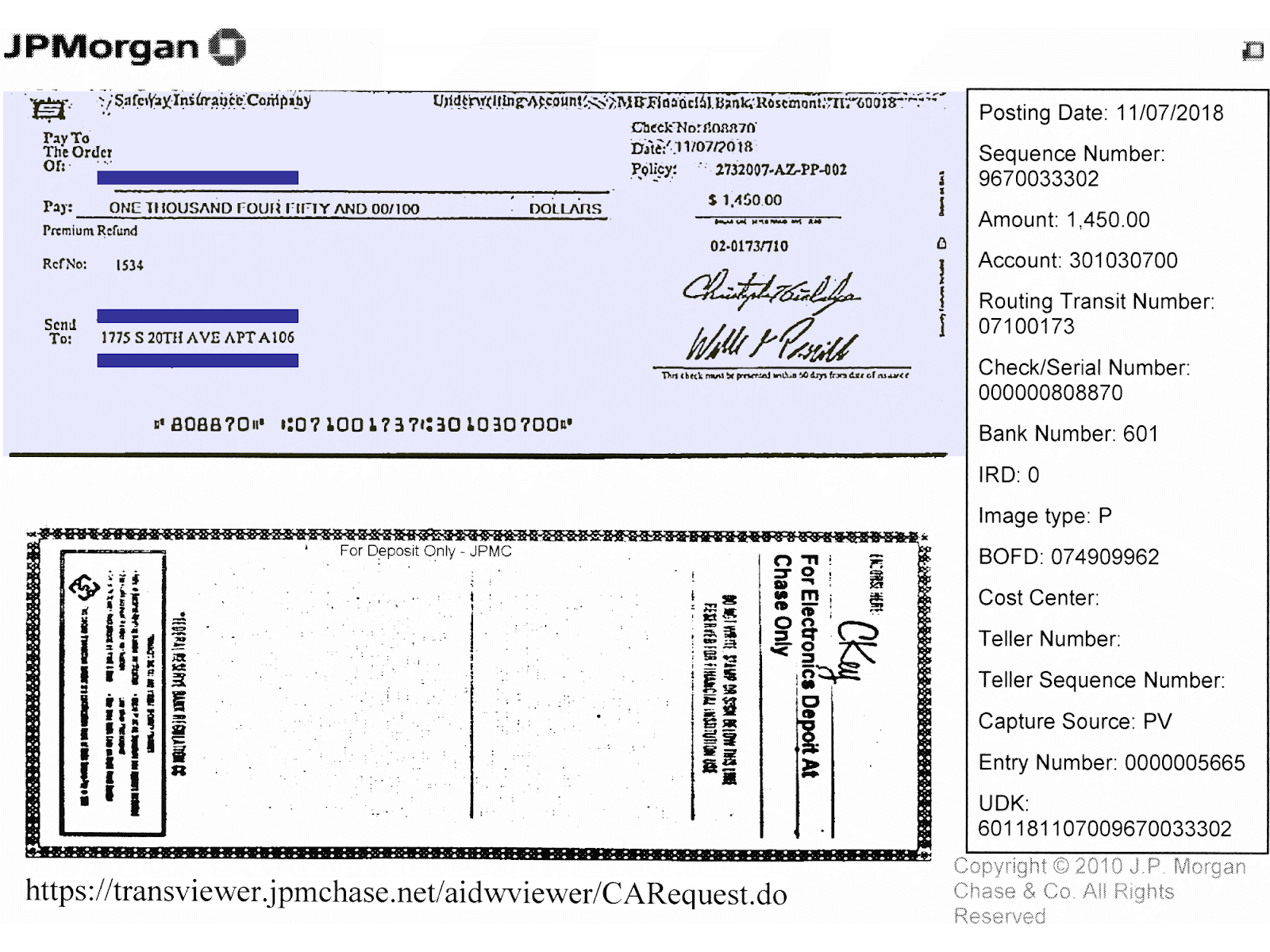

You have various options for depositing your endorsed check with Bank of America. The most traditional method involves visiting a local Bank of America branch and handing the endorsed check to a teller. Alternatively, you can utilize Bank of America's convenient ATM network. Many ATMs are equipped with check-deposit capabilities, allowing you to deposit your endorsed check without the need for human interaction.

For those who prefer the comfort of their homes, Bank of America's mobile banking app offers a seamless check deposit experience. Simply snap a photo of the front and back of your endorsed check using the app, and follow the on-screen instructions to submit it for deposit.

However, it's crucial to note that while Bank of America strives to make check deposits as convenient as possible, certain limitations and restrictions might apply. These restrictions are typically in place to protect both the bank and its customers from potential fraud or processing errors.

Advantages and Disadvantages of Depositing Endorsed Checks at Bank of America

| Advantages | Disadvantages |

|---|---|

| Convenience of multiple deposit methods (in-person, ATM, mobile app) | Potential for delays in funds availability compared to electronic transfers |

| Widely accepted form of payment | Risk of check loss or theft during physical deposit |

While the acceptance of endorsed checks remains common practice at Bank of America and other financial institutions, it's worth considering the advantages and potential drawbacks associated with this traditional payment method.

Best Practices for Depositing Endorsed Checks

To ensure a smooth and secure check deposit experience, it's wise to adhere to a few best practices:

- Endorse the check properly: Sign your name exactly as it appears on the front of the check. If you're depositing it into an account that's in a different name, you'll need to endorse it with "Pay to the order of [account name]" followed by your signature.

- Consider mobile deposits for convenience: Bank of America's mobile app provides a hassle-free way to deposit checks without visiting a branch or ATM.

- Be mindful of deposit limits: Banks often have limits on the amount of money you can deposit via mobile check deposit or ATM. Contact Bank of America to inquire about their specific limits.

- Keep your check until funds are available: While banks make deposited funds available according to a schedule, it's prudent to retain the physical check until you're certain the funds have cleared and are accessible for withdrawal.

- Check your account regularly: After depositing a check, monitor your account to confirm the deposit has been credited and that there are no discrepancies.

Common Questions about Depositing Endorsed Checks at Bank of America:

1. Does Bank of America charge a fee to deposit endorsed checks?

Bank of America's fee policies for check deposits can vary depending on your account type and deposit method. It's best to check their fee schedule or contact customer service for the most up-to-date information.

2. How long does it take for an endorsed check to clear at Bank of America?

The clearing time for endorsed checks can vary depending on factors such as the check amount and the bank on which it's drawn. Generally, it's safe to assume it can take anywhere from a couple of business days to a week for the funds to become fully available in your account.

3. Can I deposit a check that's endorsed over to me?

Generally, banks, including Bank of America, are cautious about accepting checks that have been endorsed multiple times (also known as third-party checks). It's best to consult with Bank of America directly regarding their specific policies on third-party checks.

4. What happens if I lose an endorsed check before depositing it?

Losing an endorsed check can be stressful. If this happens, it's crucial to contact the check issuer immediately and report it as lost or stolen. They can advise you on the necessary steps to cancel the original check and potentially issue a replacement.

5. Can I deposit an endorsed check at a Bank of America ATM?

Yes, most Bank of America ATMs offer check deposit services. You'll need to insert your ATM card, enter your PIN, and follow the on-screen prompts for check deposits.

6. Is there a limit on the amount I can deposit via mobile check deposit?

Bank of America, like many banks, may have limits on mobile check deposits. These limits can vary based on your account history and other factors. It's recommended to verify these limits through their app or website.

7. Can I get cash back from an endorsed check at a Bank of America ATM?

Usually, ATMs don't provide cash back when depositing checks, including endorsed ones. You might be able to withdraw a portion of the deposited amount once the funds become available, but this can vary based on the ATM and your account settings.

8. What should I do if my endorsed check is returned unpaid?

If your deposited check bounces, contact Bank of America to determine the reason. You'll need to resolve the issue with the check issuer, which may involve requesting a new check or making other arrangements for payment.

In conclusion, while the world increasingly embraces digital transactions, endorsed checks remain a valid form of payment accepted by Bank of America. Understanding the nuances of endorsed checks, the available deposit methods, and best practices can empower you to navigate this traditional banking process confidently and securely. Whether you choose the convenience of mobile deposits or the personal touch of a branch visit, Bank of America offers options to accommodate your check deposit needs.

Printable Blank Cashiers Check | Kennecott Land

does bank of america accept endorsed checks | Kennecott Land

Ejemplo De Endoso De Un Cheque | Kennecott Land

Parts of a Check: How to Endorse LLC Checks & Business Checks (2022) | Kennecott Land

Sample Cheque Writing at Kerry Cruz blog | Kennecott Land

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)

How to Endorse a Check | Kennecott Land

Wells Fargo Bill Pay Check Not Cashed | Kennecott Land

does bank of america accept endorsed checks | Kennecott Land

does bank of america accept endorsed checks | Kennecott Land

23.1: Los bancos y sus clientes | Kennecott Land

How To Write A Check Chase | Kennecott Land

How to Endorse a Check Correctly without any Mistake | Kennecott Land

Printable Fake Checks For Pranks | Kennecott Land

Bank Of America Wiring Money Instructions | Kennecott Land

Bank Of America Printable Checks | Kennecott Land