Does Chase Verify Checks? Unveiling the Security Measures

In an era dominated by digital transactions, the humble check might seem like a relic of the past. Yet, millions of people and businesses still rely on these paper instruments for financial transactions. This begs the question: in our increasingly digital world, does Chase verify checks? The answer is a resounding yes, and understanding the verification process is crucial for anyone who uses checks.

Chase, like all major financial institutions, employs a multi-layered approach to verify checks and prevent fraud. These measures are not merely a matter of policy; they are essential for maintaining the integrity of our financial system. From sophisticated algorithms that analyze transaction patterns to manual reviews by trained professionals, Chase invests significant resources in ensuring that every check processed is legitimate.

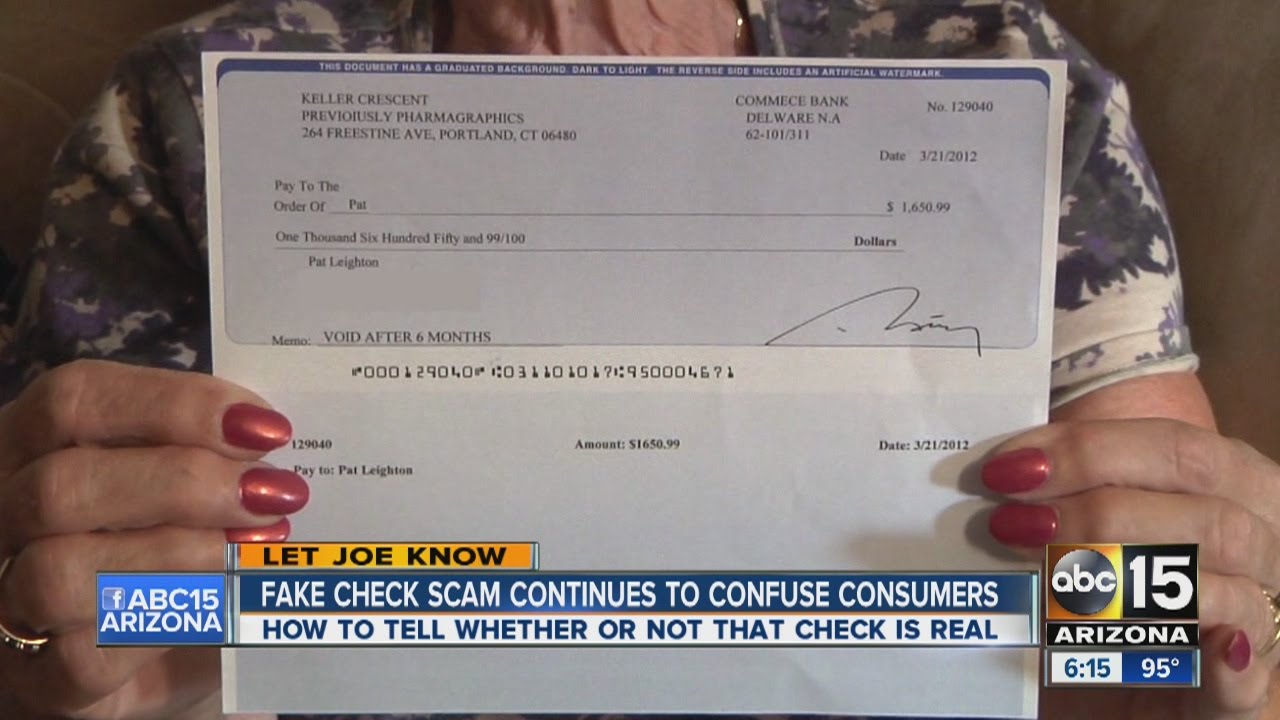

The importance of check verification cannot be overstated. Check fraud remains a persistent threat, costing businesses and individuals billions of dollars annually. While the methods employed by fraudsters have become increasingly sophisticated, so too have the security measures implemented by banks. By understanding these measures, account holders can play an active role in protecting themselves from becoming victims of fraud.

This exploration into the world of check verification delves into the specific techniques employed by Chase, shedding light on the unseen processes that safeguard your finances. We'll explore the reasons behind these security measures, discuss the potential challenges, and provide valuable insights to help you navigate the world of checks with confidence in the digital age.

While we often take the security of our financial transactions for granted, it's crucial to remember that there are dedicated individuals and sophisticated systems working tirelessly behind the scenes to keep our money safe. Understanding the meticulous process of check verification offers a glimpse into this unseen world, fostering a greater appreciation for the vital role these security measures play in our daily lives.

Advantages and Disadvantages of Chase Check Verification

| Advantages | Disadvantages |

|---|---|

| Enhanced security against check fraud | Potential for delays in check clearing, especially for large amounts |

| Reduced risk of bounced checks and associated fees | Possible inconvenience if a legitimate check is flagged for verification |

| Increased confidence and peace of mind for account holders | Limited control over the verification process once a check is deposited |

Best Practices for Depositing Checks with Chase

1. Endorse Your Checks Properly: Always endorse your checks by signing the back and, if depositing via mobile app, adding "For mobile deposit only" above your signature. This helps prevent unauthorized cashing.

2. Double-Check Check Details: Before depositing, verify the payee name, amount, and date are correct. Errors can lead to delays or even rejection of the check.

3. Understand Funds Availability: Familiarize yourself with Chase's funds availability policy, as certain checks, like those for large amounts, may have a hold period before funds are fully accessible.

4. Monitor Your Account Regularly: Keep a close eye on your account for any suspicious activity or discrepancies. If you notice anything unusual, report it to Chase immediately.

5. Opt for Secure Deposit Methods: Utilize secure methods like mobile check deposit or ATM deposits whenever possible, reducing the risk of checks being lost or stolen.

Common Questions About Chase Check Verification

1. How long does Chase take to verify a check?

The verification time varies depending on factors like the check amount, your account history, and potential fraud risk. It can range from a few hours for smaller amounts to a few business days for larger deposits.

2. Can I cash a check that is not in my name at Chase?

Cashing a check not in your name at Chase is generally not allowed. They prioritize account holder security, and cashing third-party checks poses a higher fraud risk.

3. What happens if Chase suspects a check is fraudulent?

Chase has a dedicated fraud department that investigates suspicious checks. If a check raises red flags, it might be subject to a longer hold or even rejection. You'll be notified if this occurs.

4. Can I deposit a check that is more than 90 days old at Chase?

Chase typically doesn't accept checks older than 90 days. It's best to consult their funds availability policy for specific details regarding stale-dated checks.

5. Does Chase verify checks deposited via mobile app?

Yes, even checks deposited through the mobile app undergo verification. The app employs image recognition technology and security checks to authenticate the check and your account information.

6. Can I track the status of a check I deposited at Chase?

Yes, you can monitor your deposited checks through your online account or the Chase mobile app. They provide updates on the check's status, including when funds become available.

7. What should I do if a check I deposited at Chase bounces?

Contact Chase immediately to understand the reason for the bounced check. They can guide you through the necessary steps, which may involve contacting the check issuer or taking legal action.

8. Does Chase charge a fee for check verification?

Chase does not typically charge a separate fee for check verification. However, fees might apply for other services, like cashing a cashier's check or if a deposited check bounces.

Tips and Tricks for Smooth Check Deposits

For seamless check deposits at Chase, consider these tips:

- Ensure your account is in good standing with sufficient funds to cover any potential check holds.

- Keep a record of all deposited checks, noting the date, amount, and payee. This can be helpful for tracking purposes or if any discrepancies arise.

- If depositing large checks, inform Chase in advance to potentially expedite the verification process and minimize holds.In conclusion, the question "does Chase verify checks?" leads to a deeper understanding of the intricate systems that protect our finances. Chase employs robust verification measures, balancing security with user experience. By understanding these processes and following best practices, account holders can confidently navigate the world of checks, minimizing risks and ensuring the security of their hard-earned money. In today's digital age, where financial threats constantly evolve, awareness and proactive measures are paramount. Whether you're a seasoned check-writer or new to this payment method, staying informed empowers you to make secure and informed financial decisions.

Fake Cashier's Check Scams: How to Spot and Beat Them | Kennecott Land

does chase verify checks | Kennecott Land

![[DIAGRAM] Diagram Of Finance Check](https://i2.wp.com/cdn.gobankingrates.com/wp-content/uploads/2019/08/cashiers-check-01-1280x720.png)

[DIAGRAM] Diagram Of Finance Check | Kennecott Land

How to Write a Chase Check (with Example) | Kennecott Land

Can a fake check clear? Leia aqui: What happens if you deposit a fake | Kennecott Land

Pin by Sidahsuon on Spiderman face | Kennecott Land

Cómo llenar un cheque de Chase paso a paso | Kennecott Land

does chase verify checks | Kennecott Land

How to Write a Chase Check (with Example) | Kennecott Land

Fillable Cashiers Check Template Edit Your Fillable Cashiers Check | Kennecott Land

Wells Fargo Blank Check Template | Kennecott Land

4 Easy Ways to Verify a Cashier's Check | Kennecott Land

Does Chase verify income? Leia aqui: Does Chase credit card check your | Kennecott Land

Does Chase credit card verify income? Leia aqui: Does Chase credit card | Kennecott Land

The fake check scam | Kennecott Land