Financial Freedom at 65: Exploring Whole Life Paid Up at 65

There's a certain elegance to reaching a milestone. A sense of completion. A quiet confidence that comes with knowing you've laid the groundwork for a secure future. In the world of finance, achieving "whole life paid up at 65" carries that same aura of refined accomplishment.

Imagine this: you turn 65, the traditional marker of retirement. But instead of the scramble to make ends meet, you're greeted by the comforting knowledge that your life insurance premiums are a thing of the past. The policy, a steadfast companion throughout your working years, has reached its maturity. It's now fully paid up, yet its protective embrace remains, a testament to your foresight and planning.

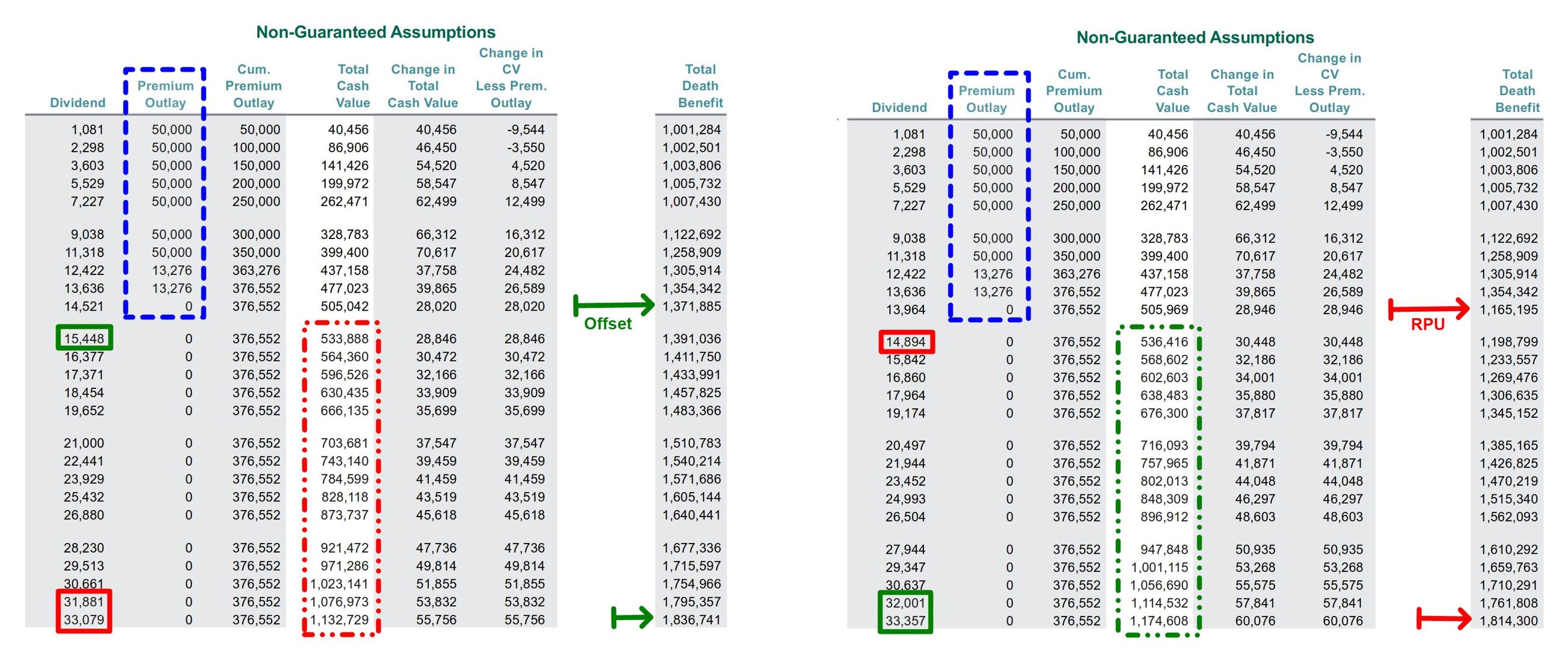

Whole life insurance, unlike its more transient term life counterpart, isn't just about protection. It's about building something lasting. A legacy, if you will. With each premium payment, you're not only securing your loved ones' future but also nurturing a cash value component within the policy. This cash value grows steadily over time, like a well-tended garden, gaining value and offering potential for borrowing against or withdrawing from should the need arise.

Now, imagine harnessing that growth to reach a point where the policy essentially pays for itself. That's the beauty of "whole life paid up at 65." By structuring your policy with this goal in mind, you create a roadmap to financial independence. As you hit 65, your obligation to pay premiums ceases, but the policy remains active, its death benefit intact, and its cash value continuing to accrue.

Of course, no financial strategy is one-size-fits-all. Whole life insurance, particularly with the goal of becoming paid up at 65, requires careful consideration and planning. It's crucial to consult with a financial advisor who understands your individual goals and risk tolerance. They can help determine the coverage amount and premium payment structure that aligns with your personal financial landscape.

Advantages and Disadvantages of Whole Life Paid Up at 65

| Advantages | Disadvantages |

|---|---|

| Guaranteed premiums that never increase | Higher initial premiums compared to term life insurance |

| Life-long coverage, providing peace of mind | Requires long-term commitment to premium payments |

| Cash value growth potential for borrowing or withdrawals | May not be suitable for individuals seeking short-term coverage only |

While the concept of "whole life paid up at 65" might seem complex at first glance, it's ultimately about taking control of your financial future. It's about making choices today that pave the way for a more secure and confident tomorrow. It's about reaching that coveted milestone with the satisfaction of knowing you've created a legacy of financial well-being.

whole life insurance rate | Kennecott Land

whole life paid up at 65 | Kennecott Land

Solved Question 8 1 pts Which of the following $100,000 | Kennecott Land

What is Reduced Paid | Kennecott Land

Solved Which of the following $100,000 whole life insurance | Kennecott Land

Reduced Paid Up Insurance | Kennecott Land

What Are Paid Up Additions (PUA) In Life Insurance | Kennecott Land

whole life paid up at 65 | Kennecott Land

Santa Comes to PNA 2022 | Kennecott Land

How To Calculate Irr Life Insurance | Kennecott Land

whole life paid up at 65 | Kennecott Land

whole life paid up at 65 | Kennecott Land

Solved Shirley wants to purchase a policy that protects her | Kennecott Land

How Long Does It Take For Whole Life Insurance To Build Cash Value | Kennecott Land

Fillable Online resources ccc govt Sport New Zealand Rural Travel Fund | Kennecott Land