How Does a Bank Endorse a Check: A Comprehensive Guide

In our increasingly digital world, it's easy to forget about the enduring relevance of checks. Yet, these paper promises of payment still hold a significant place in our financial system. While electronic transfers and mobile payments gain popularity, checks provide a tangible and often necessary method for transactions, especially in specific situations like official payments or transactions involving large sums. But have you ever wondered what happens behind the scenes when you deposit a check? A crucial part of that process involves the bank's endorsement, a seemingly simple act with significant implications.

Understanding how a bank endorses a check unveils a fundamental aspect of financial transactions, shedding light on the mechanisms that ensure secure and trustworthy movement of funds. It delves into the crucial role banks play as intermediaries, validating and processing these paper instruments. This exploration into the world of check endorsements will equip you with the knowledge to navigate this process confidently.

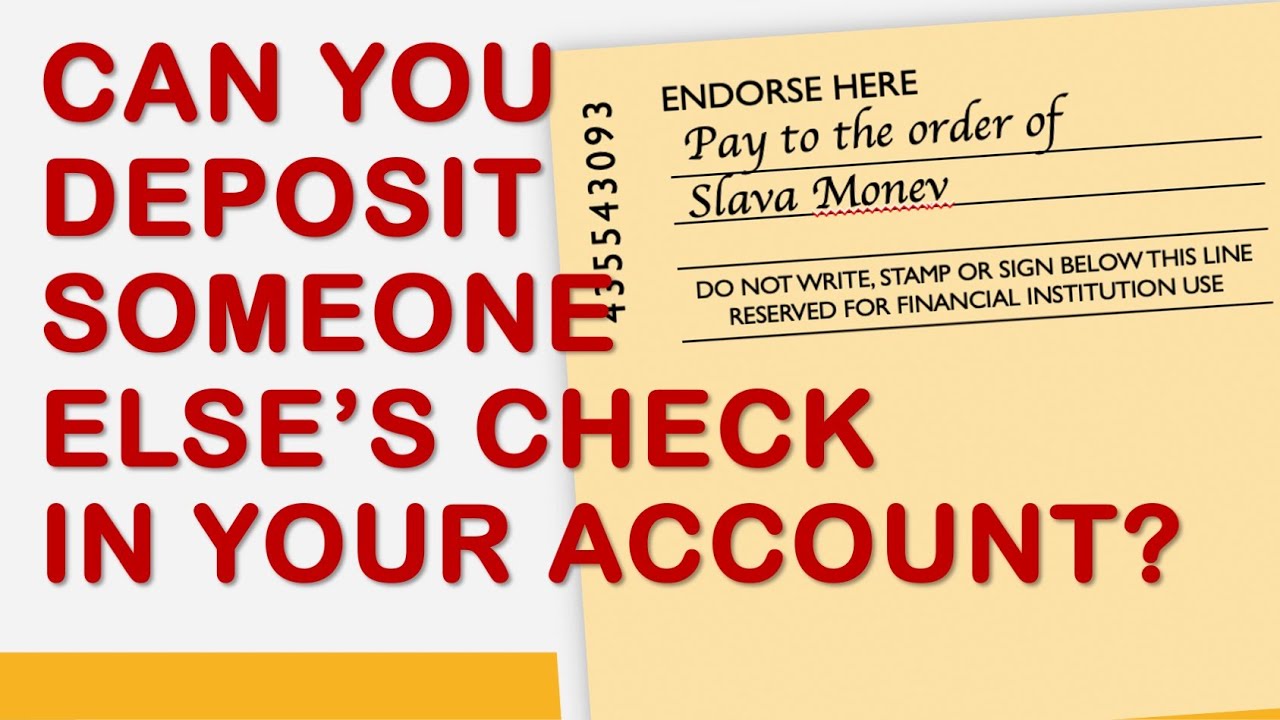

The endorsement of a check is a critical step in the check clearing process. It signifies the transfer of ownership of the funds represented by the check. When a bank endorses a check, it essentially guarantees the payment of the check, assuming the responsibility if the check writer's account has insufficient funds.

The history of bank endorsements goes hand-in-hand with the evolution of banking and financial instruments. As checks emerged as a prominent form of payment, the need for a secure and standardized method of transfer became evident. The development of endorsement practices addressed this need, establishing a system where banks could verify and guarantee the legitimacy of these paper transactions. Over time, these practices have been refined and standardized to ensure efficiency and minimize fraud.

The importance of bank endorsements lies in their role in mitigating risk within the financial system. Each endorsement acts as a layer of security, confirming the transfer of ownership and providing a trail of accountability. This process is crucial for maintaining trust and ensuring the smooth operation of financial transactions involving checks.

Advantages and Disadvantages of Bank Check Endorsements

While the system of bank check endorsements offers several advantages, some potential drawbacks need consideration:

| Advantages | Disadvantages |

|---|---|

| Security: Provides a layer of protection against fraud. | Processing Time: Can take several business days for a check to clear. |

| Clear Ownership: Establishes a clear chain of ownership for the funds. | Risk of Loss or Theft: Physical checks can be lost, stolen, or damaged. |

| Legal Recourse: Offers a paper trail in case of disputes. | Limited Accessibility: Not all individuals or businesses have easy access to banking services. |

Though check usage might decline as digital transactions rise, understanding the process of bank endorsements remains crucial for navigating specific financial situations effectively. By grasping the significance of this practice, individuals and businesses can make informed decisions about their financial transactions, ensuring a secure and efficient movement of funds.

How to Endorse a Check | Kennecott Land

Expert Advice on How to Endorse a Check | Kennecott Land

How to Endorse a Check: Step | Kennecott Land

How to Endorse a Check & What Check Endorsement Means | Kennecott Land

What Is Endorse A Check | Kennecott Land

How to Endorse a Check: A Step | Kennecott Land

How to endorse a check: Full guide for when and how to endorse a check | Kennecott Land

How to Endorse a Check Correctly without any Mistake | Kennecott Land

How to Endorse a Check to Someone Else in 4 Steps | Kennecott Land

3 formas de endosar un cheque | Kennecott Land

How to endorse a check: Full guide for when and how to endorse a check | Kennecott Land

How To Endorse A Check | Kennecott Land

3 formas de endosar un cheque | Kennecott Land

/how-to-endorse-checks-315300-156cf43ec02848b9b6ac30864994d91a.jpg)

How To Endorse Checks, Plus When and How To Sign | Kennecott Land

:max_bytes(150000):strip_icc()/endorse-checks-payable-to-multiple-people-315299-v2-5bbdffc846e0fb0026eccaf4.png)

How To Endorse and Write Checks to Multiple People | Kennecott Land