Master Your Money: A Guide to Understanding Monthly Salary Tax Calculations

Navigating the world of taxes can often feel like trying to decipher a foreign language. For many, especially those new to the workforce, understanding exactly how their monthly salary tax is calculated can be a daunting task. Yet, grasping this fundamental financial concept is crucial for anyone wanting to take control of their personal finances and ensure they're meeting their tax obligations. This guide will demystify the process, providing a clear and concise breakdown of monthly salary tax calculations.

Imagine this: you receive your first paycheck, excited to finally be earning a salary. But upon closer inspection, you notice a significant chunk of your earnings is missing. This, my friend, is the work of taxes. Taxes are financial contributions mandated by governments to fund public services like healthcare, education, and infrastructure. Understanding how these taxes are calculated based on your income is the first step to effectively managing your finances.

The importance of understanding your monthly salary tax calculations cannot be overstated. It allows you to budget effectively, knowing exactly how much money you'll have left after taxes are deducted. This knowledge empowers you to make informed financial decisions, whether it's saving for a down payment on a house, investing in your future, or simply managing your daily expenses. Furthermore, understanding these calculations can help you identify potential tax deductions or credits you might be eligible for, putting more money back in your pocket.

While the specific details of tax systems vary from country to country, the underlying principles remain similar. Generally, your monthly salary tax calculation involves determining your taxable income, which is the portion of your earnings subject to tax after deducting any allowances or exemptions. This taxable income is then taxed according to a predetermined tax bracket system, with higher income earners typically facing higher tax rates. Understanding these core concepts is vital for deciphering your pay stub and ultimately taking charge of your financial future.

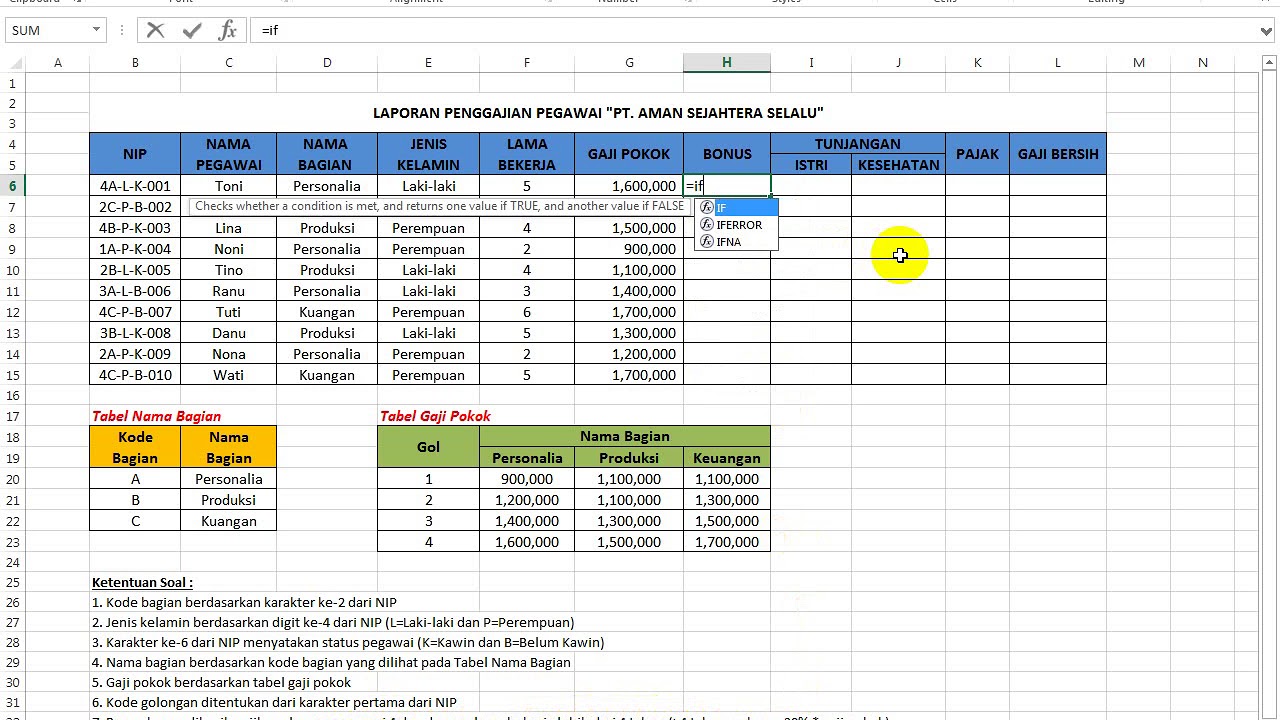

Fortunately, with the advent of technology, calculating your monthly salary tax has become easier than ever. Numerous online calculators and resources are available to simplify this process, often providing instant results based on your specific income and location. However, it's important to remember that these tools are meant to be guides, and seeking advice from qualified financial advisors can offer personalized guidance tailored to your unique financial situation.

Advantages and Disadvantages of Understanding Your Monthly Salary Tax Calculation

Understanding how your monthly salary tax is calculated offers a multitude of advantages, empowering you to make informed financial decisions and maximize your earnings. Conversely, neglecting this crucial aspect of your financial life can lead to potential pitfalls and missed opportunities. Let's delve into the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Accurate Budgeting: Precisely knowing your post-tax income allows for realistic budgeting and financial planning. | Time Commitment: Initially grasping tax concepts and calculations can require time and effort. |

| Tax Optimization: Understanding deductions and credits helps minimize your tax liability and maximize earnings. | Complexity: Tax systems can be intricate, potentially leading to confusion and errors if not approached carefully. |

| Financial Awareness: Gaining insight into your tax obligations promotes responsible financial decision-making. | Emotional Impact: Discovering a larger than expected tax liability can be disheartening, especially for those new to the workforce. |

Ultimately, mastering your monthly salary tax calculations is an investment in your financial well-being. By dedicating time to comprehend this fundamental aspect of personal finance, you'll reap the rewards of increased financial literacy, improved budgeting practices, and potentially even increased savings through informed tax planning. Don't shy away from this crucial aspect of your financial life - embrace the knowledge and empower yourself to make savvy financial decisions that will benefit your future.

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land

cara menghitung pajak gaji bulanan | Kennecott Land