Navigating Business Finance: Understanding Bank Statements

In the fast-paced world of business, financial transparency is paramount. Every transaction, every inflow and outflow of money, tells a story. This story, meticulously documented in bank statements, is crucial for decision-making, planning, and ensuring the financial health of a company. But what exactly makes these documents so vital, and how can businesses leverage them for success?

Imagine this: you're a business owner seeking a loan to expand operations. The lender, before even considering your ambitious plans, wants to understand your company's financial track record. This is where bank statements become non-negotiable. They serve as a financial passport, providing a clear snapshot of your business's cash flow, spending habits, and overall financial stability.

Bank statements are more than just a record of deposits and withdrawals. They paint a comprehensive picture of a company's financial dealings, encompassing everything from operating expenses and loan repayments to customer payments and investment income. This granular detail is essential for a multitude of reasons, from securing funding to making informed strategic decisions.

The importance of bank statements extends beyond internal operations. They are often required for various external purposes, including tax filings, audits, and even securing business partnerships. A well-maintained and organized bank statement history demonstrates financial transparency and builds trust with stakeholders, a crucial aspect of operating in today's interconnected business landscape.

But the value of bank statements isn't limited to their mere existence. It's equally important to understand how to effectively analyze and interpret the data they contain. This includes identifying spending patterns, tracking revenue streams, and monitoring key financial metrics. By delving deeper into these financial narratives, businesses can gain invaluable insights to optimize operations, mitigate risks, and ultimately, drive growth and profitability.

Advantages and Disadvantages of Utilizing Bank Statements

While bank statements are generally considered essential for businesses, it's worth noting both their advantages and disadvantages to provide a balanced perspective:

| Advantages | Disadvantages |

|---|---|

| Provide a clear and concise financial history | Can be time-consuming to review and analyze manually |

| Essential for securing loans, investments, and partnerships | May not capture all financial transactions, especially if using multiple bank accounts |

| Facilitate accurate financial reporting and tax filings | Prone to errors or discrepancies, requiring careful reconciliation |

| Enable effective budgeting and financial planning | Can be challenging to interpret without a solid understanding of financial statements |

Best Practices for Managing Business Bank Statements

Effectively managing bank statements is crucial for any business. Here are some best practices:

- Regular Reconciliation: Regularly reconcile bank statements with internal records to identify discrepancies and ensure accuracy.

- Secure Storage: Store bank statements securely, both physically and digitally, to prevent unauthorized access or loss.

- Organized Filing System: Implement a clear and organized filing system to easily locate and retrieve specific statements when needed.

- Utilize Technology: Leverage accounting software or online banking tools to streamline bank statement management, track transactions, and generate reports.

- Regular Review: Regularly review bank statements to track spending patterns, monitor cash flow, and identify potential financial issues early on.

By embracing these best practices, businesses can effectively leverage bank statements as powerful tools for financial management, decision-making, and ultimately, achieving sustainable growth and success. Remember, financial transparency is not just good practice; it's the foundation upon which successful businesses are built.

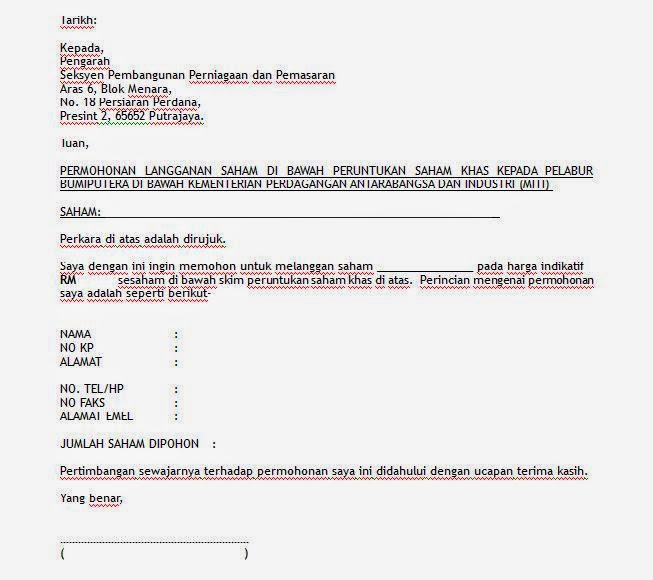

Contoh Surat Memohon Penyata Bank | Kennecott Land

Contoh Surat Permohonan Bank Statement | Kennecott Land

Surat Mohon Penyata Bank | Kennecott Land

Contoh Surat Mohon Penyata Bank | Kennecott Land

Contoh Surat Permohonan Statement Bank Contoh Surat | Kennecott Land

Contoh Surat Mohon Penyata Bank Syarikat Logam | Kennecott Land

Contoh Surat Permohonan Penyata Bank Syarikat Panduan Cetak Penyata | Kennecott Land

Contoh Surat Permohonan Bank Statement | Kennecott Land

Contoh Surat Mohon Penyata Bank Syarikat 2 Kurt Temple | Kennecott Land