Navigating Property Ownership Transfers: Understanding Fees in Malaysia

So, you're thinking about buying or selling property in Malaysia? That's exciting! But before you dive in, there's something important you need to know: property transfer fees. These fees, known locally as "cukai pendaftaran tukar nama," are a crucial part of the process and can impact your overall budget.

Think of it like this: when you buy a new phone, you don't just pay for the phone itself. There's usually a sales tax, maybe an activation fee, and perhaps even a cost for shipping. Similarly, transferring property ownership involves certain costs that go beyond the property's purchase price.

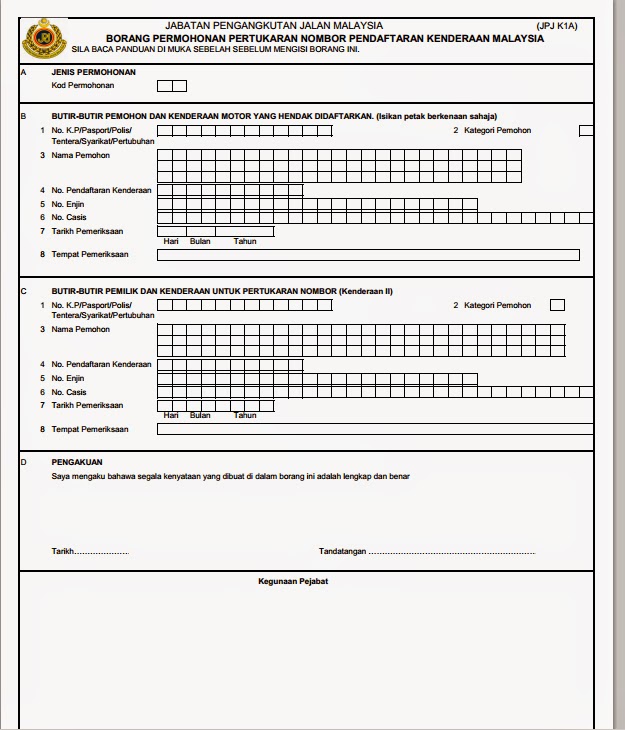

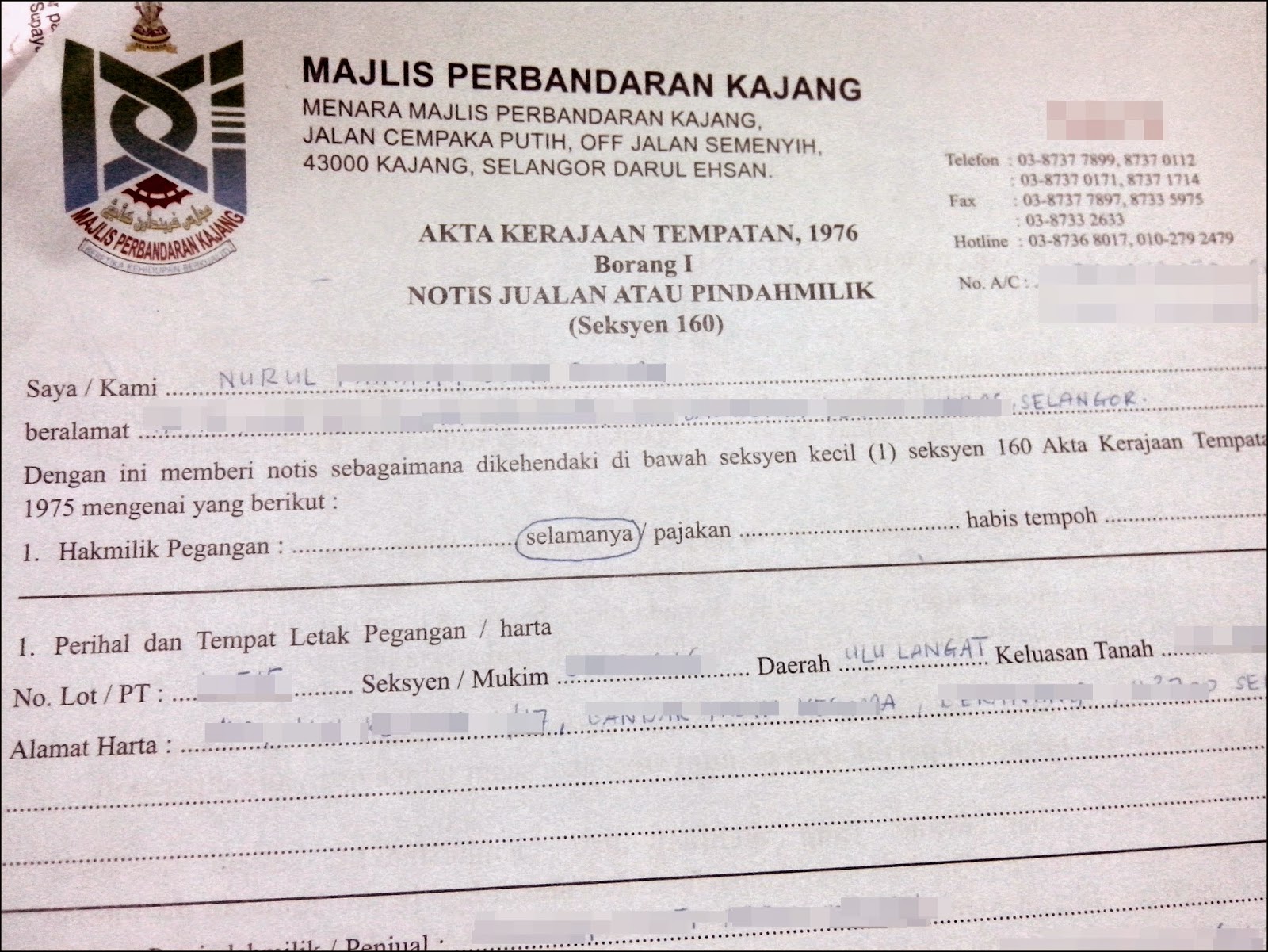

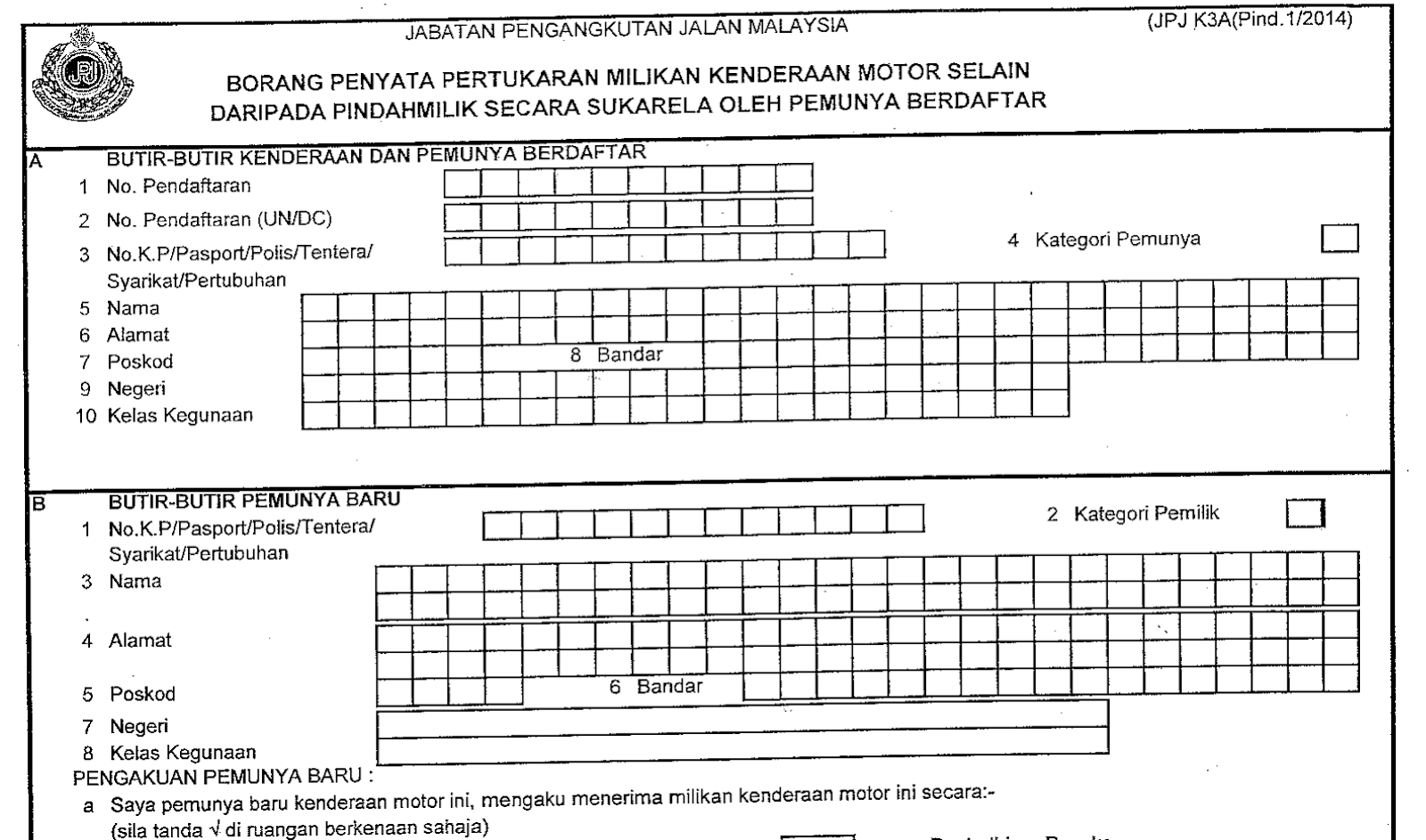

In Malaysia, "cukai pendaftaran tukar nama" is a legal requirement that formalizes the change of ownership of a property. This fee ensures that the government has an updated record of who owns what and helps fund various public services. In simpler terms, it's like paying a fee to register your new phone with your mobile provider.

Now, you might be wondering: how much are these fees, and what exactly are they for? That's where things can get a little tricky. The fees vary depending on factors like the property's value, location, and your state in Malaysia. They cover things like registration fees, stamp duties, and legal processing costs.

Don't worry, we'll dive into the details later on. Understanding these fees and how they're calculated is vital for both buyers and sellers to avoid any surprises and ensure a smooth transaction.

Advantages and Disadvantages of Property Transfer Fees in Malaysia

While property transfer fees are a standard part of real estate transactions in many countries, including Malaysia, it's essential to understand their implications. Like any other financial regulation, there are pros and cons to consider:

| Advantages | Disadvantages |

|---|---|

Government Revenue: The fees collected contribute to government revenue, which funds public services, infrastructure development, and other essential initiatives. | Increased Transaction Costs: The fees add to the overall cost of buying or selling property, potentially making it more difficult for some individuals to enter the property market. |

Legal Protection: The process of registration and payment of fees helps establish legal ownership and protects against fraudulent activities related to property transactions. | Potential for Disputes: If the fees are not correctly calculated or if there are disagreements over who bears the costs, it can lead to delays and legal disputes. |

Accurate Record Keeping: The transfer fees and registration process ensure a transparent and up-to-date record of property ownership, facilitating efficient land administration. | Complexity for Foreign Buyers: The regulations and procedures related to property transfer fees can be complex for foreign buyers to navigate, potentially discouraging foreign investment. |

Navigating the intricacies of property transfer fees ("cukai pendaftaran tukar nama") in Malaysia is an essential aspect of real estate transactions. By understanding the process, seeking professional advice, and planning accordingly, both buyers and sellers can ensure a smoother and more successful experience.

cukai pendaftaran tukar nama | Kennecott Land

Prosedur Permohonan Lesen Premis Perniagaan | Kennecott Land

Contoh Surat Rasmi Lhdn | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

Contoh Surat Pengesahan Kerja | Kennecott Land

Makluman Dari Kastam Diraja Malaysia: Pengecualian Duti Import dan | Kennecott Land

Panduan Mudah Pindahmilik dan Pembahagian Rumah dan Tanah Pusaka | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land

cukai pendaftaran tukar nama | Kennecott Land