Navigating the Nuances of a Chase Third Party Check Deposit

In the intricate tapestry of financial transactions, where convenience and security intertwine, the concept of a third party check deposit emerges as a practical solution. Imagine a scenario where a friend owes you money, but instead of handing you cash, they present you with a check made out in your name, drawn on their Chase account. This, in essence, is the foundation of a third party check deposit - a seemingly simple transaction that carries its own set of nuances and considerations.

The ability to deposit a check issued by someone else into your own account is a testament to the evolving nature of banking and financial services. It speaks to a world where flexibility and accessibility are paramount. However, like any financial instrument, understanding the intricacies of a Chase third party check deposit is essential for both the payee and the depositor. This involves navigating the bank's specific policies, understanding potential risks, and ensuring the transaction aligns with your financial goals.

Chase, a financial institution renowned for its comprehensive services, has established specific guidelines governing third party check deposits. These guidelines are designed to maintain the integrity of the financial system, protect the interests of all parties involved, and mitigate the risk of fraud. For the individual, these guidelines translate into a clear understanding of what to expect when depositing a check issued by someone else into their Chase account.

One of the primary aspects of Chase's third party check deposit policy centers around verification. The bank places a strong emphasis on confirming the legitimacy of the check and the identities of both the payee and the depositor. This typically involves presenting valid identification at a branch or using mobile check deposit features with additional security measures. This rigorous approach ensures that the funds are deposited into the correct account and helps to prevent fraudulent activities.

Understanding Chase's policies on hold periods is another crucial element of navigating third party check deposits. While some deposits may clear immediately, others may be subject to holds, particularly for larger amounts or checks from unfamiliar sources. This practice is standard across many financial institutions and serves as a precautionary measure to safeguard against potential losses.

Advantages and Disadvantages of Chase Third Party Check Deposits

| Advantages | Disadvantages |

|---|---|

| Convenience for the payee | Potential for delays in funds availability |

| Flexibility in receiving payments | Risk of fraud or bounced checks |

Best Practices for Chase Third Party Check Deposits

Ensuring a smooth and secure experience when engaging in Chase third party check deposits involves adhering to some best practices:

- Verify Check Authenticity: Before attempting to deposit, carefully examine the check for any signs of tampering or discrepancies.

- Confirm Funds Availability: It's prudent to confirm with the check issuer that sufficient funds are available to cover the check amount.

- Understand Hold Policies: Familiarize yourself with Chase's hold policies for third party checks to anticipate potential delays in funds availability.

- Maintain Clear Communication: Open communication between the payee and depositor throughout the process helps mitigate misunderstandings and facilitates a seamless experience.

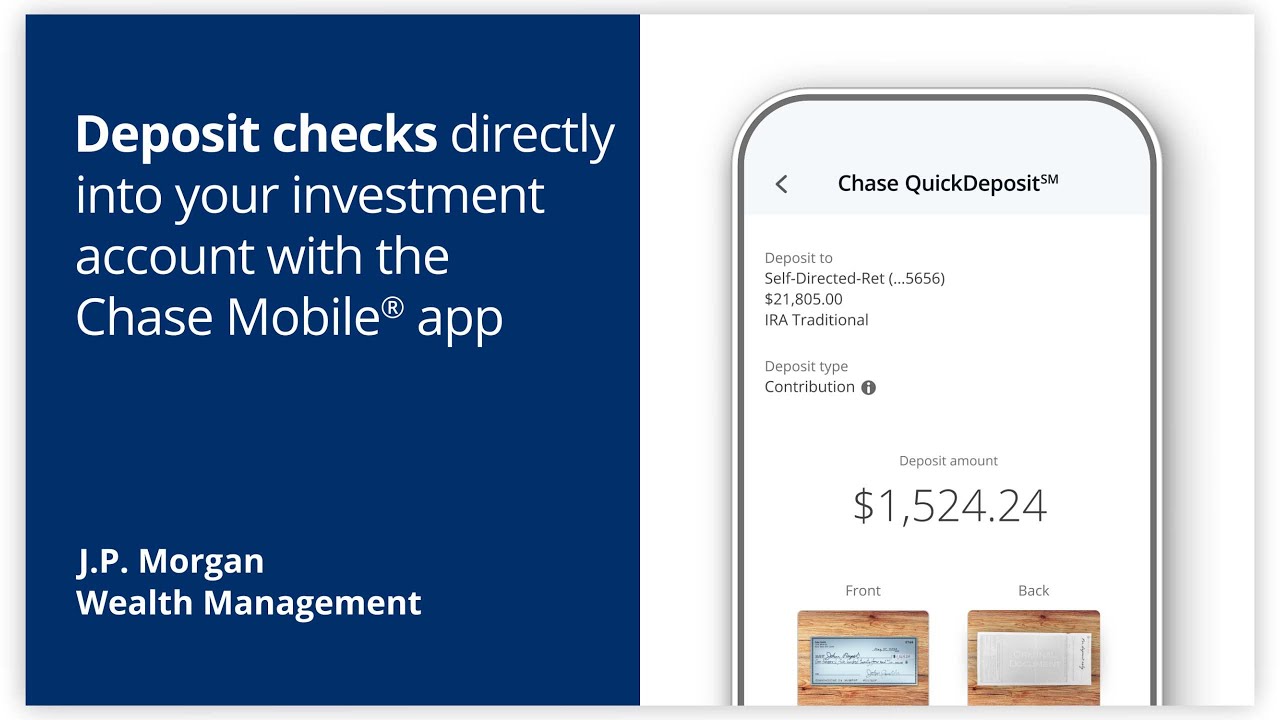

- Utilize Mobile Deposit Responsibly: If using Chase's mobile deposit feature, ensure clear endorsements and accurate information input to avoid processing delays or rejections.

Navigating the realm of Chase third party check deposits, while seemingly complex, becomes manageable with a clear understanding of the bank's policies, potential challenges, and recommended best practices. By embracing informed financial practices, individuals can leverage this transaction method confidently and efficiently, making it a seamless part of their financial toolkit.

How to Endorse Chase Bank Mobile Deposit? | Kennecott Land

Chase Mobile App Check Deposit | Kennecott Land

17 Places to Cash a Third | Kennecott Land

How to Deposit Checks on Chase App in 2023 (By ex | Kennecott Land

chase third party check deposit | Kennecott Land

How to Use Chase Quick Deposit Correctly | Kennecott Land

How To Cash A Third Party Check At Chase | Kennecott Land

3 Ways to Endorse a Check | Kennecott Land

:max_bytes(150000):strip_icc()/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)

How to Endorse a Check | Kennecott Land

chase third party check deposit | Kennecott Land

How To Cash A Third Party Check At Chase | Kennecott Land

How To Cash Third Party Check Online Instantly | Kennecott Land

:max_bytes(150000):strip_icc()/instructions-and-problems-with-signing-a-check-over-315318-final-a7d51331576c42a6ab3cac0eb683901d.jpg)

How to Endorse a Check to Someone Else | Kennecott Land

How to Deposit Checks on Chase App in 2023 (By ex | Kennecott Land

When Writing Checks As Power Of Attorney | Kennecott Land