Navigating the Path to Higher Education: Understanding PTPTN Loans

There's a certain energy that vibrates through the bustling streets of Kuala Lumpur, a palpable sense of ambition and drive. You see it in the eyes of young Malaysians, a hunger for knowledge, a yearning to carve their own paths in the world. And often, the key to unlocking those paths lies in higher education. But the pursuit of knowledge, like any worthwhile endeavor, requires investment, not just of time and dedication, but often, financially too.

This is where the Perbadanan Tabung Pendidikan Tinggi Nasional, or PTPTN as it's more commonly known, steps in. More than just a loan provider, PTPTN represents a commitment from the nation, a belief in the potential of its youth. It's a lifeline for countless Malaysians, easing the financial burden of tuition fees and living expenses, allowing them to focus on what truly matters: learning, growing, and transforming their aspirations into realities.

Established in 1997, PTPTN was born out of a need, a recognition that the rising cost of education shouldn't be a barrier to success. The vision was clear: to create a society empowered by knowledge, fueled by the dreams of its people. Over the years, this vision has translated into tangible impact, with millions of Malaysians benefiting from PTPTN loans, stepping into diverse fields, and contributing to the nation's growth story.

However, navigating the world of student loans, even one as impactful as PTPTN, can seem daunting, a maze of forms, eligibility criteria, and repayment schemes. The key is understanding, demystifying the process, and approaching it with clarity and confidence.

While the process of applying for a PTPTN loan is relatively straightforward, it does require attention to detail. Potential borrowers must meet certain eligibility criteria, including being Malaysian citizens enrolled in approved courses at recognized institutions. The loan amount offered can vary based on factors like the chosen course of study and the applicant's family income. Repayment options are designed to be manageable, typically starting after graduation, with various schemes tailored to different income levels.

Advantages and Disadvantages of PTPTN Loans

Like any financial decision, taking a PTPTN loan comes with its own set of advantages and disadvantages. It's crucial to weigh these factors carefully before making a decision.

| Advantages | Disadvantages |

|---|---|

| Access to Higher Education | Potential Debt Burden |

| Manageable Repayment Options | Interest Rates |

| Investment in the Future | Impact on Credit Score |

Ultimately, the decision of whether or not to take a PTPTN loan is a personal one. It requires careful consideration of individual circumstances, financial capabilities, and future aspirations.

Navigating the path to higher education is rarely without its challenges. It demands dedication, resilience, and often, a leap of faith. But with the right resources and support, like the opportunities presented by PTPTN, it becomes a journey of immense possibility, paving the way for a brighter, more fulfilling future.

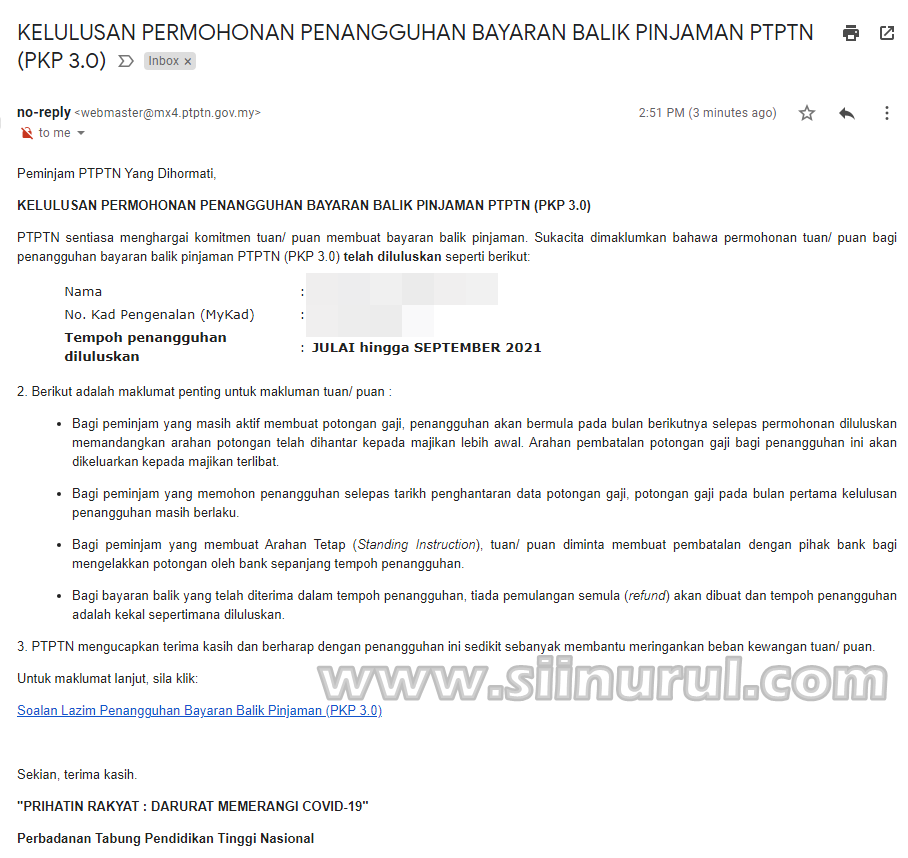

Cara Membuat Penangguhan Bayaran Balik Pinjaman PTPTN (PKP 3.0) | Kennecott Land

Cara Semak Baki Pinjaman PTPTN Secara Online | Kennecott Land

Cara Membuat Permohonan Pinjaman PTPTN | Kennecott Land

Cara Membuat Permohonan Pinjaman PTPTN | Kennecott Land

Surat Permohonan Penjadualan Semula Pinjaman Ptptn Kali | Kennecott Land

Cara Guna Simpanan KWSP Untuk Bayar Pinjaman PTPTN » EduBestari | Kennecott Land

Cara Membuat Bayaran Pinjaman Ptptn Dengan Menggunakan Jompay Mybsn | Kennecott Land

Cara Membuat Penangguhan Bayaran Balik Pinjaman PTPTN (PKP 3.0) | Kennecott Land

Cara Membuat Permohonan Pinjaman PTPTN | Kennecott Land

Permohonan PTPTN: Panduan, Syarat & Wang Pendahuluan Pinjaman RM1,500 | Kennecott Land

Contoh Surat Pinjaman Wang Dari Syarikat | Kennecott Land

Cara Mohon Pengecualian Bayaran Balik PTPTN Online (Pem | Kennecott Land

Pinjaman Pendidikan PTPTN: Cara Membuat Permohonan Secara Online | Kennecott Land

Bajet 2023: Diskaun PTPTN Sehingga 20% | Kennecott Land

Insentif Bayaran Balik Pinjaman PTPTN Anak Sarawak. Ini Cara Buat Semakan | Kennecott Land