Navigating Your Retirement: A Guide to Pension Form Completion (Panduan Pengisian Borang Pencen)

Retirement. It's a word that evokes a mixture of emotions - excitement for newfound freedom, perhaps a touch of uncertainty about the unknown, and definitely a sense of accomplishment for a lifetime of work. As you prepare to embark on this new chapter, there are practical matters to address, and one of the most important is ensuring the seamless transition of your financial security, particularly your pension.

For many, the thought of navigating bureaucratic processes can feel daunting, especially when it comes to something as crucial as your retirement funds. The process often involves forms, regulations, and specific requirements that can seem overwhelming at first glance. However, with a clear understanding and a step-by-step approach, you can approach this process with confidence, knowing you've taken the necessary steps to secure your financial well-being in retirement.

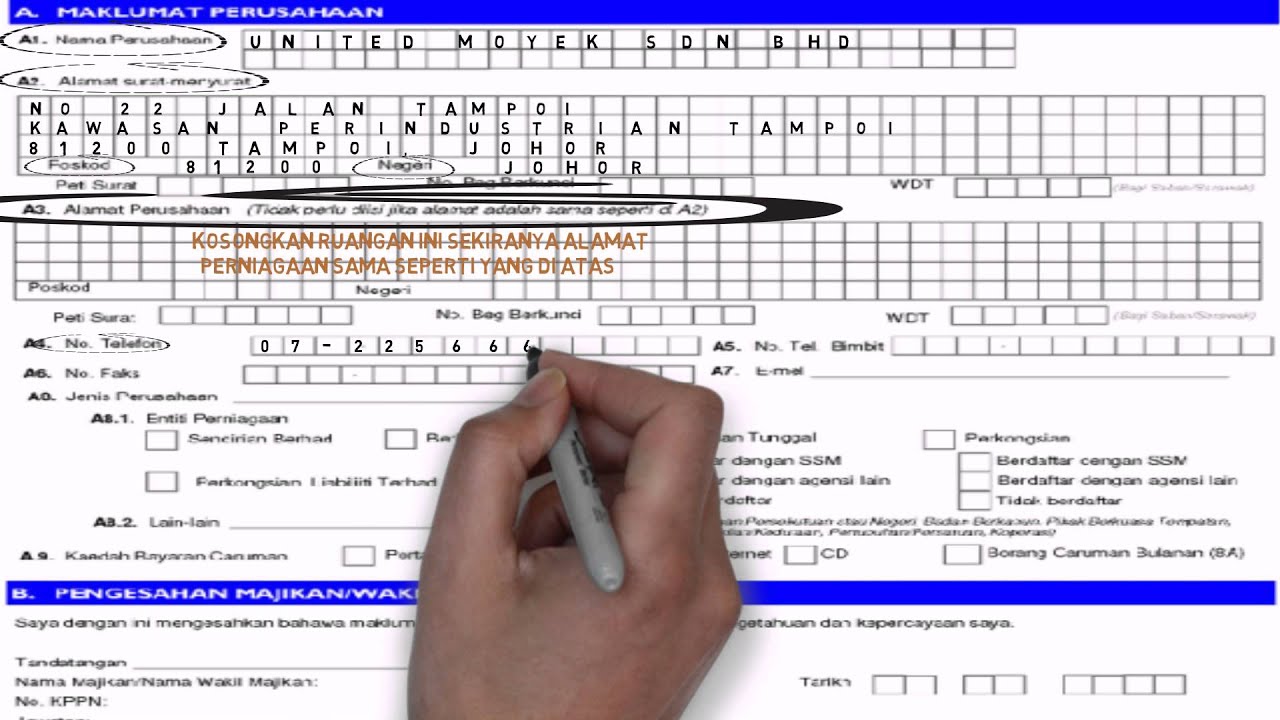

This is where the importance of a comprehensive guide, a "panduan pengisian borang pencen" in Malaysian, comes into play. This translates to "guide to filling out pension forms," and it's designed to demystify the process, providing clear and concise information to help you navigate each step with ease.

Think of this guide as your roadmap, leading you through the intricacies of pension form completion. It's like having a knowledgeable companion by your side, ready to answer your questions, clarify any confusion, and ensure you have all the necessary information at your fingertips.

Retirement should be a time to savor the fruits of your labor, to pursue passions, and embrace new adventures. By taking the time to understand and correctly complete your pension forms, you're laying the foundation for a financially secure and fulfilling retirement, allowing you to truly enjoy this well-deserved chapter of your life.

Advantages and Disadvantages of Using a Guide for Pension Form Completion

| Advantages | Disadvantages |

|---|---|

| Reduces stress and confusion | May not cover all specific situations |

| Ensures accuracy, minimizing errors | Requires effort to find and utilize effectively |

| Saves time by providing clear instructions | Information might become outdated if regulations change |

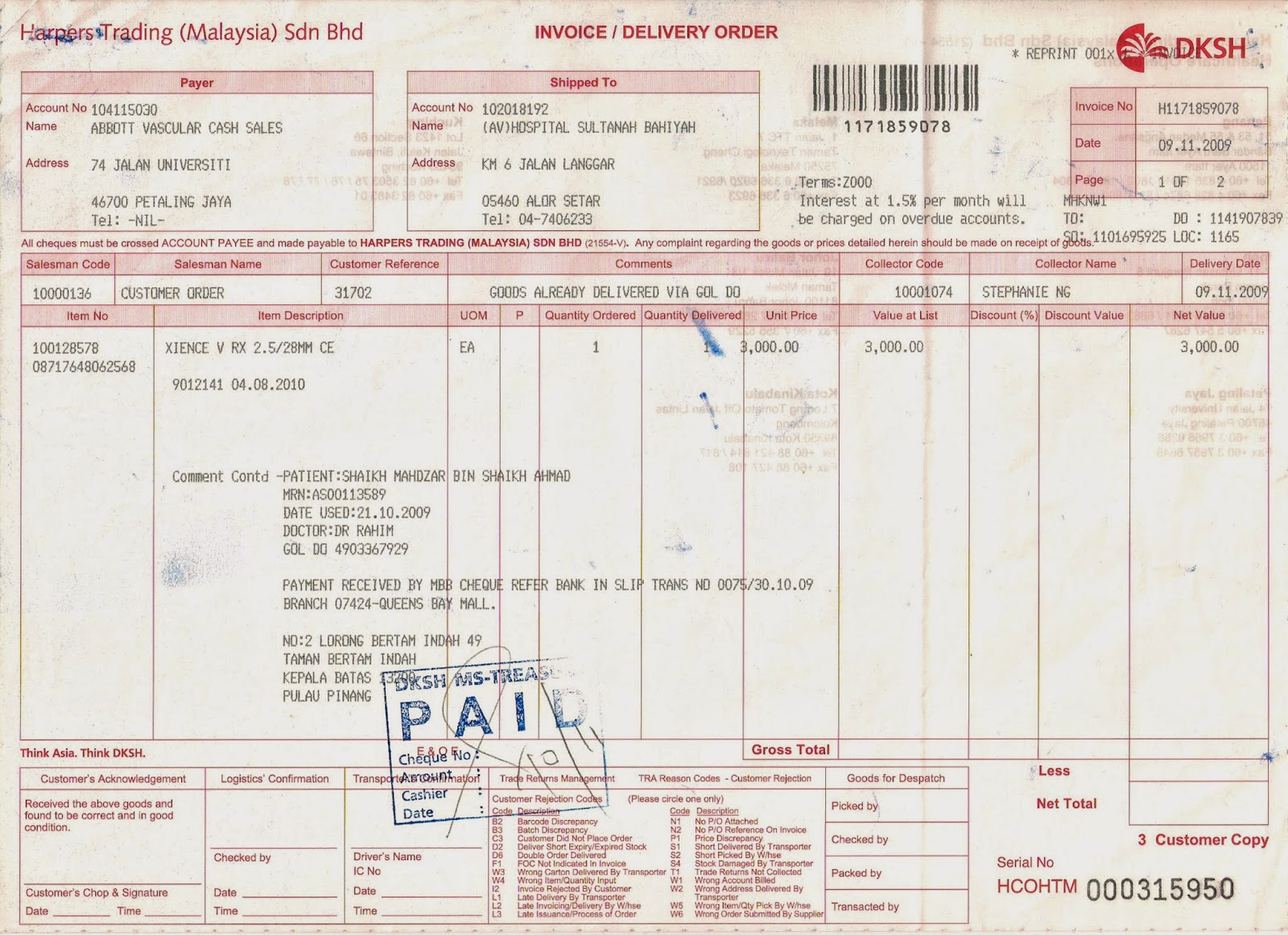

While this guide aims to be comprehensive, it's important to acknowledge that regulations and specific requirements can vary. Consulting with your pension provider directly is always recommended to address any unique circumstances or questions you may have.

Embracing retirement involves both excitement and careful planning. By proactively addressing the administrative aspects, such as pension form completion, you're taking a significant step towards a smooth and enjoyable transition. Remember, resources and support are available to guide you through this process, ensuring you can confidently step into this new chapter of life, embracing all the joys and opportunities it holds.

Panduan Pengisian Borang Pencen Lampiran Surat | Kennecott Land

PANDUAN PENGISIAN BORANG KEBERHASILAN PBPPP | Kennecott Land

Panduan Pengisian Borang Pencen Penakat | Kennecott Land

Panduan Pengisian Borang Pencen Lampiran Permenpan | Kennecott Land

Panduan Pengisian Borang Pencen Lampiran Surat | Kennecott Land

Panduan Pengisian Borang Pencen Guru Gobind | Kennecott Land

Panduan Mengisi Borang Pencen Cara Mengisi Borang Persaraan Dan Pencen | Kennecott Land

Panduan Pengisian Borang Pencen Pilihan | Kennecott Land

Get Borang Permohonan Kwsp Majikan PNG | Kennecott Land

Panduan Mengisi Borang Pencen Panduan Mengisi Borang | Kennecott Land

Panduan Mengisi Borang Pencen Cara Mengisi Borang Persaraan Dan Pencen | Kennecott Land

Panduan Pengisian Borang Perubatan 1 09 | Kennecott Land

Cara Mengisi Borang Pencen | Kennecott Land

Panduan Mengisi Borang Pencen | Kennecott Land

Panduan Pengisian Borang Pencen Penakat | Kennecott Land