Need Cash Fast? Your Wells Fargo Withdrawal Limit Inside Bank Explained

Imagine this: you're at the bank, ready to withdraw a large sum of cash for a down payment, only to find out there's a limit on how much you can take out. Frustrating, right? Understanding your bank's withdrawal limits is crucial to avoid such unpleasant surprises and ensure smooth financial transactions.

This is particularly true for larger banks like Wells Fargo, where policies can be complex and vary depending on several factors. Knowing the ins and outs of Wells Fargo's withdrawal limit inside bank policies empowers you to manage your finances effectively and avoid potential hiccups.

While we strive to provide the most accurate and up-to-date information, please remember that banking policies are constantly evolving. This article aims to give you a general understanding of Wells Fargo's withdrawal limits inside the bank. However, it's essential to contact Wells Fargo directly or visit their official website for the most current and personalized information regarding your specific account type and situation.

Navigating the world of banking can seem daunting, but it doesn't have to be. By arming yourself with knowledge, you can confidently manage your finances and ensure your money is accessible when you need it most. So, let's dive in and demystify Wells Fargo's withdrawal limit inside bank policies together!

This article will explore the intricacies of Wells Fargo withdrawal limits, equipping you with the knowledge to navigate your finances confidently. We'll cover factors influencing these limits, alternative ways to access larger sums, and tips for a seamless banking experience. Remember, staying informed is key to managing your money effectively and avoiding any unexpected hurdles.

Advantages and Disadvantages of Wells Fargo Withdrawal Limit Inside Bank

| Advantages | Disadvantages |

|---|---|

| Enhanced security against large-scale theft | Potential inconvenience for large cash transactions |

| Reduced risk of fraud and unauthorized withdrawals | May require planning and alternative arrangements for substantial withdrawals |

While Wells Fargo doesn't publicly disclose specific daily withdrawal limits inside the bank, it's essential to understand that such limits are standard practice across financial institutions. These limitations exist to protect both the bank and its customers. By restricting the amount of cash that can be withdrawn at once, banks can deter theft, manage cash flow within their branches, and mitigate potential losses from fraudulent activities.

Best Practices for Managing Your Wells Fargo Account

1. Plan Ahead: For large withdrawals, contact your local Wells Fargo branch to inform them in advance. This helps them prepare and ensures a smoother transaction.

2. Explore Alternatives: Consider cashier's checks or wire transfers for significant sums, offering more security and convenience.

3. Utilize Digital Tools: Monitor your account balance and transaction history regularly through Wells Fargo's online banking platform or mobile app.

4. Communicate: Don't hesitate to contact Wells Fargo customer service if you have questions or need assistance with withdrawals or any other banking needs.

5. Stay Informed: Keep abreast of Wells Fargo's latest policies and procedures regarding withdrawal limits, as these may change periodically.

Common Questions About Wells Fargo Withdrawal Limits

Q1: Does my account type affect my withdrawal limit?

While Wells Fargo doesn't publicly disclose specific limits, account type can influence potential withdrawal amounts. Checking accounts typically have different limits than savings accounts.

Q2: What if I need to withdraw more than the limit?

Explore alternatives like cashier's checks or wire transfers for large sums. Contacting your branch in advance is advised for substantial withdrawals.

Q3: Are there fees for exceeding withdrawal limits?

Wells Fargo doesn't usually charge fees for exceeding internal withdrawal limits. However, exceeding ATM withdrawal limits may incur fees. Always refer to your account terms and conditions.

Q4: Can I withdraw cash from a non-Wells Fargo ATM?

Yes, but fees may apply. Wells Fargo may also impose limits on withdrawals from non-Wells Fargo ATMs.

Q5: Can I withdraw cash from international ATMs?

Yes, but international withdrawal fees and restrictions may apply. Contact Wells Fargo for details regarding international transactions.

Q6: How can I check my available balance?

You can conveniently check your balance through Wells Fargo's online banking platform, mobile app, or by visiting an ATM.

Q7: Can I withdraw money from my account if I lose my debit card?

Yes, you can typically withdraw money inside a branch with proper identification even without your debit card.

Q8: What should I do if I suspect fraudulent activity on my account?

Immediately contact Wells Fargo customer service to report any suspicious transactions and take necessary steps to protect your account.

Conclusion

Understanding Wells Fargo's withdrawal limit inside bank policies is crucial for managing your finances effectively. While the bank doesn't publicly disclose specific limits, remember that these are in place to protect both you and the institution. By familiarizing yourself with the factors influencing these limits, exploring alternative options for larger sums, and adopting proactive communication, you can ensure a smooth and hassle-free banking experience. For the most accurate and up-to-date information, always refer to Wells Fargo's official website or contact their customer service directly.

McMurdo's Automated Teller Machines | Kennecott Land

Wells Fargo Accidentally Drains $4,000 From Customer | Kennecott Land

How Much Can I Withdraw from Wells Fargo? Exploring Your ATM Withdrawal | Kennecott Land

Wells Fargo ATM withdrawal limits | Kennecott Land

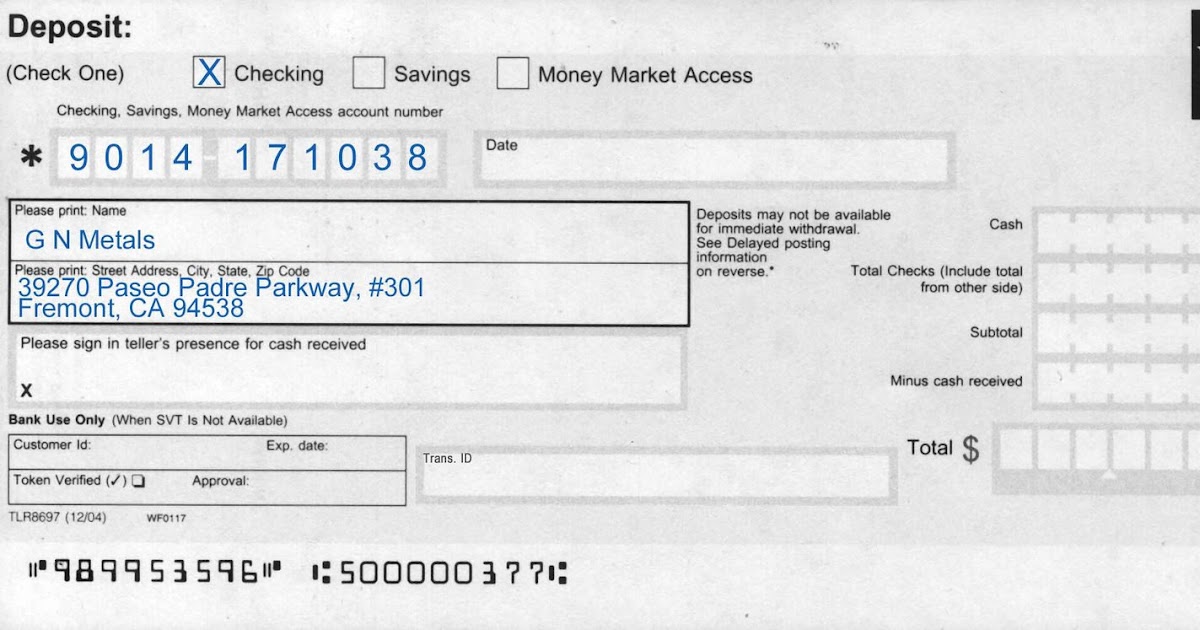

Wells Fargo Bank Account Number On Check | Kennecott Land

![Wells Fargo Daily ATM Withdrawal Limit [Explained]](https://i2.wp.com/milvestor.com/wp-content/uploads/2021/10/Wells-Fargo-Daily-ATM-Withdrawal-Limit.jpg)

Wells Fargo Daily ATM Withdrawal Limit [Explained] | Kennecott Land

Wells Fargo ATM Withdrawal Limit, 2022, ATM Cash Limits | Kennecott Land

48 printable fax cover sheet pdf page 4 | Kennecott Land

How Much Can I Withdraw from Wells Fargo? Exploring Your ATM Withdrawal | Kennecott Land

Wells Fargo ATM Withdrawal Limit 2023 | Kennecott Land

Can I Print A Wells Fargo Deposit Slip | Kennecott Land

wells fargo withdrawal limit inside bank | Kennecott Land

Printable Wells Fargo Deposit Slip | Kennecott Land

Wells Fargo Bank Statement Template | Kennecott Land

Wells Fargo ATM Withdrawal Limit And Debit Purchase | Kennecott Land