Permohonan Pengurangan Bayaran Balik JPA: Navigating Your Options

Navigating the complexities of student loan repayment can be a daunting task, especially when faced with unexpected financial challenges. In Malaysia, recipients of scholarships and loans from the Public Service Department (JPA) have options available to them if they find themselves struggling to meet their repayment obligations. Understanding the process of "permohonan pengurangan bayaran balik JPA," which translates to "application for reduction of JPA repayment," is crucial for those seeking financial relief.

Imagine this: you've diligently completed your studies, fueled by the support of a JPA scholarship, and are eager to contribute to society. However, life throws a curveball – perhaps an economic downturn, unexpected medical expenses, or family obligations – leaving you grappling with a financial burden that makes repaying your loan a significant challenge. This is where the option to apply for a reduction in your JPA repayment comes into play.

The availability of this application process underscores the Malaysian government's commitment to supporting its scholars even after they've completed their studies. It recognizes that unforeseen circumstances can arise, potentially hindering individuals from fulfilling their financial obligations as initially planned. This article aims to demystify the process of applying for a JPA repayment reduction, providing clarity on the steps involved, eligibility criteria, and potential benefits.

Before delving into the specifics, it's essential to understand that each case is unique. The JPA evaluates each application based on its individual merits, considering the applicant's financial situation, reasons for requesting a reduction, and other relevant factors. Transparency is key throughout this process. Applicants are encouraged to provide accurate and detailed information to facilitate a smooth and fair evaluation. Remember, seeking assistance when facing financial hardship is a responsible decision, and understanding the available options is the first step towards finding a solution.

While the process of applying for a JPA repayment reduction might seem complicated, it's designed to be accessible and manageable. By breaking down the process into understandable steps and providing clear explanations, this article aims to empower JPA scholars facing financial difficulties to explore this option and potentially alleviate some of their financial stress. Remember, reaching out for support when needed is a sign of strength, and understanding your options is the first step towards navigating challenging financial times.

Advantages and Disadvantages of Applying for JPA Repayment Reduction

| Advantages | Disadvantages |

|---|---|

| Potential for lower monthly payments | Application process might require time and effort |

| Reduced financial burden | Possible extension of the overall repayment period |

| Opportunity to improve financial stability | Application outcome is not guaranteed |

Surat Rasmi Permohonan Diskaun | Kennecott Land

Surat Permohonan Pembayaran Balik Jpa Scholarship Interview | Kennecott Land

Contoh Surat Permohonan Tuntutan Balik Bayaran Levi Daripada Majikan | Kennecott Land

Contoh Surat Rayuan Pengurangan Bayaran Penuh Pinjaman Bank | Kennecott Land

Cara Membuat Surat Penangguhan Pembayaran Barang matamu | Kennecott Land

Contoh Surat Permohonan Pengurangan Bayaran Sewa Kedai | Kennecott Land

Contoh Surat Rayuan Pengurangan Bayaran Sewa Kedai Contoh Surat | Kennecott Land

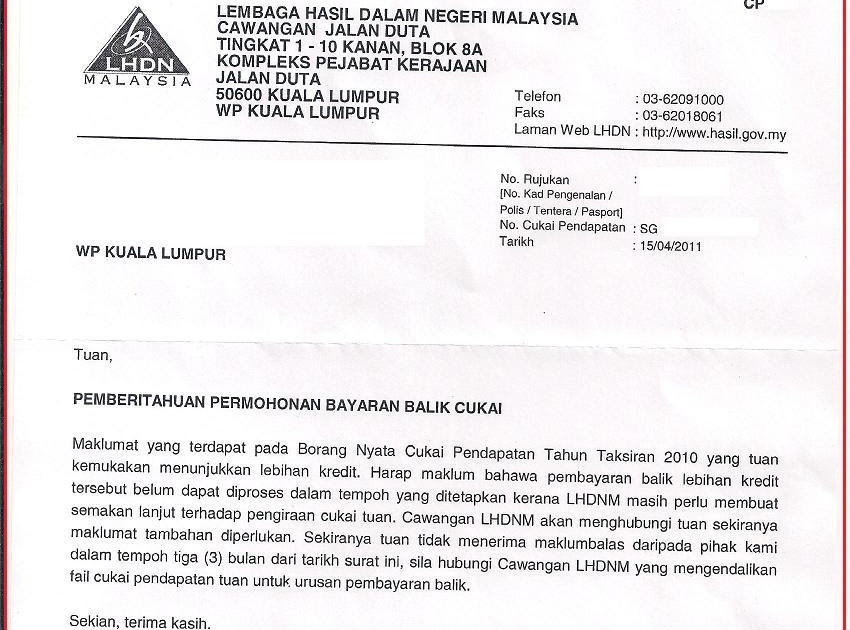

Surat Permohonan Bayaran Balik Imagesee | Kennecott Land

Surat Memohon Pengurangan Bayaran | Kennecott Land

Surat Pembayaran Balik Ptptn | Kennecott Land

Contoh Surat Rayuan Pengurangan Bayaran Yuran Pengajian | Kennecott Land

Surat Permohonan Pengurangan Bayaran Balik | Kennecott Land

Permohonan Pengurangan Bayaran Balik Pinjaman Pelajaran Mara Conversion | Kennecott Land

Contoh Surat Permohonan Pengurangan Bayaran Pinjaman Bank | Kennecott Land

Surat Permohonan Pengurangan Bayaran Balik | Kennecott Land