PTPTN Penangguhan Bayaran Balik: Navigating Loan Deferment

Graduating from university is a major milestone, often marked by a mix of exhilaration and the daunting reality of student loans. For many Malaysian students, the National Higher Education Fund Corporation (PTPTN) loan has been instrumental in funding their education. However, transitioning into the workforce and managing finances can be challenging, leading many graduates to seek ways to manage their PTPTN loan repayments. This is where "PTPTN Penangguhan Bayaran Balik," or PTPTN loan deferment, comes in, offering a safety net for graduates facing financial constraints.

Imagine this: you've just graduated, but haven't landed a stable job yet. The pressure to start repaying your PTPTN loan can be immense. This is a common scenario for many young Malaysians, and it highlights the importance of understanding the available options for managing student loan debt. PTPTN loan deferment provides a temporary solution, allowing graduates to postpone their monthly repayments until their financial situation stabilizes.

However, navigating the intricacies of loan deferment can be complex. Eligibility criteria, application procedures, and the implications of deferment are crucial factors to consider. This article delves into the intricacies of PTPTN Penangguhan Bayaran Balik, providing a comprehensive guide for graduates seeking to understand and utilize this financial tool.

Before diving into the specifics of PTPTN loan deferment, it's crucial to understand the broader context of student loans in Malaysia. The PTPTN loan scheme was introduced to provide financial assistance to students pursuing higher education, enabling them to focus on their studies without excessive financial burdens. While the loan has been instrumental in increasing access to higher education, it has also sparked debates about affordability, repayment rates, and the long-term implications of student debt.

PTPTN Penangguhan Bayaran Balik is a mechanism designed to address some of these concerns by providing temporary relief to borrowers facing financial difficulties. By understanding the nuances of this option, graduates can make informed decisions about managing their loans and navigating the initial years of their careers with greater financial stability.

Advantages and Disadvantages of PTPTN Penangguhan Bayaran Balik

While PTPTN Penangguhan Bayaran Balik offers respite, it's essential to weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Provides temporary financial relief | Accrued interest increases overall loan amount |

| Allows graduates to focus on job searching or other financial priorities | Extends the loan repayment period |

| Prevents loan default and potential legal consequences | Requires meeting specific eligibility criteria |

ptptn penangguhan bayaran balik | Kennecott Land

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Kennecott Land

Cara Kemaskini Maklumat Pendapatan PTPTN (Penangguhan Bayaran Balik) | Kennecott Land

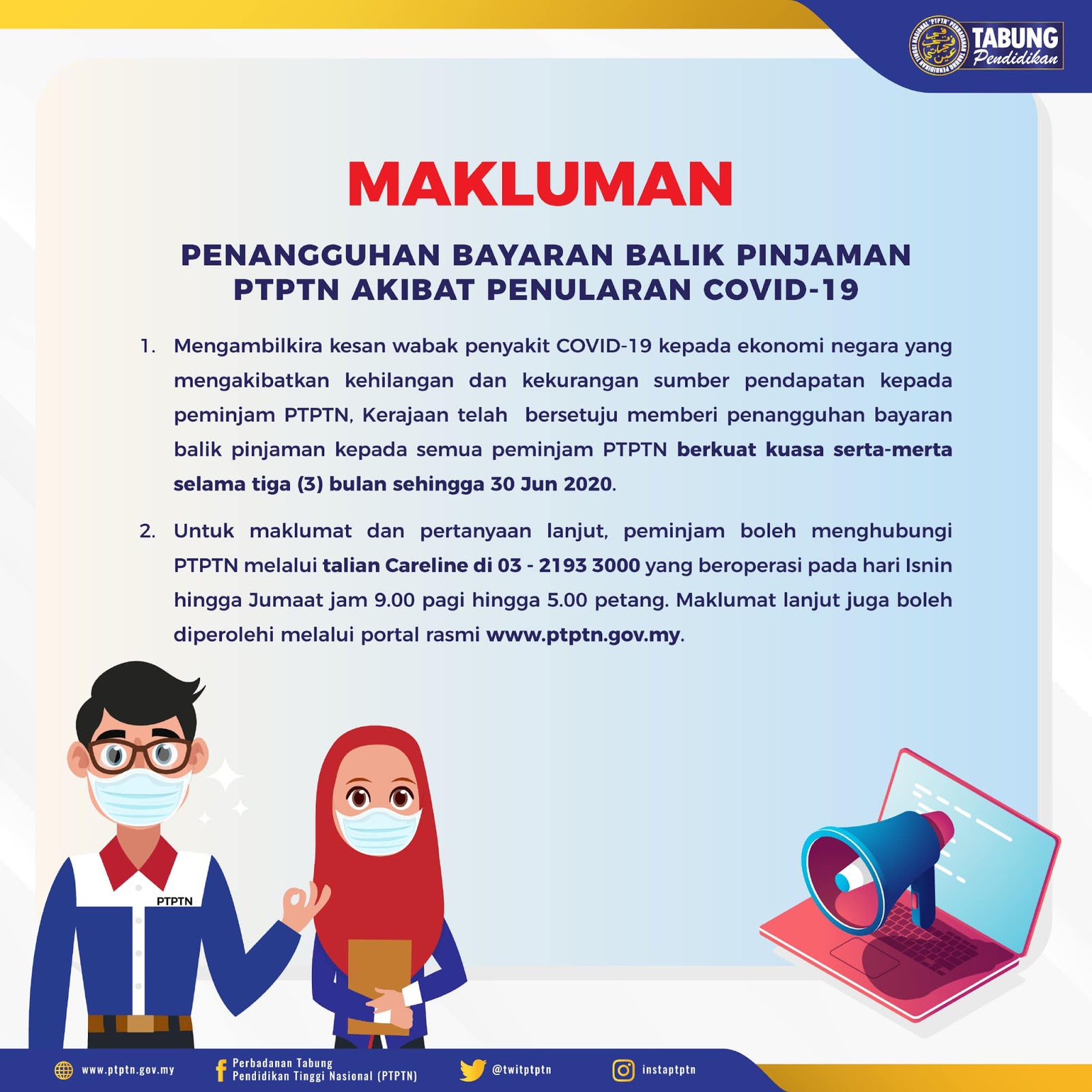

PKP 3.0: Permohonan Penangguhan Bayaran Balik Pinjaman PTPTN Selama 3 | Kennecott Land

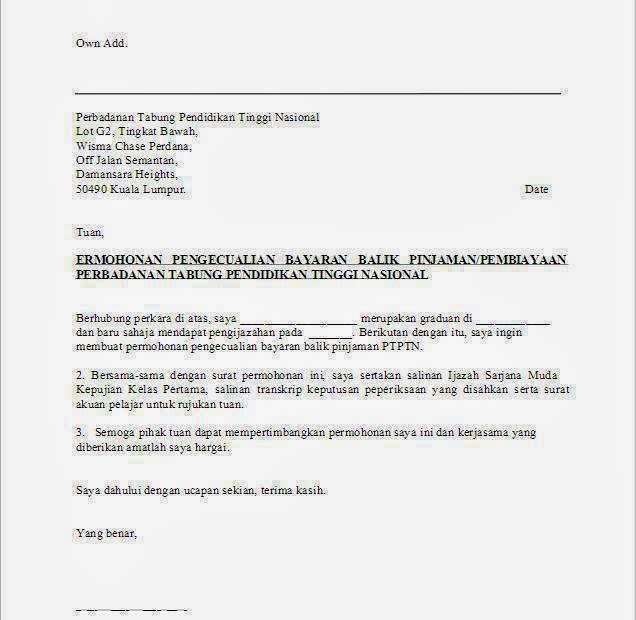

Contoh Surat Permohonan Pengecualian Bayaran Balik Ptptn | Kennecott Land

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Kennecott Land

Penangguhan Bayaran Balik Pinjaman PTPTN Di Tangguh Selama 6 Bulan | Kennecott Land

Penangguhan Bayaran Balik PTPTN & Pertukaran Ujrah (LOGIN) | Kennecott Land

ptptn penangguhan bayaran balik | Kennecott Land

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Kennecott Land

Cara Mohon Diskaun & Penangguhan Bayaran Balik PTPTN | Kennecott Land

Surat Rayuan Pengurangan Bayaran | Kennecott Land

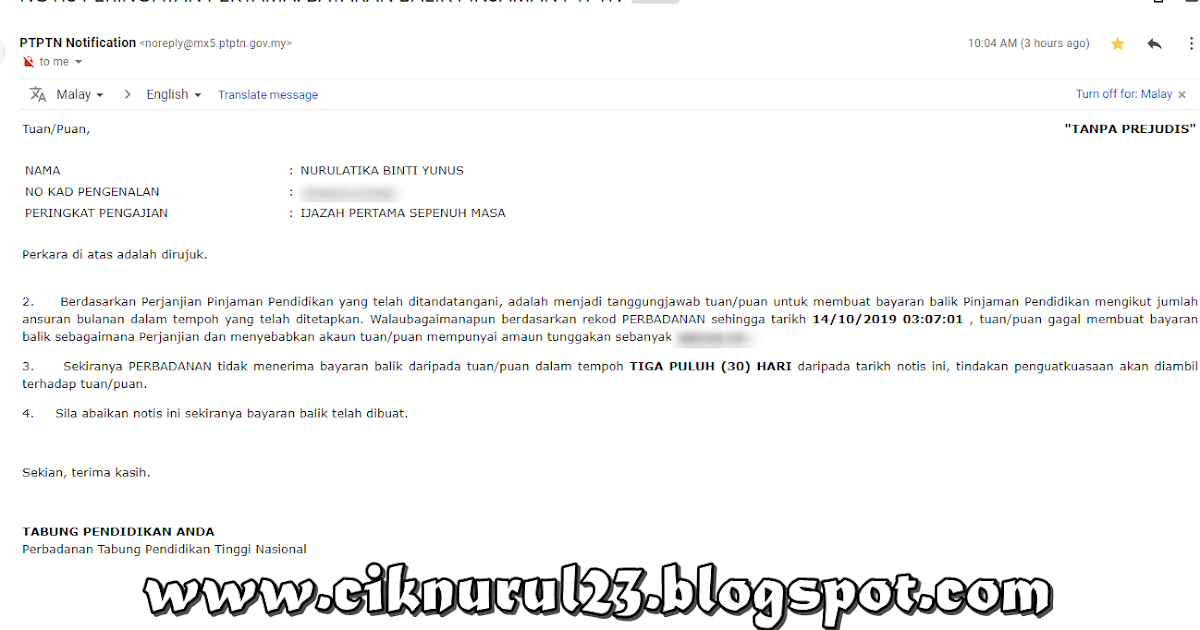

Dapat Notis Bayaran Balik Pinjaman PTPTN | Kennecott Land

PTPTN Pengecualian Bayaran Balik, Bila Tarikh Bayar (2023) | Kennecott Land

Contoh Surat Rasmi Penangguhan Bayaran Kereta | Kennecott Land