Simplify Your Zakat Payments with Borang Potongan Gaji Zakat Selangor

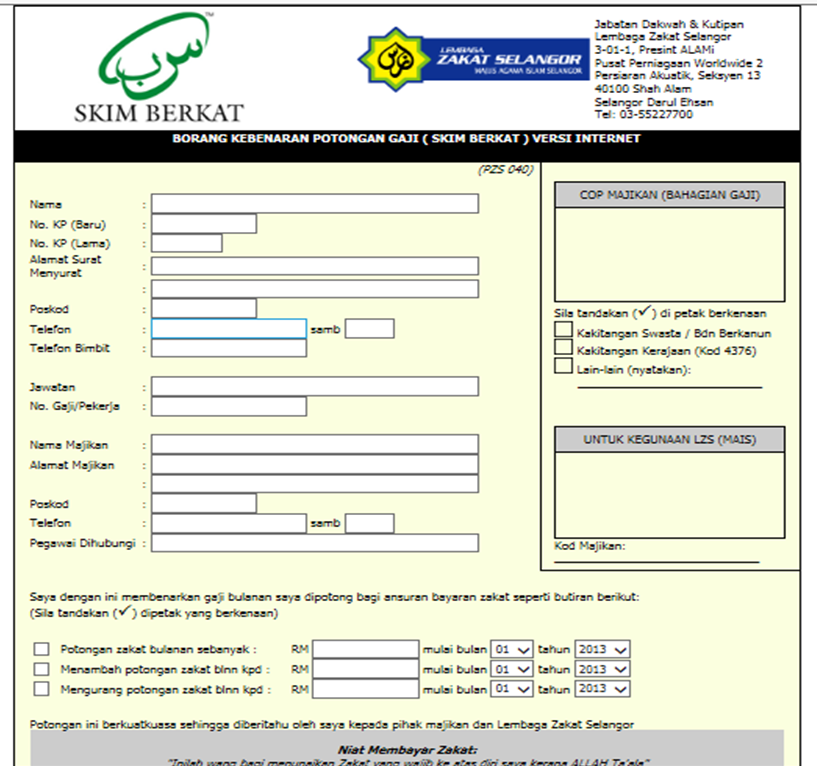

For many Muslims in Selangor, fulfilling their Zakat obligations is an important act of worship. But navigating the process of calculating and submitting Zakat payments can sometimes feel like a daunting task. What if there was an easier, more streamlined way to manage your Zakat contributions, ensuring you fulfill your religious duty without any hassle? This is where the Borang Potongan Gaji Zakat Selangor (Salary Deduction Form for Zakat Selangor) comes in.

The Borang Potongan Gaji Zakat Selangor is a system implemented by the Selangor Zakat Board (Lembaga Zakat Selangor or LZS) to simplify Zakat payments for working individuals. This system allows you to make regular Zakat contributions directly from your salary, eliminating the need for manual calculations and payments every year. It's a convenient, efficient, and transparent way to ensure that your Zakat reaches those in need while simplifying your religious obligations.

The concept of Zakat, one of the five pillars of Islam, emphasizes the importance of wealth distribution and social responsibility. By contributing a portion of your income to Zakat, you are directly helping to uplift underprivileged communities and foster a more equitable society. The Borang Potongan Gaji Zakat Selangor reinforces this principle by making it easier for individuals to contribute regularly and consistently.

This system is part of LZS’s continuous effort to modernize Zakat collection and distribution. By leveraging technology and simplifying procedures, LZS encourages more people to fulfill their Zakat obligations, ultimately maximizing the positive impact of Zakat on the community. The widespread adoption of the Borang Potongan Gaji Zakat Selangor reflects its success in making Zakat more accessible and convenient for the modern Muslim workforce.

Despite its numerous advantages, some individuals might be unfamiliar with the Borang Potongan Gaji Zakat Selangor or hesitate to embrace this system due to misconceptions or lack of information. This article aims to provide a comprehensive understanding of the Borang Potongan Gaji Zakat Selangor, address common concerns, and highlight its benefits, empowering individuals to make informed decisions regarding their Zakat contributions.

Advantages and Disadvantages of Borang Potongan Gaji Zakat Selangor

| Advantages | Disadvantages |

|---|---|

| Convenience: Automatic deductions eliminate manual payments. | Potential for Errors: Incorrect deductions might occur, requiring follow-up with LZS and your employer. |

| Consistency: Ensures regular Zakat contributions throughout the year. | Limited Flexibility: Deductions are fixed unless you adjust the amount with LZS. |

| Transparency: Clear records of your Zakat contributions are available. | Dependence on Employer: Timely deductions rely on your employer processing the payments correctly. |

Understanding the nuances of the Borang Potongan Gaji Zakat Selangor, including its benefits and potential drawbacks, is crucial for individuals seeking to fulfill their Zakat obligations effectively and efficiently. By embracing this system, you not only simplify your Zakat contributions but also contribute to the well-being of the less fortunate in Selangor.

Borang A Zakat Selangor | Kennecott Land

borang potongan gaji zakat selangor | Kennecott Land

Borang A Zakat Selangor | Kennecott Land

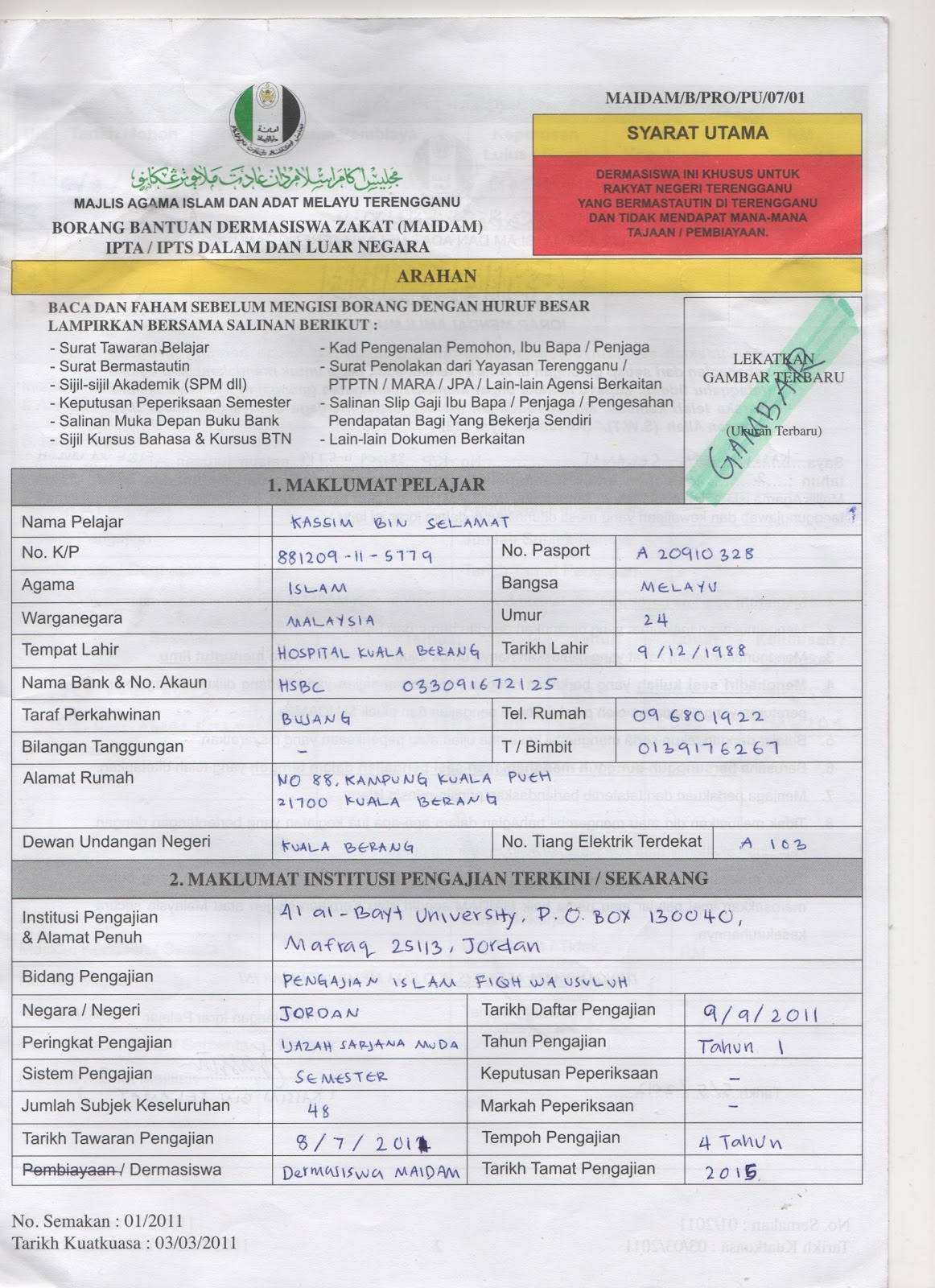

Borang Potongan Zakat Maidam | Kennecott Land

Kempen Skim Potongan Zakat Bulanan | Kennecott Land

borang potongan gaji zakat selangor | Kennecott Land

MAJLIS PENYERAHAN BORANG POTONGAN ZAKAT PENDAPATAN EXCO KERAJAAN NEGERI | Kennecott Land

Borang Kebenaran Bayaran Balik Pinjaman Latihan Kemahiran Melalui | Kennecott Land

Borang Potongan Gaji Bayar Zakat Format Melaka | Kennecott Land

borang potong gaji PTPTN | Kennecott Land

(Download PDF) borang potongan gaji | Kennecott Land

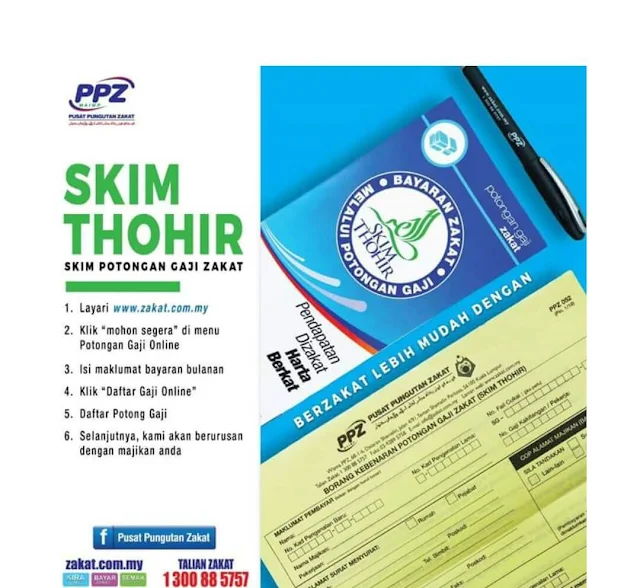

Kempen Skim Potongan Gaji Zakat (Skim Thohir) | Kennecott Land

borang potongan gaji zakat selangor | Kennecott Land