Skip the Line: Your Guide to Mobile Check Deposit with Wells Fargo

Remember the days of carving time out of your day to visit a bank branch, just to deposit a check? We live in a world of instant gratification – streaming movies on demand, food delivered to our doorstep – so why should banking be stuck in the past? Thankfully, with the advent of mobile banking apps, those days are fading fast. Wells Fargo, one of the nation’s largest banks, offers a convenient and secure way to deposit checks without leaving your home: mobile check deposit.

Mobile check deposit is exactly what it sounds like – the ability to send a digital image of your check to your bank for processing, all through your smartphone. This technology has revolutionized the way we manage our finances, providing an unprecedented level of flexibility and convenience. No longer are you constrained by branch hours or forced to wait in lines. With just a few taps on your phone, you can deposit your check from anywhere, anytime.

The origins of mobile check deposit can be traced back to the early 2000s, as banks began exploring innovative ways to leverage the growing power of smartphones. Early iterations were often clunky and unreliable, but as technology advanced, so too did the capabilities of mobile banking apps. Today, mobile check deposit is a standard feature offered by most major financial institutions, including Wells Fargo.

This shift towards mobile banking has been driven by the increasing demand for on-demand services. Consumers have grown accustomed to managing their lives digitally, and banking is no exception. Mobile check deposit is a prime example of how technology is simplifying our daily tasks, allowing us to focus on what matters most.

However, like any technological advancement, mobile check deposit has its share of challenges. Security concerns are paramount, as users must be confident that their financial information is protected throughout the digital process. Wells Fargo, like other major banks, employs robust security measures, including encryption and multi-factor authentication, to safeguard user data and prevent fraud.

Advantages and Disadvantages of Wells Fargo Mobile Check Deposit

| Advantages | Disadvantages |

|---|---|

| Convenience (deposit anytime, anywhere) | Potential for technical issues |

| Saves time (no need to visit a branch) | Check deposit limits |

| Faster access to funds (compared to ATM deposits) | Requires a smartphone and internet access |

Best Practices for Secure Mobile Deposits

While Wells Fargo's mobile deposit system is designed with security in mind, following these best practices can further minimize risks:

- Strong Password: Use a unique, strong password for your Wells Fargo app and avoid using the same password across multiple platforms.

- Secure Network: Only deposit checks when connected to a trusted Wi-Fi network, preferably your home or mobile data connection, to avoid potential vulnerabilities on public Wi-Fi.

- Endorsement and Note: Always endorse your checks with a signature and "For Mobile Deposit Only at Wells Fargo" to prevent someone else from depositing it.

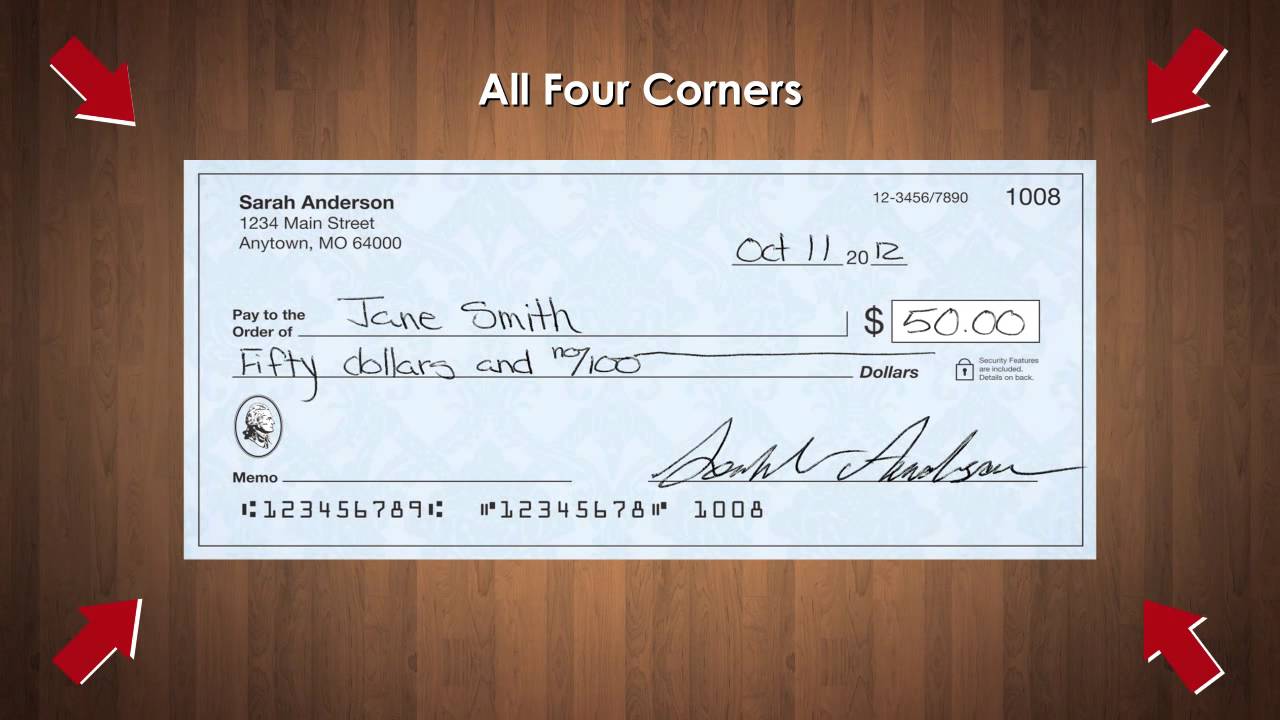

- Image Quality: Ensure clear, well-lit photos of both the front and back of your check. A blurry image can lead to processing delays or rejection.

- Keep the Original: Store the physical check in a safe place for a few days after the deposit is successfully processed, then shred it for security.

Common Questions About Wells Fargo Mobile Check Deposit

1. What is the maximum amount I can deposit using mobile check deposit? Deposit limits vary depending on your account history and other factors. You can find your specific limit within the Wells Fargo app.

2. How long does it take for a mobile check deposit to clear? Funds are typically available within 1-2 business days, but some deposits may take longer to process.

3. Can I deposit international checks using the Wells Fargo app? No, mobile check deposit is currently only available for U.S. dollar-denominated checks drawn on U.S. banks.

4. What do I do if my mobile check deposit is rejected? The app will provide a reason for the rejection. Common reasons include image quality issues, exceeding deposit limits, or issues with the check itself. Contact Wells Fargo customer service for assistance.

5. Can I schedule a mobile check deposit in advance? At this time, Wells Fargo does not offer the option to schedule mobile check deposits.

6. Is there a fee for using mobile check deposit with Wells Fargo? Wells Fargo does not charge a separate fee for mobile check deposits. However, standard account fees may still apply.

7. How do I know if my mobile deposit was successful? You will receive a confirmation email from Wells Fargo once your deposit has been successfully submitted and again when the funds are available.

8. What if I experience technical difficulties while making a mobile deposit? Wells Fargo offers 24/7 customer support. You can reach them through the app or by phone.

Tips and Tricks for Wells Fargo Mobile Deposits

- Set Deposit Reminders: Don't let checks get lost in the shuffle. Set reminders on your phone to deposit checks as soon as you receive them.

- Utilize Direct Deposit: Whenever possible, opt for direct deposit for paychecks and recurring payments to streamline your finances and minimize the need for physical checks.

In today’s fast-paced world, convenience is king. Wells Fargo’s mobile check deposit feature perfectly embodies this principle, giving you the power to manage your finances on your own terms. By eliminating the need to physically visit a branch, this technology saves you time and hassle, allowing you to focus on the things that matter most. While it’s important to be mindful of security best practices, the benefits of mobile check deposit are undeniable. Take advantage of this transformative technology and experience the future of banking, all from the palm of your hand.

how to mobile deposit a check wells fargo | Kennecott Land

Wells Fargo Check Deposit | Kennecott Land

How To Deposit A Check In A Wells Fargo ATM | Kennecott Land

Wells Fargo Mobile Deposit | Kennecott Land

how to mobile deposit a check wells fargo | Kennecott Land

how to mobile deposit a check wells fargo | Kennecott Land

Wells Fargo Check Template | Kennecott Land

How to Deposit Check Online Wells Fargo | Kennecott Land

how to mobile deposit a check wells fargo | Kennecott Land

Wells Fargo Mobile Deposit Limits, Fees & Cut | Kennecott Land

Mobile Deposit screen in the Wells Fargo Mobile® app showing the | Kennecott Land

how to mobile deposit a check wells fargo | Kennecott Land

Wells Fargo Mobile Deposit at Carol Young blog | Kennecott Land

wells fargo atm check deposit limit, large deal Save 90% available | Kennecott Land

Wells Fargo Mobile Deposit | Kennecott Land