Streamline Your Payments: A Guide to Cashier's Check Wells Fargo Online

In today's digital age, the way we handle finances is continuously evolving. We've transitioned from cash-filled wallets to plastic cards and now increasingly rely on online transactions. Yet, certain financial instruments retain their relevance, albeit with modern twists. One such instrument is the cashier's check, a payment method known for its security and reliability. This article delves into the realm of cashier's checks within the context of online banking, specifically focusing on Wells Fargo's offerings.

The financial landscape is brimming with options, so why might one opt for a cashier's check in the age of instant transfers and mobile payments? Cashier's checks, unlike personal checks, are pre-funded and guaranteed by the issuing bank, making them a more secure form of payment for large transactions or situations where the payee might be wary of accepting a personal check.

Traditionally, obtaining a cashier's check involved a trip to a physical bank branch. However, recognizing the need for convenience and accessibility, many financial institutions, including Wells Fargo, now offer the ability to request and manage cashier's checks online. This shift has significantly streamlined the process, making it more efficient and user-friendly.

Imagine this: you're about to close on your dream home, a significant financial milestone. You need to provide a large sum of money securely and reliably. This is where a cashier's check comes into play. A cashier's check from a reputable institution like Wells Fargo provides peace of mind to both the buyer and the seller, ensuring a smooth and trustworthy transaction.

Whether you're a first-time user exploring the world of cashier's checks or someone seeking information on Wells Fargo's specific online process, this article serves as your comprehensive guide. We'll delve into the intricacies of cashier's checks, explore the benefits and potential drawbacks of obtaining them online, and provide a step-by-step walkthrough of the process at Wells Fargo. Additionally, we'll address common questions, highlight best practices, and equip you with the knowledge to navigate this essential financial tool confidently.

Advantages and Disadvantages of Cashier's Check Wells Fargo Online

Before diving into the specifics, let's weigh the pros and cons of utilizing Wells Fargo's online platform for cashier's checks:

| Advantages | Disadvantages |

|---|---|

| Convenience of online access | Potential for online security risks if proper precautions aren't taken |

| Faster processing times compared to visiting a branch | May require existing online banking enrollment |

| Ability to track the status of your cashier's check online | Limited customer support outside of banking hours if issues arise |

While the convenience of online banking is undeniable, understanding both the advantages and potential drawbacks ensures you can leverage this service effectively while mitigating risks.

cashier's check wells fargo online | Kennecott Land

Wells Fargo Bill Pay Check Not Cashed | Kennecott Land

Can I Print A Wells Fargo Deposit Slip | Kennecott Land

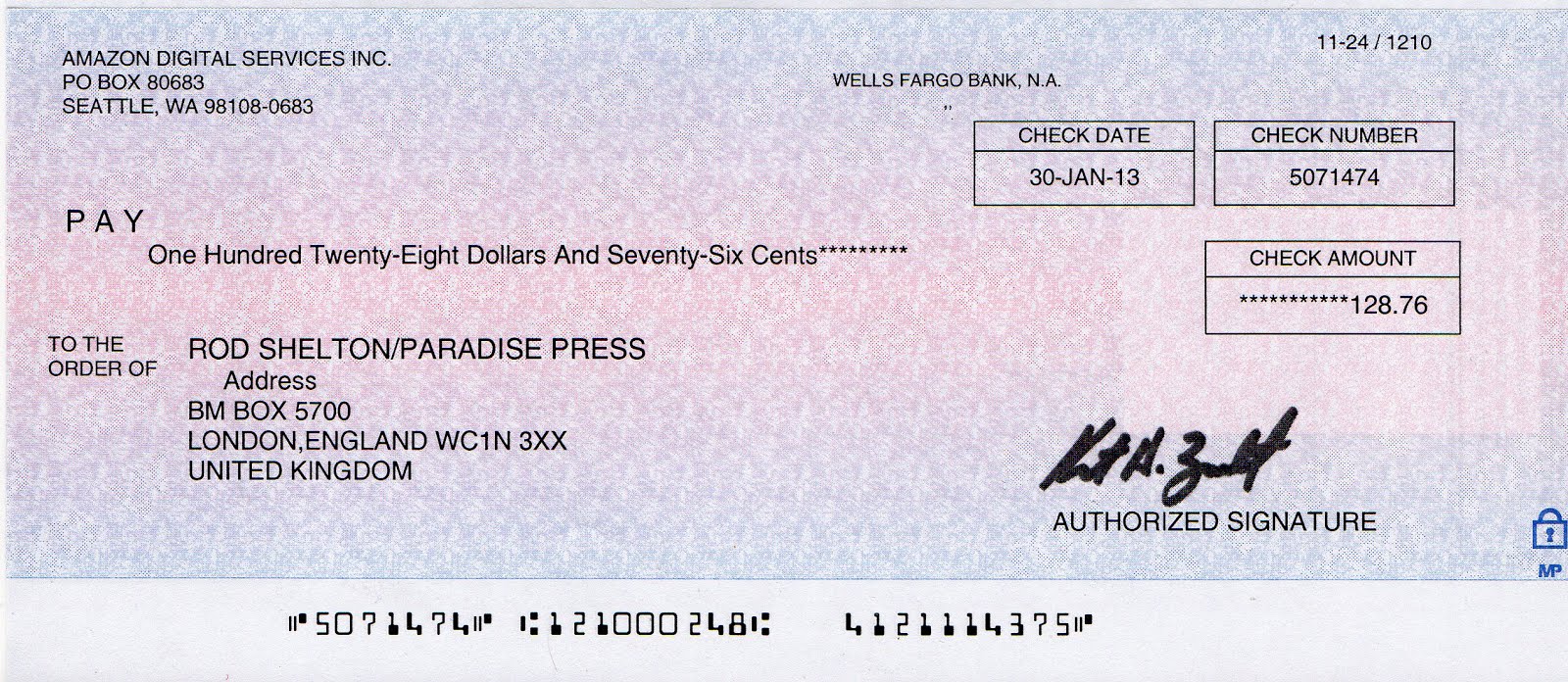

Diagram Of A Wells Fargo Check | Kennecott Land

cashier's check wells fargo online | Kennecott Land

Wells Fargo Blank Check Template | Kennecott Land

Printable Blank Cashiers Check | Kennecott Land

Wells Fargo Blank Check Template | Kennecott Land

Wells Fargo & Company Bank Check | Kennecott Land

Wells Fargo Blank Check Template | Kennecott Land

cashier's check wells fargo online | Kennecott Land

Wells fargo check verification: Fill out & sign online | Kennecott Land

Wells Fargo Wiring Info | Kennecott Land

Wells Fargo Check by jacobellispresents on DeviantArt | Kennecott Land

cashier's check wells fargo online | Kennecott Land