Texas Workforce Commission Tax Payments: A Simple Guide

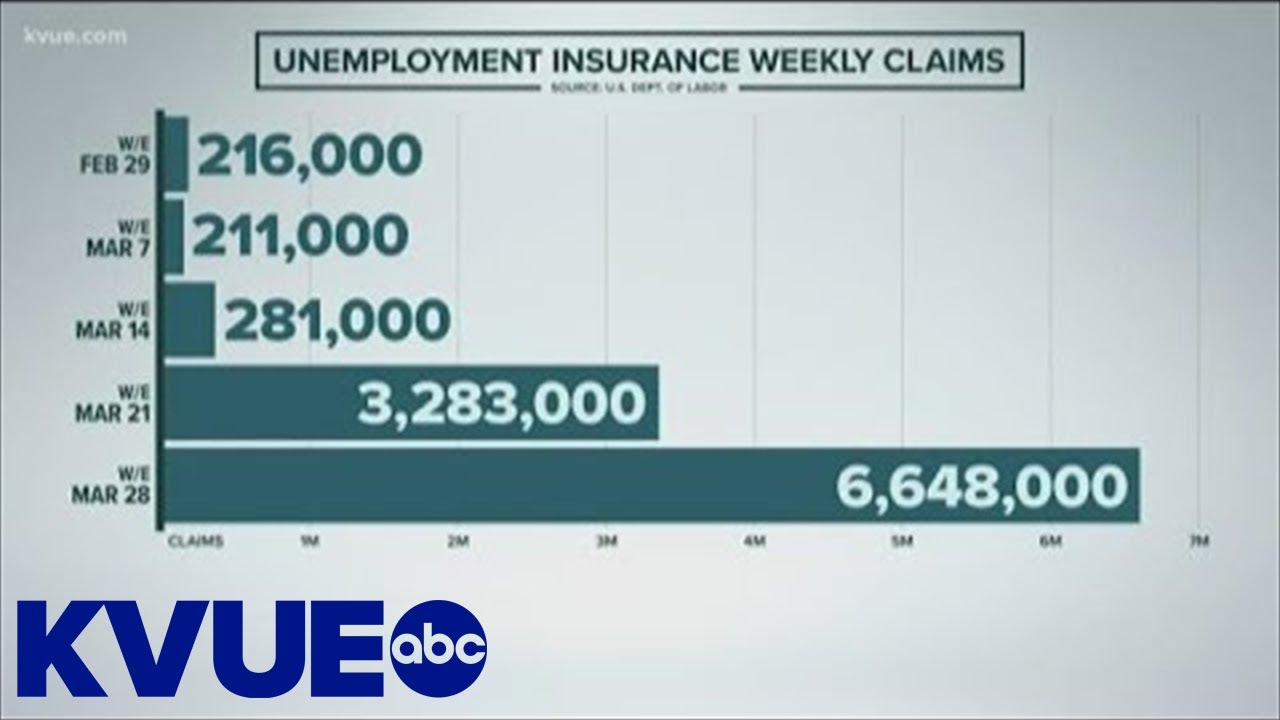

Running a business in Texas comes with responsibilities, including managing your Texas Workforce Commission (TWC) taxes. These taxes fund important programs like unemployment benefits, and understanding how to submit them efficiently can save you time and potential headaches. This guide will walk you through the process of paying your Texas Workforce Commission taxes online, offering insights, tips, and resources to simplify the experience.

Navigating the world of taxes can feel daunting, but the TWC offers a streamlined online payment system to make remitting these contributions more manageable. The ability to pay Texas Workforce Commission taxes online provides flexibility and convenience for businesses of all sizes. Whether you're a seasoned entrepreneur or just starting out, understanding the online payment process is essential for staying compliant and contributing to the state's workforce programs.

The online payment system for Texas Workforce Commission taxes offers a modern approach to fulfilling your tax obligations. This digital platform allows you to submit payments securely and efficiently, eliminating the need for paper checks and manual mailings. By embracing this digital solution, businesses can optimize their financial management processes and reduce the risk of errors or delays.

Historically, paying TWC taxes involved manual processes that could be time-consuming and prone to errors. The introduction of the online payment system has revolutionized this aspect of business administration in Texas. This shift towards digital tax management has not only simplified the process for employers but also enhanced the efficiency of the TWC's operations.

The importance of accurately and timely paying Texas Workforce Commission taxes cannot be overstated. These funds are crucial for supporting unemployment benefits and workforce development programs that benefit Texans. By fulfilling your tax obligations, you are contributing to the overall well-being of the state's workforce and ensuring the availability of essential resources for those seeking employment.

The Texas Workforce Commission offers clear guidelines and resources to help employers understand their tax responsibilities. Their website provides comprehensive information on tax rates, payment schedules, and online payment procedures. Familiarizing yourself with these resources can ensure you are meeting your obligations and avoiding potential penalties.

One of the key benefits of paying your TWC taxes online is the convenience it offers. You can access the payment portal 24/7, eliminating the need to adhere to traditional business hours. This flexibility allows you to manage your tax payments at your own pace and ensures that deadlines are met, even with busy schedules.

Another advantage of online payment is the enhanced security it provides. The TWC’s online system utilizes secure encryption technology to protect your financial information. This safeguards your business from potential fraud and ensures the confidentiality of your transactions.

Additionally, paying online provides a clear and readily accessible payment history. This digital record can simplify your accounting processes and make it easier to track your tax payments over time. Having this information at your fingertips can be valuable during audits or when reconciling your financial records.

Advantages and Disadvantages of Paying Texas Workforce Commission Taxes Online

| Advantages | Disadvantages |

|---|---|

| Convenience and 24/7 access | Requires internet access and basic computer skills |

| Enhanced security and data protection | Potential technical issues with the website or payment gateway |

| Automated payment reminders and notifications | Less personal interaction with TWC staff if needed |

Best Practices for Paying Texas Workforce Commission Taxes Online:

1. Register for an online account with the TWC.

2. Keep accurate records of your payroll and tax liabilities.

3. Schedule payments in advance to avoid late fees.

4. Verify payment confirmation after each transaction.

5. Regularly review your online payment history.

FAQs:

1. Q: Where can I find the online payment portal for TWC taxes? A: You can find it on the official TWC website.

2. Q: What payment methods are accepted? A: Typically, electronic funds transfer and credit/debit cards.

3. Q: What do I do if I encounter a technical issue while making a payment? A: Contact the TWC's support line for assistance.

4. Q: Can I schedule recurring payments? A: Yes, in most cases, you can set up automatic payments.

5. Q: Are there any fees associated with online payments? A: Check the TWC website for details on potential fees.

6. Q: How can I retrieve my payment history? A: Access your online account on the TWC website.

7. Q: What if I miss a payment deadline? A: Contact the TWC as soon as possible to discuss options.

8. Q: How do I update my business information for tax payments? A: Log in to your online account and update your profile.

In conclusion, efficiently managing your Texas Workforce Commission tax payments is a critical aspect of running a successful business in Texas. The online payment system offers a convenient, secure, and streamlined way to fulfill your tax obligations. By understanding the process, utilizing best practices, and staying informed about any updates from the TWC, you can contribute to the well-being of the Texas workforce while simplifying your administrative tasks. Take the time to familiarize yourself with the TWC resources available and embrace the advantages of online payment to ensure timely and accurate tax remittances. Taking proactive steps to manage your TWC taxes online will benefit both your business and the Texas workforce as a whole. This not only saves you time and reduces the risk of errors but also contributes to the vital programs supported by these funds. The transition to online tax management reflects the ongoing effort to streamline government processes and enhance accessibility for businesses across Texas. Embrace this digital solution to simplify your tax obligations and contribute to the success of the Texas workforce.

Texas Workforce Press Release | Kennecott Land

Blank Texas Workforce Commission Report | Kennecott Land

Texas Workforce Commission Account | Kennecott Land

Texas Workforce Commission Sets Employer Tax Rates For | Kennecott Land

pay texas workforce commission taxes online | Kennecott Land

Texas Workforce Commission Sets Employer Tax Rates For | Kennecott Land

Texas Workforce Commission Reinstates Work Search Requirement | Kennecott Land

pay texas workforce commission taxes online | Kennecott Land

Texas Workforce Commission Sets Employer Tax Rates For | Kennecott Land

Texas Workforce Commission Seeing an Increase in Unemployment Fraud | Kennecott Land

Texas Workforce Press Release | Kennecott Land

Texas Request Form for Texas Workforce Commission Twc Records | Kennecott Land

pay texas workforce commission taxes online | Kennecott Land

Texas Workforce Commission TWC | Kennecott Land

Texas Workforce Commission Sets Employer Tax Rates For | Kennecott Land