Understanding Income Tax in Indonesia: A Guide to "Pajak Gaji Berapa Persen"

Navigating the world of taxes can be daunting, especially in a new country. If you're working in Indonesia or considering doing so, understanding the Indonesian income tax system is crucial. One of the first questions that might pop into your head is, "Pajak gaji berapa persen?" or "What percentage of my salary goes to income tax?" This guide is here to break down everything you need to know about Indonesian income tax.

Indonesia, like most countries, operates on a system where a portion of your income is taxed to fund public services like healthcare, education, and infrastructure. The percentage you pay, or "pajak gaji berapa persen," depends on your income level. The tax system aims to be progressive, meaning those with higher incomes contribute a larger percentage.

The Indonesian income tax system has gone through various changes throughout its history, reflecting the country's economic growth and government policies. Understanding this history provides valuable context for the current system. While the specific regulations might seem complex, the fundamental goal remains the same - to ensure a fair and sustainable method for collecting revenue to support the nation's development.

Now, why is it so important to understand "pajak gaji berapa persen?" First and foremost, it directly affects your take-home pay. Knowing how much tax you'll be paying allows for better financial planning. Secondly, it ensures you comply with Indonesian tax laws and avoid any potential penalties. Lastly, it gives you a clearer picture of your financial contribution to the country's growth.

While the concept of income tax might seem straightforward, the practical aspects can feel overwhelming. But don't worry, this guide will equip you with the knowledge to navigate the Indonesian income tax system with confidence.

Advantages and Disadvantages of the Indonesian Income Tax System

| Advantages | Disadvantages |

|---|---|

|

|

Frequently Asked Questions about "Pajak Gaji Berapa Persen"

Here are some common questions and answers about Indonesian income tax:

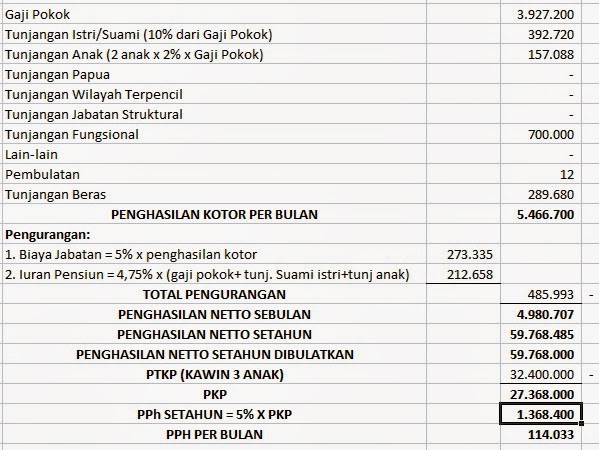

Q: How do I calculate my income tax?

A: Indonesia uses a progressive tax bracket system. You can find the tax brackets and rates on the official website of the Indonesian Directorate General of Taxes (DGT).Q: When is the deadline for filing income tax returns?

A: The deadline for individual income tax returns is March 31st of the following year.Q: What are the penalties for late filing or non-payment?

A: Penalties for late filing or non-payment can include fines and interest charges.Q: What if I have questions or need assistance with my taxes?

A: You can contact the Indonesian Directorate General of Taxes (DGT) for guidance.

Understanding "pajak gaji berapa persen" is not just about fulfilling your tax obligations. It's about participating in Indonesia's economic landscape and contributing to its development. While the system might seem intricate, remember that resources and assistance are readily available. Equip yourself with the right information, seek help when needed, and navigate the world of Indonesian income tax with confidence!

pajak gaji berapa persen | Kennecott Land

Implementasi Tarif Efektif Rata | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land

Bagaimana Cara Menghitung Pph 21 | Kennecott Land

Bagaimana Cara Menghitung Pph 21 | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land

Cara Hitung THR untuk Karyawan Outsourcing | Kennecott Land

pajak gaji berapa persen | Kennecott Land

pajak gaji berapa persen | Kennecott Land