Understanding Payslips in Malaysia: A Comprehensive Guide

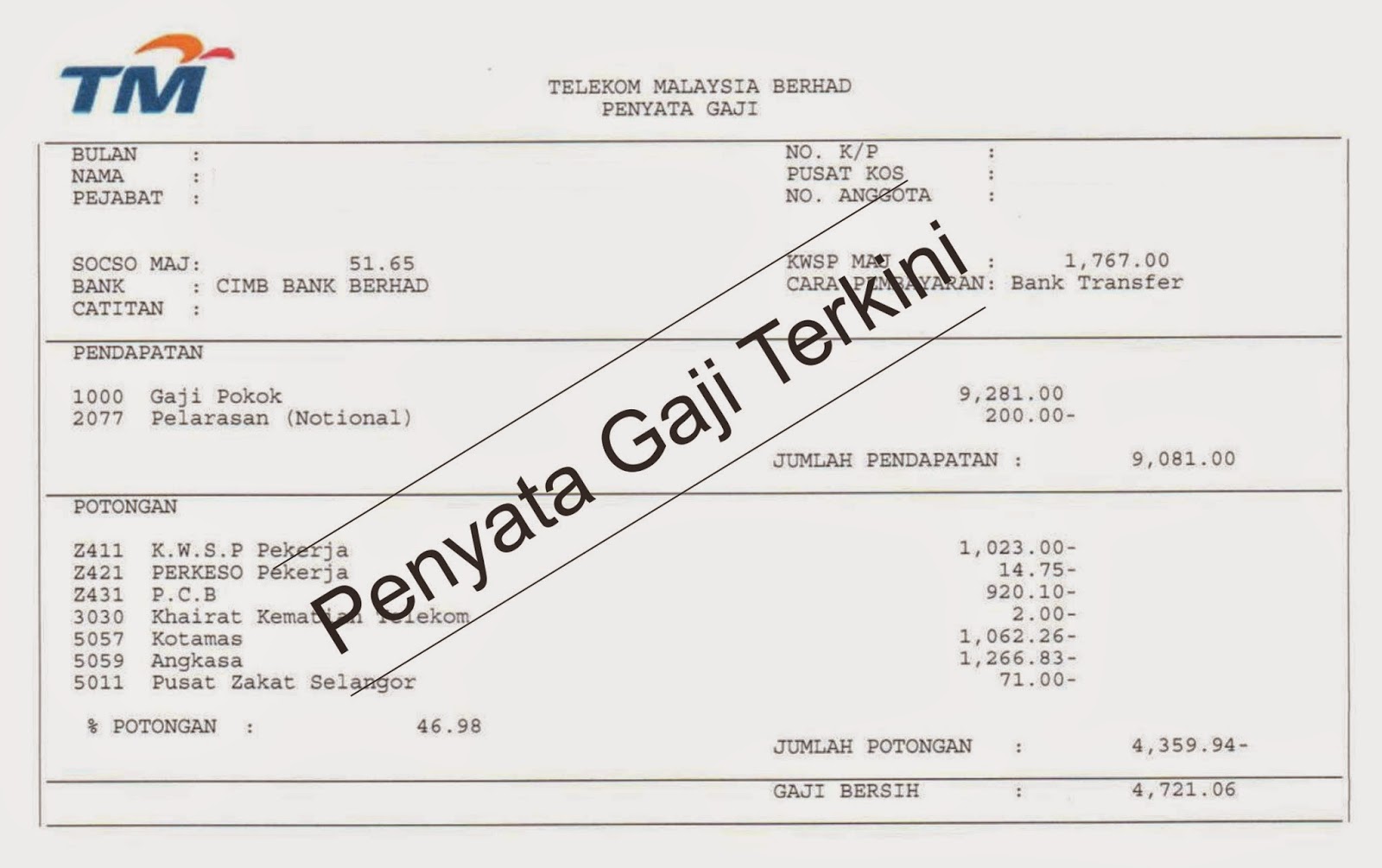

In the bustling professional landscape of Malaysia, a seemingly simple document holds immense significance: the payslip. Often glanced at and filed away, a Malaysian payslip, sometimes searched for online as "contoh slip gaji word Malaysia," is a powerful tool that empowers both employers and employees. It serves as a detailed record of an employee's earnings, deductions, and contributions, acting as a testament to the financial agreement between both parties.

Understanding the intricacies of a Malaysian payslip is crucial for everyone involved. For employees, it's not just about knowing how much money is deposited into their bank accounts each month. It's about financial awareness, ensuring accuracy, and having the necessary documentation for various life events. For employers, generating accurate and transparent payslips is not just a legal obligation but a sign of good business practice. It fosters trust, streamlines payroll processes, and ensures compliance with Malaysian labor laws.

The history of payslips in Malaysia can be traced back to the evolution of its labor laws and the formalization of employment practices. As Malaysia transitioned into an industrialized nation, the need for standardized documentation of employee compensation became apparent. This led to the incorporation of payslip regulations within the Employment Act of 1955, which has been amended over the years to reflect the changing employment landscape.

A Malaysian payslip, whether issued in a traditional paper format or its modern digital counterpart, contains a wealth of information. Key components typically include the employer and employee details, payment period, gross salary, allowances, deductions (such as for income tax, EPF, SOCSO), net salary, and employer contributions (EPF, SOCSO). Understanding these components is vital for employees to track their earnings, manage their finances effectively, and ensure they are being compensated fairly.

One of the primary issues surrounding payslips in Malaysia, and indeed globally, is the potential for discrepancies or errors. An inaccurate payslip can have significant repercussions for both the employer and employee. For employees, it could mean financial instability due to underpayment, difficulty in securing loans, or even legal issues. For employers, errors can lead to penalties, legal disputes, and damage to their reputation. This highlights the crucial need for diligence, accuracy, and transparency throughout the payroll process.

Advantages and Disadvantages of Digital Payslips

| Advantages | Disadvantages |

|---|---|

| Convenient access and storage | Requires employees to have digital access |

| Environmentally friendly | Security concerns if not implemented properly |

| Reduced printing and distribution costs | Potential for technical issues |

Best Practices for Implementing Payslip Systems:

1. Choose a Reliable Payroll System: Invest in a robust and trustworthy payroll software or system that aligns with Malaysian regulations and offers comprehensive payslip generation features. 2. Ensure Data Security: Prioritize the security of employee data by implementing strong passwords, access controls, and encryption protocols within your payroll system. 3. Regular Audits and Reconciliation: Conduct periodic audits of your payroll processes and reconcile data to minimize the risk of errors and ensure accuracy in payslip generation. 4. Transparent Communication: Foster open communication with your employees regarding their payslips. Provide clear explanations of deductions, benefits, and any changes to their compensation. 5. Stay Updated on Regulations: Malaysian labor laws are subject to change, so it's essential to stay informed about any updates or amendments that might impact payslip requirements and payroll calculations.

FAQs about Malaysian Payslips:

1. What is the format of a payslip in Malaysia?

While there is no strict format mandated by law, a Malaysian payslip generally includes employer and employee information, payment details, earnings breakdown, deductions, and net pay.

2. Is it mandatory to provide payslips in Malaysia?Yes, according to the Employment Act of 1955, employers are legally obligated to provide their employees with itemized payslips.

3. Can I receive my payslip electronically?Yes, electronic payslips are legally acceptable in Malaysia, provided they are easily accessible and can be stored securely by employees.

4. How long should I keep my payslips for?It is recommended to keep your payslips for at least seven years, especially for tax and legal purposes.

5. What should I do if there's an error on my payslip?Immediately bring the discrepancy to your employer's attention. It is their responsibility to rectify any errors and provide you with a corrected payslip.

6. Are bonuses included in my payslip?Yes, any bonuses, commissions, or allowances should be clearly outlined in your payslip as part of your total earnings.

7. What is EPF and SOCSO on my payslip?EPF (Employees Provident Fund) and SOCSO (Social Security Organisation) are mandatory contributions deducted from your salary and contributed by your employer for your retirement and social security benefits, respectively.

8. How can I calculate my net salary from my payslip? Your net salary is calculated by subtracting all deductions (income tax, EPF, SOCSO, etc.) from your gross salary.In conclusion, the humble payslip is far more than a mere record of payment. It's a cornerstone of transparency, trust, and legal compliance in the employer-employee relationship. For employees, understanding the components of their payslip and verifying their accuracy is crucial for financial well-being and peace of mind. For employers, generating accurate and timely payslips is not only a legal obligation but also a sign of good business practice.

By prioritizing clarity, accuracy, and open communication surrounding payslips, both employers and employees in Malaysia can contribute to a fairer, more transparent, and mutually beneficial work environment.

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land

contoh slip gaji word malaysia | Kennecott Land