Understanding Property Tax in Kuala Selangor: Your Guide to 'Cukai Taksiran'

Owning a piece of Kuala Selangor, whether a modern apartment overlooking the Straits of Malacca or a traditional house nestled in a quiet village, is more than just having an address. It's about being part of a vibrant community, contributing to the local economy, and yes, understanding your civic responsibilities. Among these is the 'cukai taksiran,' the property tax levied by the Kuala Selangor Municipal Council (MDKS). But what exactly does it entail, and how can you stay informed and compliant?

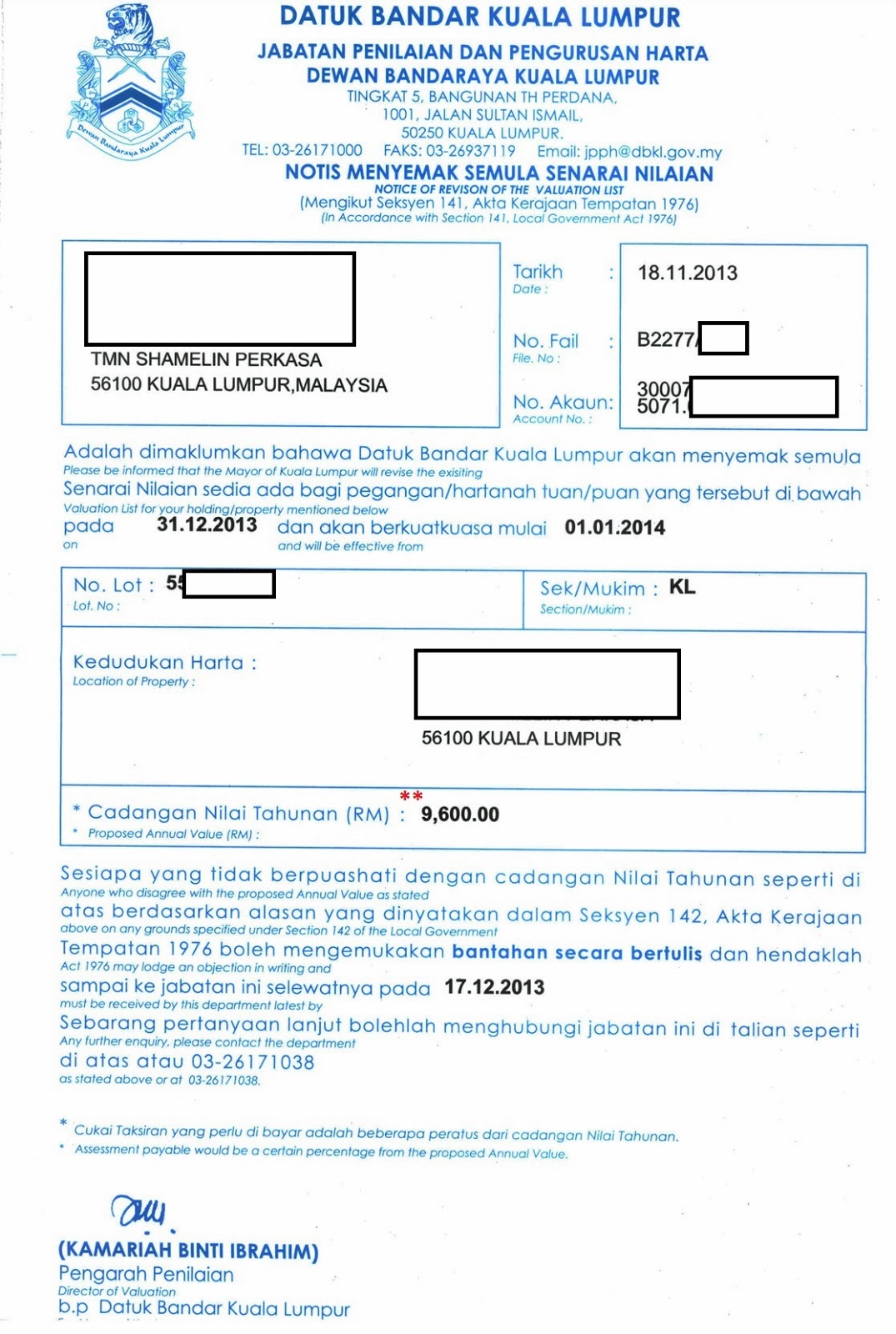

Think of 'cukai taksiran' as your property's contribution to the development and upkeep of Kuala Selangor. These funds collected are crucial for the MDKS to maintain public amenities like parks, roads, streetlights, and drainage systems. It's an investment in the well-being of the community and, ultimately, enhances the value of your property.

Navigating the world of property taxes might seem daunting at first, especially with unfamiliar terms and procedures. However, accessing and understanding your 'semakan cukai taksiran Kuala Selangor,' or property tax assessment, is easier than you might think. The MDKS has implemented online platforms and services, making it convenient for property owners to access their assessment details, payment history, and even make payments from the comfort of their homes.

This shift towards digitalization signifies the MDKS's commitment to transparency and efficiency in its services. No more long queues or tedious paperwork! Everything you need to know about your property tax in Kuala Selangor is just a few clicks away. This accessibility empowers property owners to be proactive in managing their tax obligations and ensures they contribute to the growth and prosperity of Kuala Selangor.

Now, let's delve deeper into the specifics of 'semakan cukai taksiran Kuala Selangor,' its history, significance, and how you can easily access and understand your property tax information. Equipped with this knowledge, you can confidently navigate your responsibilities as a property owner in this charming district.

Advantages and Disadvantages of Online 'Semakan Cukai Taksiran Kuala Selangor'

| Advantages | Disadvantages |

|---|---|

| Convenience: Check your assessment anytime, anywhere. | Technical Issues: Website downtime or errors might occur. |

| Time-Saving: No need to visit MDKS physically. | Digital Literacy: Requires basic computer skills and internet access. |

| Transparency: Access your assessment details and payment history easily. | Security Concerns: Ensure you are using the official MDKS website for security. |

In conclusion, understanding and managing your 'semakan cukai taksiran Kuala Selangor' is an integral part of property ownership in this vibrant district. By utilizing the online resources provided by MDKS, you can easily access your assessment, make payments, and stay informed about your property tax obligations. Remember, your contribution helps shape a better future for Kuala Selangor, making it a thriving community for all. Take advantage of the online tools and be a responsible property owner in this beautiful part of Malaysia!

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land

semakan cukai taksiran kuala selangor | Kennecott Land