Understanding Your Financial Well-being: A Guide to Retirement Income Statements

Retirement marks a significant transition in life, and securing financial stability during this phase is paramount. For those who have dedicated their careers to public service in Malaysia, understanding the intricacies of retirement income statements is crucial for a smooth and comfortable post-retirement life.

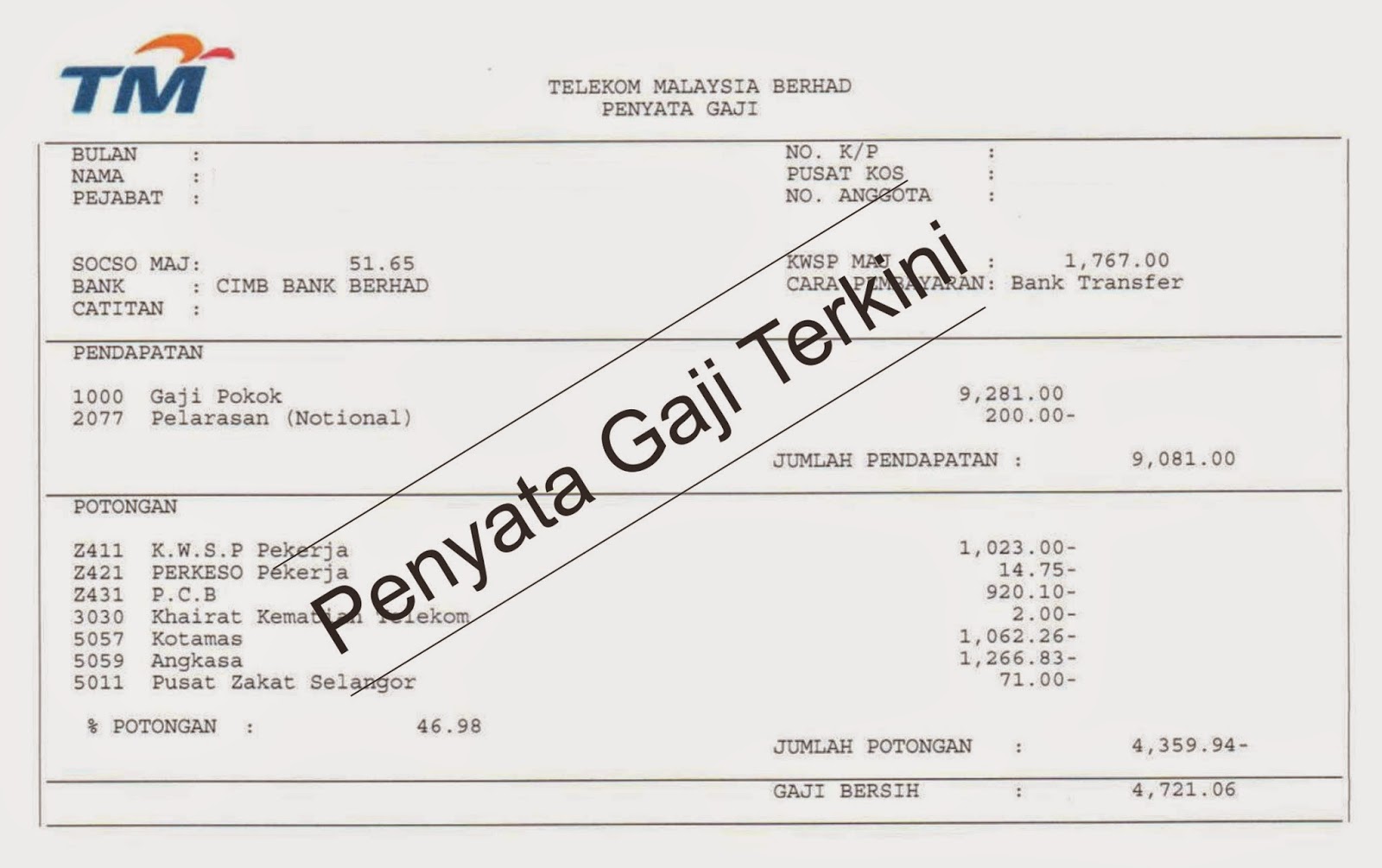

Imagine this: you've diligently served in the Malaysian government for decades, contributing to the nation's growth. Now, as you embark on a well-deserved retirement, you need to ensure your financial well-being remains intact. This is where your retirement income statement, a detailed record of your pension payments, becomes your financial compass.

This statement isn't just a piece of paper; it's a testament to your years of service and a roadmap to your financial security. It outlines your monthly pension amount, deductions, and any other benefits you're entitled to, empowering you to manage your finances effectively.

Navigating the complexities of retirement finances can seem daunting, but it's essential to familiarize yourself with the key aspects of your retirement income statement. This knowledge empowers you to plan your expenses, make informed financial decisions, and enjoy your golden years with peace of mind.

In this comprehensive guide, we'll delve into the intricacies of retirement income statements, exploring their importance, benefits, and practical tips to help you make the most of your hard-earned pension. Whether you're nearing retirement or already enjoying your post-service life, this guide serves as a valuable resource for navigating your financial journey. Let's embark on this journey toward financial empowerment together!

Advantages and Disadvantages of Online Access to Retirement Income Statements

In today's digital age, many services have transitioned online, offering convenience and efficiency. The same applies to accessing your retirement income statements. Let's explore the advantages and disadvantages of this digital shift:

| Advantages | Disadvantages |

|---|---|

|

|

While online access offers undeniable convenience, it's crucial to be aware of potential drawbacks and take necessary precautions to safeguard your personal information.

Best Practices for Managing Your Retirement Income

Managing your retirement income wisely is essential for a financially secure future. Here are five best practices to help you make the most of your pension:

- Budgeting: Create a realistic budget that aligns with your income and expenses, ensuring you can cover essential costs and maintain your desired lifestyle.

- Emergency Fund: Establish an emergency fund to cover unforeseen expenses such as medical bills or home repairs, providing a financial safety net.

- Investment: Explore investment opportunities to grow your savings and outpace inflation, but seek professional advice before making any investment decisions.

- Debt Management: Prioritize paying down any outstanding debts to reduce financial burdens and free up more income for your retirement years.

- Regular Reviews: Periodically review your budget, expenses, and investments to adjust your financial plan as needed and ensure you stay on track.

By following these best practices, you can enjoy your retirement years with financial peace of mind, knowing you've taken proactive steps to secure your financial well-being.

Frequently Asked Questions

Here are some common questions retirees often have about their pension payments:

- Q: When will I receive my first pension payment?

A: Typically, the first payment is processed within a month or two after your retirement date. However, it's best to confirm with the relevant authorities for specific timelines. - Q: What happens to my pension if I move abroad?

A: In most cases, you can still receive your pension even if you reside overseas. However, specific regulations and procedures may apply. - Q: Can my spouse continue to receive my pension after my passing?

A: Yes, surviving spouses are often entitled to a portion of their deceased spouse's pension. The specific percentage and eligibility criteria vary, so it's essential to inquire about these provisions. - Q: What should I do if there's an error in my pension payment?

A: Report any discrepancies or errors to the relevant pension department immediately. Provide supporting documentation and keep records of all communications for reference. - Q: Can I access my pension statements online?

A: Yes, many pension providers offer online platforms where you can conveniently access your statements electronically. Check with your specific provider for availability. - Q: Are my pension payments subject to income tax?

A: Tax regulations regarding pension income can vary. It's advisable to consult with a tax professional to understand the specific tax implications in your situation. - Q: How can I update my personal information, such as my bank account details?

A: Contact the pension department and provide them with the updated information. They will guide you through the necessary steps. - Q: Where can I seek assistance or guidance regarding my pension and retirement benefits?

A: The pension department or relevant government agency responsible for retirement benefits is the best point of contact for any questions or assistance you may need.

Tips for a Smooth Transition into Retirement

Retirement is a major life change. Here are some tips to help you navigate this transition smoothly:

- Plan Ahead: Don't wait until the last minute to start planning for retirement. The earlier you start, the better prepared you'll be financially and emotionally.

- Explore Your Interests: Retirement offers an opportunity to pursue hobbies, passions, or volunteer work that you may not have had time for before.

- Stay Active and Social: Engage in activities that keep you physically active and mentally stimulated. Maintain social connections to prevent isolation.

- Manage Stress: Retirement can be an adjustment. Find healthy ways to manage stress, such as exercise, meditation, or spending time in nature.

- Seek Support: Don't hesitate to reach out to family, friends, or support groups for emotional support and guidance during this significant life change.

As you transition into this new chapter, remember that your retirement income statement is more than just a financial document. It's a testament to your dedication and hard work. By understanding and managing your pension effectively, you can embrace your retirement years with confidence and peace of mind.

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

Miliki proton PERSONA dengan ansuran bulanan Serendah RM562* sahaja | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

Miliki proton PERSONA dengan ansuran bulanan Serendah RM562* sahaja | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land

penyata gaji pesara kerajaan | Kennecott Land