Unlock Your Financial Freedom: A Guide to Borang Permohonan Pengecualian Cukai

Are you tired of seeing your hard-earned money disappear into the endless abyss of taxes? Do you dream of keeping more of your income to invest in your future and achieve financial independence sooner? You're not alone. Fortunately, there are legal ways to reduce your tax burden, and one of them is through the "borang permohonan pengecualian cukai," which translates to "tax exemption application form" in Malay.

This powerful tool, often overlooked or misunderstood, can be your ticket to unlocking significant savings and accelerating your journey towards financial freedom. This comprehensive guide will demystify the borang permohonan pengecualian cukai, explore its potential benefits, and empower you to take control of your finances like a true master of your money.

Imagine a life where you have more control over your income, more resources to pursue your passions, and more financial security for you and your loved ones. Sounds good, right? That's the power of understanding and utilizing tax optimization strategies like the borang permohonan pengecualian cukai.

Let's dive in and uncover the ins and outs of this valuable financial tool, empowering you to make informed decisions and pave the way for a brighter, more financially secure future. Remember, knowledge is power, and in the realm of personal finance, that power translates to greater freedom and opportunity.

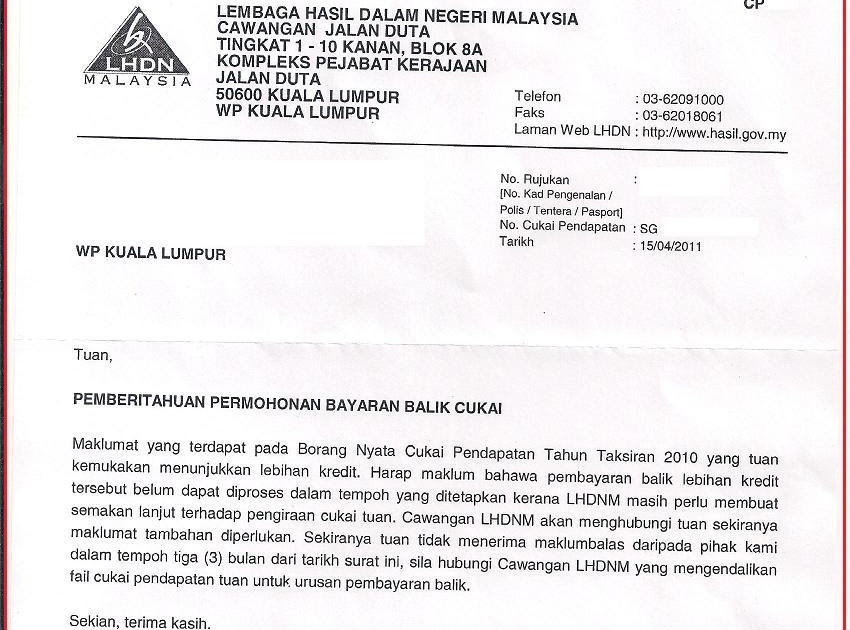

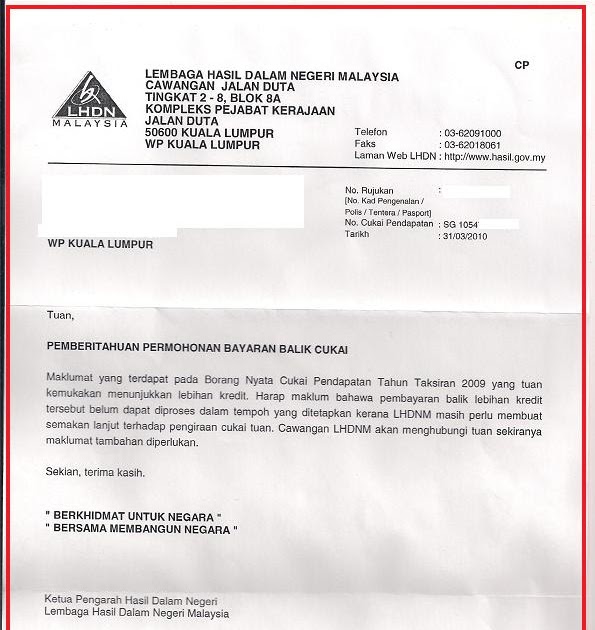

While we delve into the specifics of the borang permohonan pengecualian cukai, it's important to understand the broader context of its application. This form is particularly relevant within the Malaysian tax system, and its utilization hinges on specific criteria and regulations set forth by the Lembaga Hasil Dalam Negeri (LHDN), the Malaysian Inland Revenue Board.

Advantages and Disadvantages of Borang Permohonan Pengecualian Cukai

Before diving into the details, let's weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

Understanding both sides of the coin empowers you to make an informed decision about utilizing the borang permohonan pengecualian cukai effectively.

Navigating the complexities of any tax system can be daunting, and the Malaysian system is no exception. However, arming yourself with the right knowledge and resources can make the process smoother and significantly increase your chances of success. This is where thorough research, seeking advice from qualified tax professionals, and meticulous documentation become your greatest allies.

In conclusion, the borang permohonan pengecualian cukai, while potentially complex, presents a valuable opportunity for eligible individuals and businesses in Malaysia to optimize their tax obligations and retain more of their hard-earned income. By understanding the intricacies of this application, meeting the necessary criteria, and approaching the process with diligence and care, you can unlock significant financial benefits and pave the way for a more secure and prosperous future. Remember, knowledge is power, and in the realm of personal finance, that power translates to greater freedom and opportunity.

borang permohonan pengecualian cukai | Kennecott Land

Contoh Surat Rayuan Cukai Lhdn | Kennecott Land

Contoh Surat Memohon Pelepasan Bayaran Cukai | Kennecott Land

borang permohonan pengecualian cukai | Kennecott Land

Surat Permohonan Pembayaran Balik Maranatha Music | Kennecott Land

Permohonan Pengecualian Cukai Jualan Kepada Pengusaha Bas Ke Atas | Kennecott Land

Download Borang Jpj L8 | Kennecott Land

Contoh Surat Cukai Pintu | Kennecott Land

Senarai Pelepasan Cukai 2022 Untuk E | Kennecott Land