Unlocking Financial Bliss: Your Guide to "Cara Kira Zakat Pendapatan Bulanan"

Ever feel like your financial life could use a sprinkle of something more? Something beyond just budgeting and investing? For millions around the world, the answer lies in the powerful practice of Zakat. And no, we're not just talking about an annual event – we're diving deep into "cara kira zakat pendapatan bulanan," which translates to "how to calculate zakat on monthly income." Get ready to unlock a new level of financial and spiritual fulfillment, one paycheck at a time.

Now, you might be thinking, "Hold on, isn't Zakat something I do once a year during Ramadan?" Well, you're partially right. Zakat, one of the five pillars of Islam, is often associated with annual giving, especially when it comes to wealth and assets. But here's the exciting part: incorporating Zakat into your monthly budget is like adding a turbocharger to your financial engine. It's about creating a consistent flow of giving that not only benefits those in need but also brings a profound sense of purpose and abundance to your own life.

The beauty of "cara kira zakat pendapatan bulanan" lies in its simplicity. Imagine this: instead of waiting for a whole year, you set aside a small portion of your earnings each month. This consistent act of giving, aligned with Islamic principles, becomes a powerful tool for self-purification and financial growth.

But how do you actually calculate your monthly Zakat obligation? Don't worry, it's not rocket science! We'll break it down into easy-to-follow steps, using real-life examples that resonate with your everyday finances. Whether you're a salaried employee, a freelancer juggling multiple gigs, or a business owner navigating the ups and downs of entrepreneurship, we've got you covered.

Get ready to embark on a journey that goes beyond mere financial planning. This is about aligning your wealth with your values, fostering a sense of gratitude, and experiencing the transformative power of giving. Let's dive in and unlock the secrets of "cara kira zakat pendapatan bulanan" together!

Advantages and Disadvantages of Calculating Zakat Monthly

| Advantages | Disadvantages |

|---|---|

| Consistent giving throughout the year | Requires more frequent calculations |

| Easier to budget for smaller, regular donations | May not align with receiving income (e.g., annual bonuses) |

| Potential for greater impact by supporting ongoing needs | May require adjustments if income fluctuates significantly |

Best Practices for Calculating and Paying Zakat on Monthly Income

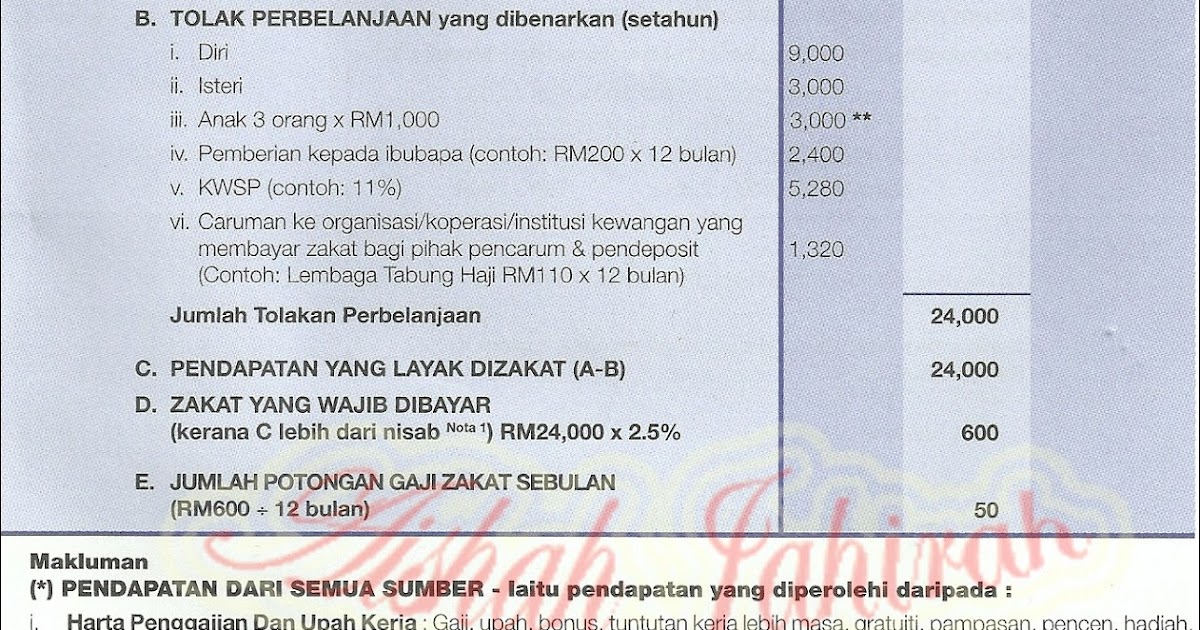

1. Understand the Nisab: The nisab is the minimum amount of wealth you need to possess before Zakat becomes obligatory. Familiarize yourself with the current nisab value for gold or silver, as this will determine if you need to pay Zakat each month.

2. Track Your Income and Expenses: Maintain a clear record of your monthly income and essential expenses. This will help you determine your disposable income, which is the amount you'll calculate Zakat on.

3. Calculate Your Zakat: Once you know your disposable income, calculate 2.5% of that amount. This is the amount of Zakat you owe for the month.

4. Choose a Reputable Charity: Select a trustworthy organization or individual who is eligible to receive Zakat. Ensure your donations are going towards causes that align with your values and have a tangible impact.

5. Make it a Habit: Set up a recurring payment or reminder to ensure you fulfill your Zakat obligation consistently each month.

By embracing "cara kira zakat pendapatan bulanan," you embark on a journey of financial mindfulness, spiritual growth, and social responsibility. It's a powerful reminder that our wealth is not merely meant for personal accumulation, but for sharing and making a difference in the lives of others. As you integrate this practice into your life, you'll likely discover that the blessings you receive far outweigh the contributions you make.

Rupanya Ada 2 Cara Kira Zakat Pendapatan | Kennecott Land

Cara Kira Zakat Simpanan Yang Wajib Anda Tahu » EduBestari | Kennecott Land

cara kira zakat pendapatan bulanan | Kennecott Land

Zakat Fitrah dan Jenis | Kennecott Land

Cara Kira Zakat Pendapatan Bulanan : Zakat | Kennecott Land

Panduan Kira Zakat Perniagaan Dengan Mudah | Kennecott Land

Cara Kira Kadar Zakat Pendapatan 2022 Yang Perlu Dibayar. Jangan Lupa | Kennecott Land

Cara Pengiraan Zakat Pendapatan | Kennecott Land

Apa Itu Zakat Pendapatan dan Cara Pengiraan Zakat Pendapatan | Kennecott Land

Kadar cukai individu pemastautin | Kennecott Land

Cara Kira Kadar Zakat Pendapatan 2020 Yang Perlu Dibayar. Jangan Lupa | Kennecott Land

Panduan Lengkap Zakat Pendapatan di Malaysia 2024 | Kennecott Land

cara kira zakat pendapatan bulanan | Kennecott Land

Cara Kira Kadar Zakat Pendapatan 2022 Yang Perlu Dibayar. Jangan Lupa | Kennecott Land

Kalkulator Bayar Zakat Pendapatan Online | Kennecott Land