Unlocking Financial Opportunities: Your Guide to Download Borang Pengesahan Pendapatan

Ever felt like a locked treasure chest, brimming with potential but missing the right key? In the realm of personal finance, especially in Malaysia, that key often comes in the form of a document called "Borang Pengesahan Pendapatan," which translates to "Income Verification Form." This seemingly simple piece of paper can be the difference between accessing life-changing financial opportunities and being stuck on the sidelines.

Now, you might be wondering, "Why all the fuss about a form?" Well, imagine wanting to buy your dream home, secure a loan to start your own business, or even apply for a credit card to manage your expenses more effectively. In all these situations, financial institutions need a reliable way to assess your financial standing, and that's where the Borang Pengesahan Pendapatan comes in. It's essentially a financial fingerprint, providing official proof of your income and employment status.

But here's the catch: navigating the world of Borang Pengesahan Pendapatan can feel like venturing into uncharted territory, especially if you're not familiar with the ins and outs of Malaysian bureaucracy. Fear not, intrepid reader, for this guide will serve as your trusty compass, guiding you through the process of downloading, understanding, and utilizing this essential document to unlock your financial potential.

Think of the Borang Pengesahan Pendapatan as a passport to a world of financial possibilities. Just like a passport verifies your identity and allows you to travel to different countries, this form verifies your income and opens doors to a wide array of financial products and services. From home loans and personal loans to credit cards and even certain government subsidies, having a valid Borang Pengesahan Pendapatan can be your ticket to achieving your financial goals.

Whether you're a seasoned professional looking to make a major financial move or just starting your journey toward financial independence, understanding the importance of the Borang Pengesahan Pendapatan is crucial. It's not just a piece of paper; it's a symbol of your financial credibility, and mastering its use can empower you to take control of your finances and build the future you deserve. So, let's dive in and demystify the process, shall we?

Advantages and Disadvantages of Download Borang Pengesahan Pendapatan

While downloading the Borang Pengesahan Pendapatan offers convenience, it's essential to weigh the pros and cons:

| Advantages | Disadvantages |

|---|---|

| Time-saving and efficient | Requires internet access and digital literacy |

| Easy access to the form anytime, anywhere | Potential for security risks if downloaded from unverified sources |

| Environmentally friendly by reducing paper usage | May require printing and physical submission, depending on the institution |

By understanding the advantages and disadvantages, you can make an informed decision about whether downloading the Borang Pengesahan Pendapatan is the right approach for your needs. Remember, if you're ever unsure, don't hesitate to reach out to the relevant financial institution or government agency for guidance.

Surat Akuan Pengesahan Pendapatan | Kennecott Land

Download Borang Pengesahan Pendapatan | Kennecott Land

Surat Akuan Pengesahan Tidak Bekerja | Kennecott Land

Surat Pengesahan Pendapatan Majikan | Kennecott Land

Contoh Surat Pernyataan Pendapatan | Kennecott Land

Contoh Surat Akuan Pengesahan Pendapatan Bagi Yang Bekerja Sendiri | Kennecott Land

download borang pengesahan pendapatan | Kennecott Land

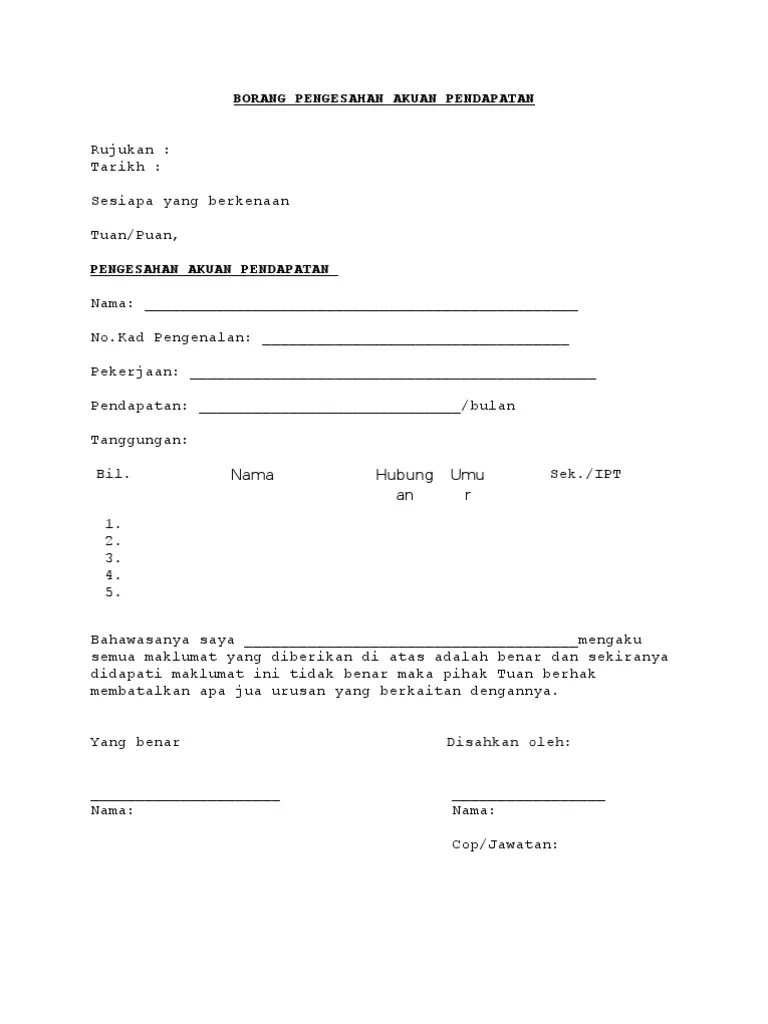

Borang pengesahan akuan pendapatan | Kennecott Land

download borang pengesahan pendapatan | Kennecott Land

download borang pengesahan pendapatan | Kennecott Land

Contoh Borang Akuan Penerimaan Barang Adalah | Kennecott Land

Contoh Borang Pengesahan Akuan Pendapatan | Kennecott Land

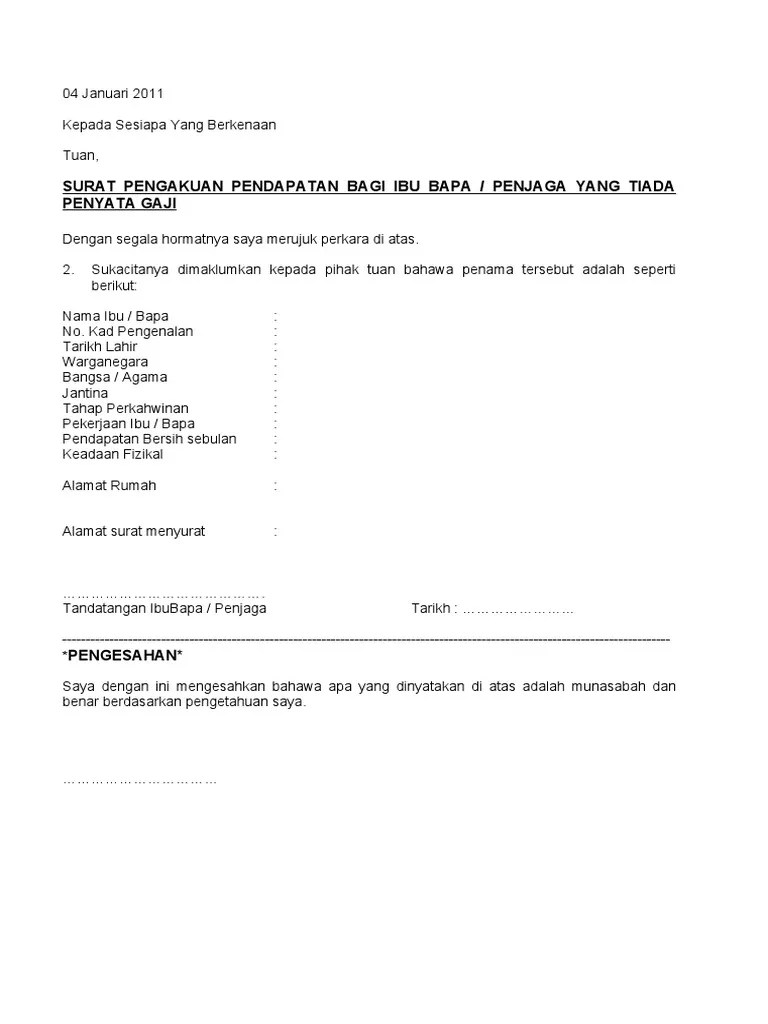

Surat Pengesahan Ibu Bapa Tanpa penyata Gaji | Kennecott Land

Contoh Surat Pengesahan Pendapatan Dari Majikan Kueh Apem | Kennecott Land

Contoh Surat Akuan Pendapatan Bekerja Sendiri | Kennecott Land