Unlocking Healthcare Savings: Your Guide to AARP Supplemental Health Insurance

Are you concerned about rising healthcare costs and potential out-of-pocket expenses, even with existing coverage? You're not alone. Many retirees and Medicare beneficiaries find themselves facing unexpected medical bills that can quickly strain their budgets. This is where supplemental health insurance, sometimes referred to as Medigap, can play a crucial role. For AARP members, understanding the options available through AARP-endorsed supplemental health insurance plans is a key step towards securing financial peace of mind.

AARP supplemental health insurance plans, provided by UnitedHealthcare Insurance Company, are designed to help fill the gaps in Original Medicare coverage. Original Medicare (Parts A and B) covers a significant portion of healthcare costs, but it doesn't cover everything. There are deductibles, coinsurance, and copayments that you're responsible for. These out-of-pocket expenses can add up quickly, especially if you require extensive medical care. AARP supplemental plans aim to mitigate these costs, providing coverage for expenses like deductibles, coinsurance, and copayments.

The history of supplemental health insurance is intertwined with the development of Medicare itself. As Medicare became established, the need for coverage to supplement the gaps in the program became apparent. Private insurers stepped in to offer these supplemental plans, and AARP, as a prominent advocate for seniors, began endorsing plans to help its members access these important coverage options. The importance of supplemental insurance lies in its ability to provide a financial safety net for healthcare expenses, offering predictability and peace of mind.

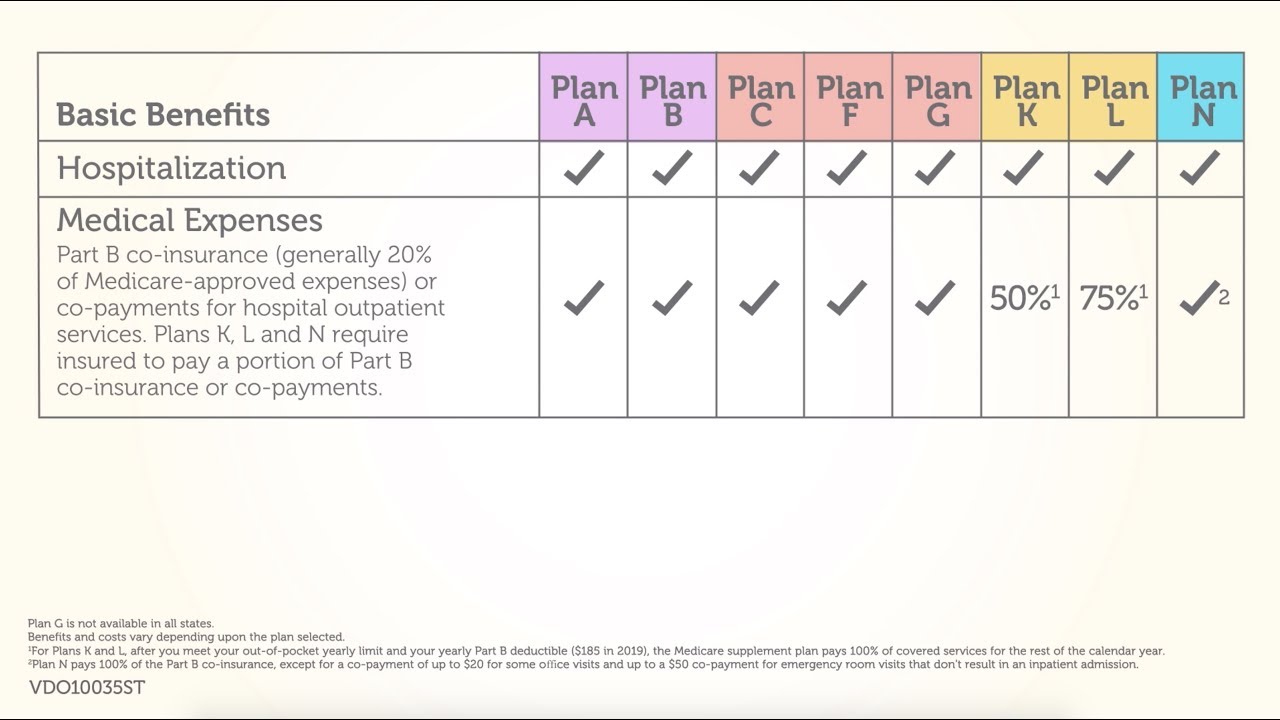

One of the main issues related to supplemental health insurance is understanding the various plan options available. There are standardized plans, labeled with letters (Plan A, Plan G, etc.), each offering different levels of coverage. Choosing the right plan depends on your individual healthcare needs and budget. It's important to compare the benefits and costs of each plan carefully to determine which one aligns best with your situation. AARP offers a range of plans to provide flexibility for its members.

Supplemental insurance is different from Medicare Advantage (Part C). While Medicare Advantage plans provide an alternative way to receive Medicare benefits, supplemental insurance works alongside Original Medicare. Think of it like this: Original Medicare is the foundation, and the supplemental plan acts as a protective layer, helping to cover the costs that Original Medicare doesn't. For example, if you have a hospital stay and Original Medicare covers 80% of the cost, your AARP supplemental plan could cover the remaining 20%, depending on the specific plan you've chosen.

Benefits of AARP Supplemental Health Insurance:

1. Predictable Healthcare Costs: By covering gaps in Original Medicare, these plans help make your healthcare expenses more predictable, reducing the risk of unexpected medical bills.

2. Access to a Wide Network of Doctors and Hospitals: With Original Medicare and an AARP supplement, you can generally see any doctor or hospital that accepts Medicare, providing flexibility in your healthcare choices.

3. Travel Coverage: Many AARP supplemental plans offer coverage for medical expenses incurred while traveling, providing peace of mind when away from home. Check the specific plan details for coverage specifics.

Finding the Right Plan:

1. Evaluate your Healthcare Needs: Consider your current health status, anticipated medical expenses, and budget.

2. Compare Plan Benefits and Costs: Use online tools and resources, or consult with a licensed insurance agent, to compare the different AARP supplemental plans available in your area.

3. Enroll During Open Enrollment: This is generally the best time to enroll in a supplemental plan without medical underwriting restrictions.

Advantages and Disadvantages of AARP Supplemental Health Insurance

| Advantages | Disadvantages |

|---|---|

| Predictable Costs | Monthly Premiums |

| Broad Provider Network | May Not Cover All Out-of-Pocket Expenses |

| Travel Coverage (in many plans) | Can Be Complex to Choose a Plan |

FAQ:

1. What is the difference between Medicare Advantage and a supplement? (Answer provided above)

2. How do I enroll in an AARP supplemental plan? Contact UnitedHealthcare or visit their website.

3. Are there age restrictions? Generally, you must be eligible for Medicare.

4. What are the costs? Premiums vary by plan and location.

5. Can I switch plans? Yes, during specific enrollment periods.

6. Does it cover vision or dental? Typically not, separate coverage is needed.

7. What is Medigap? Medigap is another term for supplemental insurance.

8. Can I have a supplement with Medicare Advantage? No, they are mutually exclusive.

Understanding AARP-endorsed supplemental health insurance, provided by UnitedHealthcare Insurance Company, is crucial for Medicare beneficiaries looking to manage healthcare costs effectively. By carefully evaluating your needs and exploring the available plan options, you can take proactive steps towards securing your financial well-being and enjoying peace of mind knowing that you have a safety net in place for unexpected medical expenses. Explore the available resources, compare plans, and make an informed decision that empowers you to navigate the healthcare landscape with confidence.

aarp secondary health insurance | Kennecott Land

aarp secondary health insurance | Kennecott Land

aarp secondary health insurance | Kennecott Land

aarp secondary health insurance | Kennecott Land

Simplifying AARP Secondary Insurance to Medicare Your Essential Guide | Kennecott Land

Ceylinco VIP enhances accidental health insurance benefit to Rs 10 Mn | Kennecott Land

Aarp Supplemental Medicare Insurance | Kennecott Land

aarp secondary health insurance | Kennecott Land

Direct Casting Aluminium Coils for Secondary Rolling real | Kennecott Land

Aarp Supplemental Health Insurance | Kennecott Land

Best 5 Companies Health Insurance Plans In Florida Quotes | Kennecott Land

Aarp Supplemental Insurance Plans | Kennecott Land

AARP Secondary Health Insurance Plans | Kennecott Land

AARP Secondary Health Insurance | Kennecott Land

Aarp Supplemental Health Insurance | Kennecott Land