Unlocking Homeownership Dreams: Your Guide to Pinjaman Perumahan Kerajaan Malaysia

Owning a home stands as a cornerstone of the Malaysian dream. Yet, the path to homeownership often feels like navigating a complex maze, particularly when it comes to securing financing. That's where "Pinjaman Perumahan Kerajaan Malaysia" comes in - a beacon of hope for aspiring homeowners. This translates to "Government Housing Loans in Malaysia," a scheme implemented to ease the financial burden and pave the way for more Malaysians to own their dream homes.

Imagine the joy of finally holding the keys to your own property, a place to call your own, where you can build a future for yourself and your loved ones. For many, this dream seems out of reach, especially in the face of rising property prices and stringent loan requirements. But, the Malaysian government, recognizing the importance of homeownership, has stepped in with initiatives aimed at making this dream a reality for a wider segment of the population.

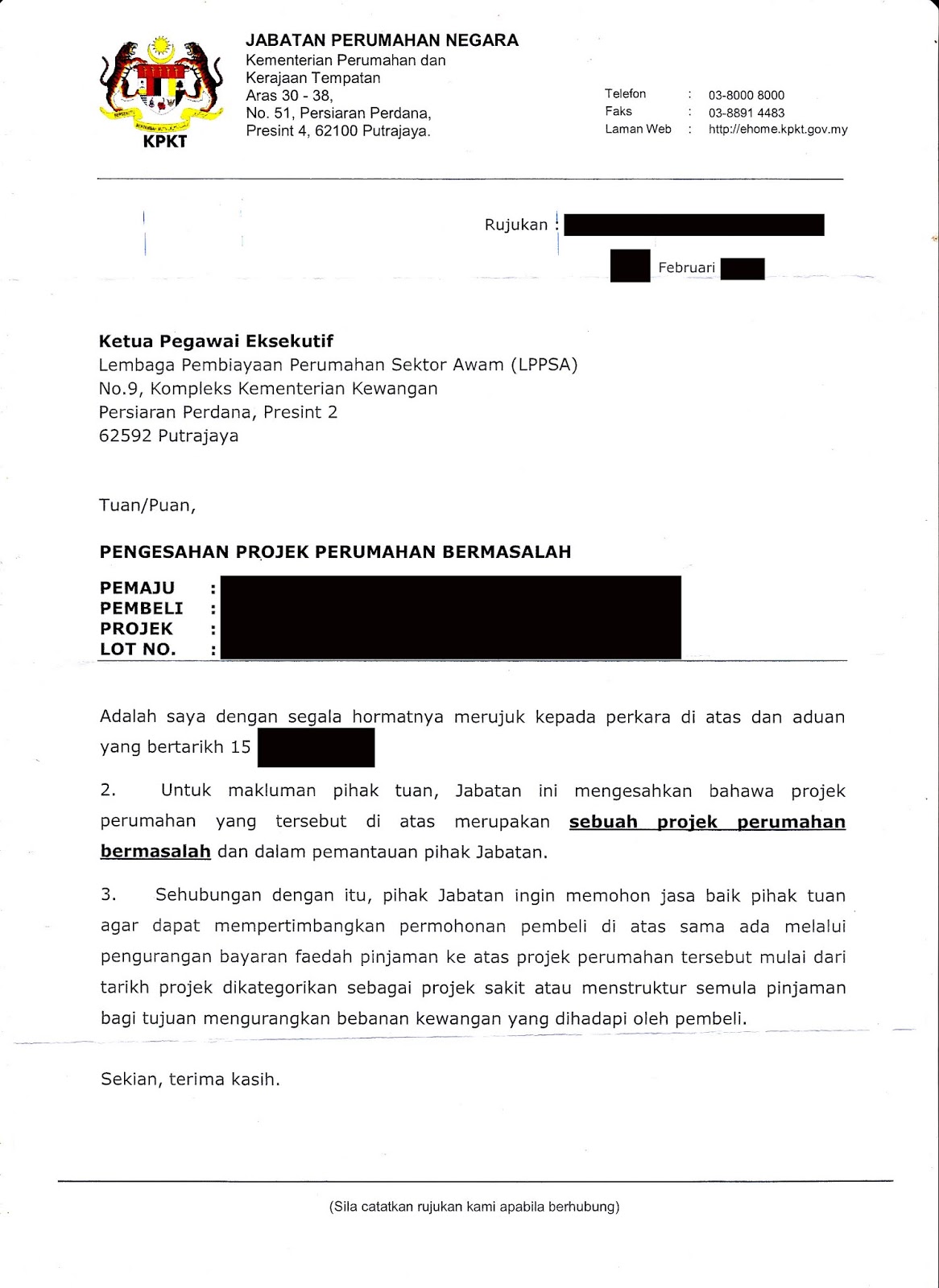

Pinjaman Perumahan Kerajaan Malaysia isn't merely a loan; it's a commitment from the government to empower its citizens. These loans often come with more favorable terms compared to conventional loans, making them particularly attractive to first-time homebuyers, civil servants, and those in specific income brackets. The aim is clear: to bridge the affordability gap and promote homeownership as a key driver of social and economic well-being.

But what exactly does Pinjaman Perumahan Kerajaan Malaysia entail? What are the eligibility criteria, the application process, and the different types of schemes available? This comprehensive guide delves into the intricacies of these government housing loans, equipping you with the knowledge and insights needed to make informed decisions on your homeownership journey. We'll explore the various facets of these loans, empowering you to navigate the process with confidence and clarity.

Whether you're just starting to explore the possibility of owning a home or are actively seeking the right financing option, understanding the ins and outs of Pinjaman Perumahan Kerajaan Malaysia is crucial. It's about more than just securing a loan; it's about understanding the support system the government has put in place to help you achieve one of life's most significant milestones. Join us as we demystify the world of government housing loans in Malaysia and unlock the door to your dream home.

Advantages and Disadvantages of Pinjaman Perumahan Kerajaan Malaysia

| Advantages | Disadvantages |

|---|---|

| Lower interest rates compared to conventional loans. | May have stricter eligibility requirements. |

| Longer loan tenures, leading to more manageable monthly repayments. | May have limitations on the types of properties eligible for financing. |

| Potential for government subsidies or financial assistance. | Processing times for applications could be longer due to government procedures. |

Best Practices for Navigating Pinjaman Perumahan Kerajaan Malaysia

1. Thorough Research is Key: Before diving into the application process, thoroughly research the various schemes available under Pinjaman Perumahan Kerajaan Malaysia. Understand the specific eligibility criteria, loan terms, and benefits associated with each scheme to identify the one that aligns best with your financial situation and homeownership goals.

2. Meticulous Financial Planning: Evaluate your financial health realistically. Calculate your debt-to-income ratio, assess your savings, and factor in additional expenses associated with homeownership, such as legal fees, stamp duty, and moving costs. This comprehensive financial assessment will help you determine a comfortable and sustainable loan amount.

3. Seek Professional Guidance: Don't hesitate to seek guidance from financial advisors or housing loan specialists. They can provide personalized advice based on your circumstances, clarify any doubts you may have, and help you navigate the intricacies of the loan application process.

4. Prepare Documents in Advance: Gather all necessary documents, such as your identification card, income statements, bank statements, and property details well in advance. Having your paperwork organized will expedite the application process and demonstrate your preparedness to lenders.

5. Timely Loan Repayments: Once your loan is approved, prioritize timely repayments to avoid late payment charges and maintain a good credit history. Setting up automatic payments can be an effective way to ensure you never miss a due date.

Common Questions and Answers about Pinjaman Perumahan Kerajaan Malaysia

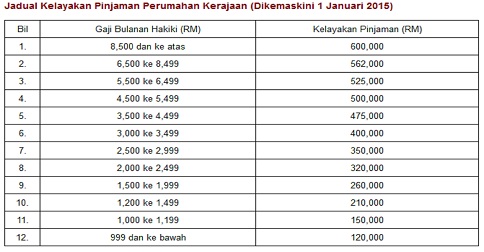

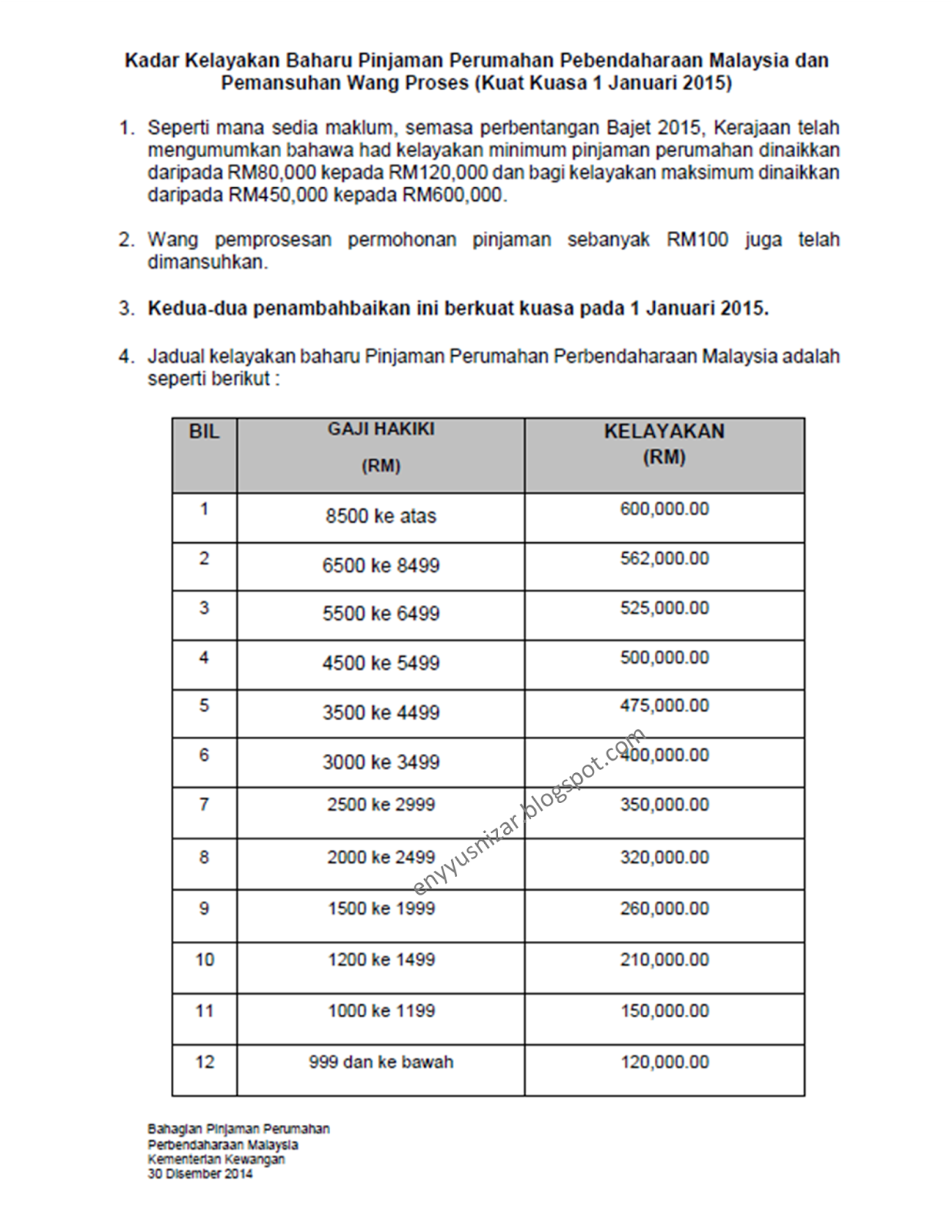

1. Who is eligible for Pinjaman Perumahan Kerajaan Malaysia? Eligibility criteria vary depending on the specific scheme. Generally, Malaysian citizens above a certain age, with a specific income bracket, and who are first-time homebuyers or fall under certain categories (e.g., civil servants) may be eligible.

2. What types of properties are eligible for financing? Most schemes cover residential properties, including landed houses, apartments, and condominiums. However, there might be limitations on the property's location, age, or value.

3. What is the maximum loan amount I can apply for? The maximum loan amount depends on factors like your income level, debt obligations, and the property's value. Each scheme has specific guidelines regarding the loan amount.

4. Can I use my EPF (Employees Provident Fund) savings for the down payment? Yes, most schemes allow the use of EPF savings for the down payment and other associated costs, subject to specific terms and conditions.

5. What is the usual loan tenure for Pinjaman Perumahan Kerajaan Malaysia? Loan tenures typically range from 20 to 30 years, depending on factors like the applicant's age and the loan amount.

6. Are there any government subsidies or financial assistance programs available? Yes, the government periodically introduces subsidies, stamp duty exemptions, or other financial assistance programs to further support homebuyers. It's essential to stay updated on these initiatives.

7. How do I apply for a Pinjaman Perumahan Kerajaan Malaysia? You can typically apply through the relevant government agency or participating financial institutions. Online portals might also be available for application submissions.

8. What is the processing time for a Pinjaman Perumahan Kerajaan Malaysia application? Processing times can vary but generally take several weeks to a few months. It's advisable to follow up with the relevant parties and ensure all required documents are submitted promptly.

Conclusion: Embark on Your Homeownership Journey

The dream of owning a home in Malaysia is within reach, thanks to the Pinjaman Perumahan Kerajaan Malaysia initiatives. These government housing loans are designed to make homeownership accessible to a wider range of Malaysians, offering more favorable terms and conditions compared to conventional loans. While navigating the world of housing loans may seem daunting, understanding the options available, conducting thorough research, and seeking professional guidance can make the process significantly smoother.

Remember, owning a home is a significant financial and personal milestone. By carefully considering your options, planning meticulously, and making informed decisions, you can turn the dream of owning a property into a rewarding reality. Take the first step towards your homeownership journey today and explore the possibilities that await you with Pinjaman Perumahan Kerajaan Malaysia.

pinjaman perumahan kerajaan malaysia | Kennecott Land

Had Kelayakan Pinjaman Perumahan Kerajaan | Kennecott Land

Pinjaman Loan Perumahan Untuk Kakitangan Kerajaan Malaysia | Kennecott Land

Perbandingan Pakej Pinjaman Perumahan Bank: Pilihan Terbaik Anda | Kennecott Land

Semakan Kelayakan Pinjaman Perumahan Kerajaan | Kennecott Land

Semakan Kelayakan Pinjaman Perumahan Kerajaan | Kennecott Land

pinjaman perumahan kerajaan malaysia | Kennecott Land

Kadar Kelayakan Pinjaman Perumahan Kerajaan Tahun 2015 | Kennecott Land

Surat Permohonan Penjadualan Semula Pinjaman Perumahan Kerajaan | Kennecott Land

Jadual Kelayakan Pinjaman Perumahan Kerajaan Lebih Relevan | Kennecott Land

Borang Had Kelayakan Pinjaman Perumahan Dari Bank | Kennecott Land

Jenis Pinjaman Perumahan Kerajaan Malaysia dan Cara Permohonannya | Kennecott Land

pinjaman perumahan kerajaan malaysia | Kennecott Land

LPPSA: Syarat Pembiayaan, Kelayakan dan Cara Mohon Terkini! | Kennecott Land

Semakan Baki Pinjaman Perumahan Kerajaan Online Dan SMS | Kennecott Land