Unlocking Medicare Supplement Plans and Part B Coverage

Are you seeking clarity on the often-confusing landscape of Medicare? Understanding the interplay between Medicare Supplement (Medigap) plans and Part B coverage is crucial for anyone approaching retirement or currently enrolled in Medicare. This comprehensive guide will demystify the relationship, helping you curate the perfect healthcare strategy for your individual needs.

Imagine Medicare Part B as the foundation of your healthcare coverage, covering essential services like doctor visits, outpatient care, and certain preventive services. But Part B doesn't cover everything. This is where Medigap steps in, offering an extra layer of financial security.

Essentially, Medigap plans help pay for some of the out-of-pocket expenses that Part B doesn't cover, like copayments, coinsurance, and deductibles. Think of it as a safety net, catching those costs that could otherwise strain your budget. This added protection allows you to focus on your well-being, rather than worrying about unexpected medical bills.

The origin of Medicare Supplement insurance lies in the recognition that original Medicare, while valuable, leaves gaps in coverage. These plans were designed to fill those gaps, providing a more comprehensive safety net for beneficiaries. Understanding this history underscores the importance of Medigap in achieving true peace of mind regarding healthcare costs.

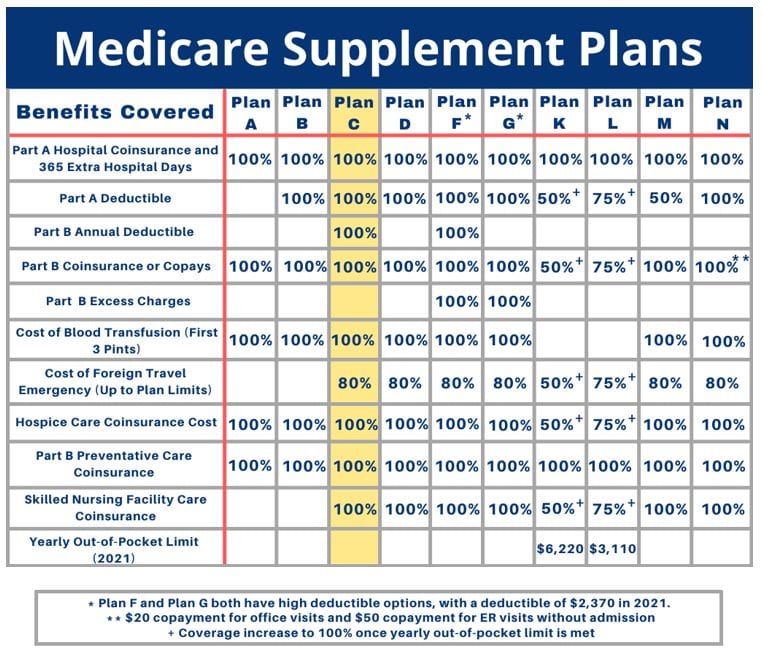

One of the key issues surrounding Medigap is choosing the right plan. With various letters designating different coverage levels (Plan A, Plan G, etc.), selecting the most appropriate plan for your needs can be daunting. This is where careful research and consultation with a knowledgeable advisor become paramount. A well-chosen plan can significantly reduce your financial exposure to healthcare expenses.

Medicare Supplement plans do, in fact, help cover some of the costs associated with Part B. They do this by picking up where Part B leaves off, paying for certain deductibles, coinsurance, and copayments that you would otherwise be responsible for. For example, if you have Plan G, it covers the Part B deductible, meaning you wouldn't have to pay it out of pocket.

One benefit of having a Medigap plan is predictable healthcare costs. Knowing what your out-of-pocket expenses will be helps with budgeting and financial planning. Another advantage is greater access to healthcare providers. Since Medigap plans are standardized, they are accepted by any doctor who accepts Medicare, giving you more choice in your care.

A further advantage is the potential for foreign travel emergency coverage. Some Medigap plans offer coverage for emergency care received outside the U.S., providing valuable protection when traveling abroad. This means that you don’t have to acquire separate travel insurance each time you leave the country.

To choose a Medigap plan, start by researching the different plan options available in your state. Compare the coverage and costs of each plan. Consider your healthcare needs and budget. Consult with a licensed insurance agent or a Medicare advisor to get personalized guidance.

Advantages and Disadvantages of Medicare Supplement Plans

| Advantages | Disadvantages |

|---|---|

| Predictable Costs | Monthly Premiums |

| Freedom to Choose Doctors | Potential for Higher Overall Cost if Health is Excellent |

| Potential Foreign Travel Emergency Coverage | Can be Complex to Choose the Right Plan |

Frequently Asked Questions:

1. What is the difference between Medicare Supplement and Medicare Advantage? Medicare Supplement works alongside original Medicare, while Medicare Advantage is an alternative to original Medicare.

2. When can I enroll in a Medigap plan? The best time to enroll is during your Medigap Open Enrollment Period.

3. Can I switch Medigap plans? You can switch Medigap plans, but you may be subject to underwriting and higher premiums.

4. Do all Medigap plans offer the same coverage? No, different plans offer different levels of coverage.

5. What is the most comprehensive Medigap plan? Plan G is generally considered the most comprehensive.

6. Are there any restrictions on pre-existing conditions with Medigap plans? During the Medigap Open Enrollment Period, you cannot be denied coverage or charged higher premiums based on pre-existing conditions.

7. Do Medigap plans cover prescription drugs? No, you'll need a separate Part D plan for prescription drug coverage.

8. Where can I get more information about Medigap plans? You can contact your State Health Insurance Assistance Program (SHIP) or visit the Medicare website.

Tips and Tricks: Compare plan premiums, consider your future health needs, and talk to a broker specializing in Medigap plans.

In conclusion, navigating the world of Medicare can feel overwhelming, but understanding the crucial role that Medicare Supplement plans play in covering Part B expenses is empowering. By taking the time to understand the intricacies of Medigap, you're taking control of your healthcare future. Remember, a well-chosen Medigap plan provides peace of mind, financial security, and the freedom to focus on what truly matters – your health and well-being. Consult a trusted advisor and embark on the journey towards a secure healthcare future today. Your future self will thank you.

do medicare supplement plans cover part b | Kennecott Land

What Tests Are Not Covered By Medicare at Antonio Marie blog | Kennecott Land

Medicare Supplement Medigap Plans Comparison | Kennecott Land

Medicare Supplement Plan C Coverage Costs Medigap Plan C | Kennecott Land

Devoted Health Advantage Plans 2024 List | Kennecott Land

do medicare supplement plans cover part b | Kennecott Land

Florida Medicare Fee Schedule 2024 For Seniors | Kennecott Land

Compare Drug Plans For 2025 | Kennecott Land

Devoted Health Medicare Advantage Plans 2024 Florida | Kennecott Land