Unlocking Your Business Success: The Power of Monthly Sales Statements

Imagine you're on a road trip. You wouldn't embark on a journey without a map, right? The same goes for your business. You need a tool that guides you, shows you where you've been, and helps you navigate toward your goals. That tool is your monthly sales statement—your financial compass for success.

In the simplest terms, a monthly sales statement (or "contoh penyata kewangan jualan bulanan" in Malay) is a snapshot of your business's financial performance over a month. It's like a report card that tells you how much you sold, what your expenses were, and ultimately, whether you made a profit or loss. It's a crucial document for any business owner, regardless of size or industry.

Now, let's rewind a bit. The concept of tracking sales and expenses has been around for centuries, evolving alongside business practices. From simple ledgers to sophisticated software, the way we generate these statements has transformed, but the core purpose remains the same: to provide clarity on financial health.

But why is this monthly ritual so important? Think about it—how can you make informed decisions about your business if you don't know how much money is coming in and going out? A monthly sales statement gives you that insight, allowing you to spot trends, identify areas for improvement, and make strategic adjustments to your operations.

Without these insights, you're essentially driving blindfolded. You might be making a profit, but are you maximizing it? Are there hidden expenses eating away at your earnings? A monthly sales statement reveals these crucial details, empowering you to make informed choices that propel your business forward.

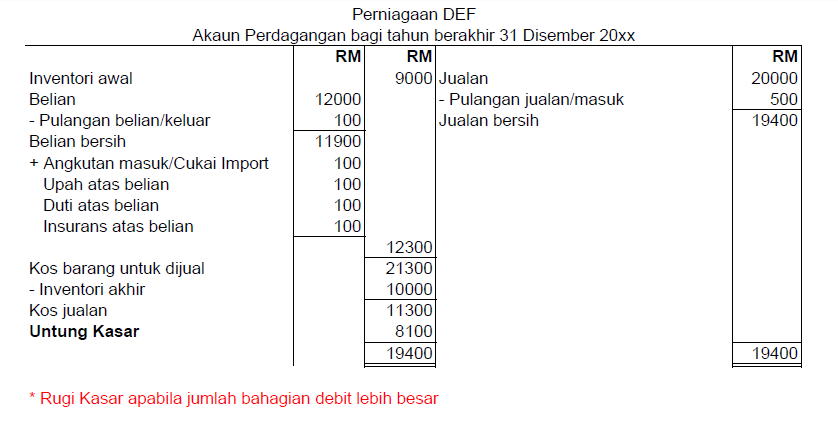

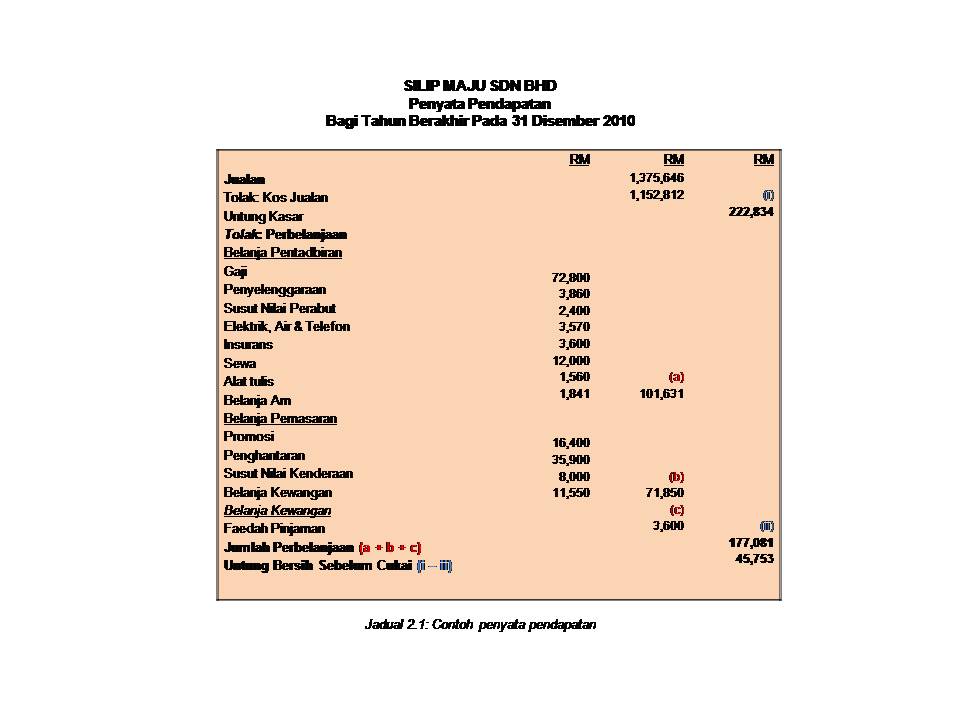

Let's delve deeper into the world of monthly sales statements. A typical statement includes key components such as revenue (money earned from sales), cost of goods sold (expenses directly related to producing or acquiring the goods sold), gross profit (revenue minus cost of goods sold), operating expenses (expenses like rent, salaries, and marketing), and net income (the bottom line—your profit after all expenses).

Advantages and Disadvantages of Monthly Sales Statements

| Advantages | Disadvantages |

|---|---|

| Provide a clear picture of financial health | Can be time-consuming to prepare manually |

| Enable informed decision-making | May not capture all financial nuances for complex businesses |

| Help identify trends and patterns | Require accurate data entry to be reliable |

| Facilitate performance tracking against goals |

To unlock the full potential of monthly sales statements, consider these best practices:

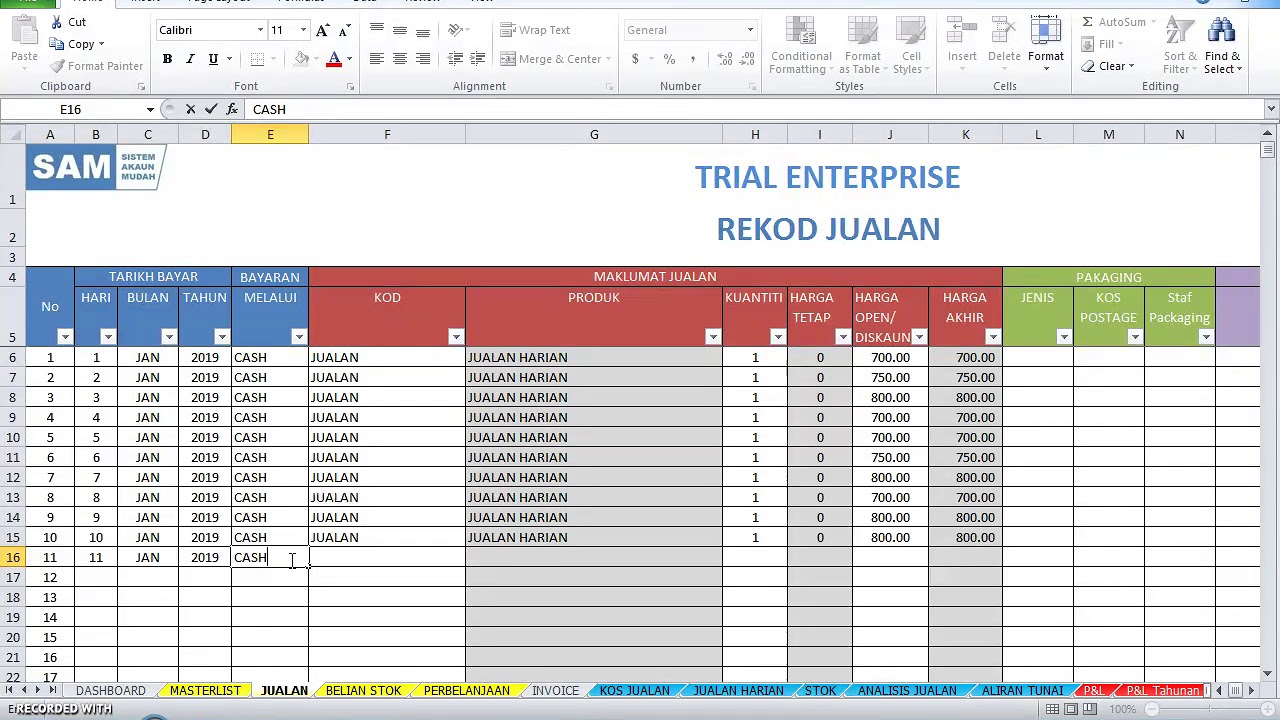

1. Embrace Technology: Utilize accounting software to automate the process, ensuring accuracy and saving time.

2. Reconcile Regularly: Compare your statements with bank records to catch any discrepancies early on.

3. Analyze the Numbers: Don't just glance at the figures; delve deeper to understand the story behind them and identify areas for improvement.

4. Track Key Performance Indicators (KPIs): Focus on metrics relevant to your industry and business goals, such as gross profit margin or customer acquisition cost.

5. Seek Professional Guidance: Consult with an accountant or financial advisor to gain expert insights and optimize your financial strategies.

While monthly sales statements are invaluable tools, businesses may face challenges such as data entry errors, difficulty interpreting financial ratios, or keeping up with the task amidst a busy schedule. However, these challenges can be overcome by implementing the best practices mentioned earlier, using user-friendly software, and seeking professional help when needed.

In conclusion, embracing the power of monthly sales statements is not merely a financial chore—it's a strategic imperative. By understanding your financial performance, you gain the knowledge to make informed decisions, optimize your operations, and chart a course toward sustainable growth and long-term success.

contoh penyata kewangan jualan bulanan | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land

Template Untung Rugi Excel & Kunci Kira | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land

contoh penyata kewangan jualan bulanan | Kennecott Land