Unlocking Your FSafeds Benefits: Understanding Qualifying Life Events

Navigating the world of federal employee benefits can feel like traversing a complex maze. Among the many options available to federal employees, the Federal Flexible Spending Account Program (FSafeds) stands out as a valuable tool for managing healthcare and dependent care expenses. However, accessing these benefits isn't always straightforward. One crucial aspect to understand is the concept of Qualifying Life Events (QLEs).

Think of QLEs as your key to unlocking or modifying your FSafeds benefits outside the annual open enrollment period. These events represent significant changes in your life that might impact your need for flexible spending accounts. But what exactly qualifies as a QLE? And how can you leverage these events to your advantage?

This article serves as your comprehensive guide to understanding and navigating FSafeds QLEs. We'll delve into the various types of QLEs, the process for making changes to your FSafeds elections, and essential tips to ensure you're maximizing your benefits during life's transitions.

Before we dive into the specifics, it's important to grasp the fundamental role of FSafeds in a federal employee's financial well-being. FSafeds allows you to set aside pre-tax dollars from your salary to cover eligible healthcare and dependent care expenses. This translates into significant tax savings, putting more money back in your pocket.

However, the rules surrounding FSafeds are designed to ensure fairness and prevent abuse. One of the key mechanisms for maintaining this balance is the requirement of a Qualifying Life Event to make changes to your FSafeds elections outside of the designated open enrollment period. This ensures that employees can only adjust their contributions or enroll in FSafeds when faced with legitimate changes in their circumstances that directly impact their need for these benefits.

Advantages and Disadvantages of Qualifying Life Events for FSafeds

While Qualifying Life Events offer flexibility in managing your FSafeds, it's essential to understand both the advantages and disadvantages they present:

| Advantages | Disadvantages |

|---|---|

| Adapt to life changes: Adjust your benefits to align with new healthcare or dependent care needs. | Time sensitivity: You typically have a limited window (usually 30 or 60 days) to make changes after a QLE. |

| Maximize tax savings: Adjust your contributions to optimize your tax savings based on your new circumstances. | Documentation required: You'll need to provide documentation to verify the qualifying event. |

| Avoid penalties: QLEs allow you to make changes outside of open enrollment without incurring penalties. | Event eligibility: Not all life events qualify, and it's essential to understand the specific requirements. |

Understanding these advantages and disadvantages can help you make informed decisions about your FSafeds elections when faced with a qualifying life event.

In conclusion, navigating the world of FSafeds and Qualifying Life Events might seem daunting at first, but armed with the right knowledge, you can confidently manage your benefits and make the most of this valuable program. Remember, QLEs are designed to provide you with flexibility during significant life changes. By understanding the types of events that qualify, the documentation required, and the process for making changes, you can ensure you're always maximizing your FSafeds benefits and adapting to life's ever-changing circumstances. Take advantage of the resources available to you, including consulting with your agency's benefits coordinator or seeking guidance from reputable online sources.

What Qualifies You For a Special Enrollment Period? | Kennecott Land

Qualifying Life Events for Health Insurance | Kennecott Land

Qualifying Life Events Health Insurance South Dakota | Kennecott Land

What is a qualifying life event? | Kennecott Land

Fillable Online Proof of Qualifying Life Event Form Fax Email Print | Kennecott Land

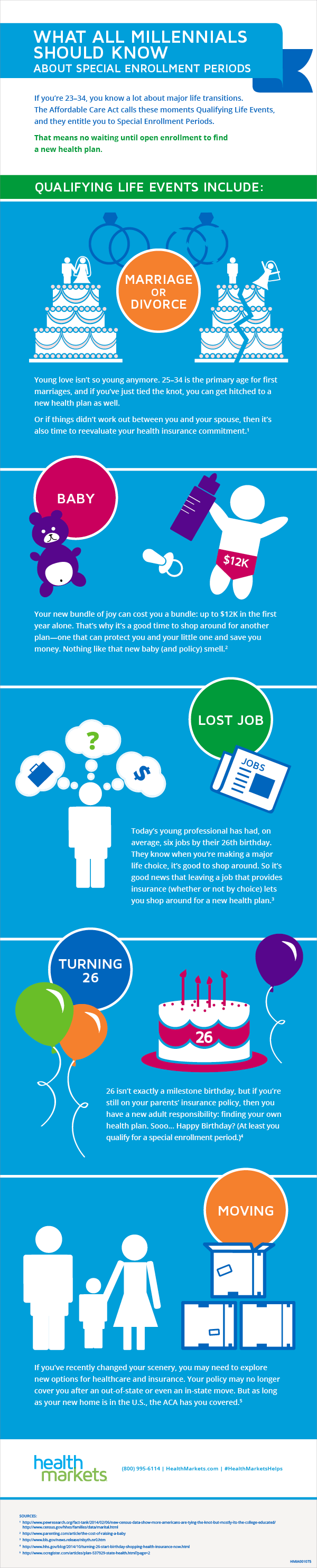

The Amazing Truth About Qualifying Life Events for Millennials | Kennecott Land

Init feature become verify via who Supervisors for Choice at of | Kennecott Land

Fillable Online Proof of qualifying life event form Fax Email Print | Kennecott Land

Qualifying Life Event (QLE) | Kennecott Land

what is a qualifying life event for fsafeds | Kennecott Land

What is a qualifying life event for health insurance? | Kennecott Land

What is a TRICARE Qualifying Life Event? > Air Force Wounded Warrior | Kennecott Land

what is a qualifying life event for fsafeds | Kennecott Land

New Special Enrollment Period Qualifying Life Events | Kennecott Land

what is a qualifying life event for fsafeds | Kennecott Land