Unraveling the Mystery: Employee Income Tax Calculation in Indonesia

Imagine this: you get your first paycheck, excited to see the fruits of your labor. But wait, what's this deduction? It's labeled "income tax," and suddenly, your excitement deflates a little. Don't worry, it happens to the best of us. Understanding how your income tax is calculated is crucial, not just for managing your finances, but also for ensuring you're fulfilling your tax obligations in Indonesia.

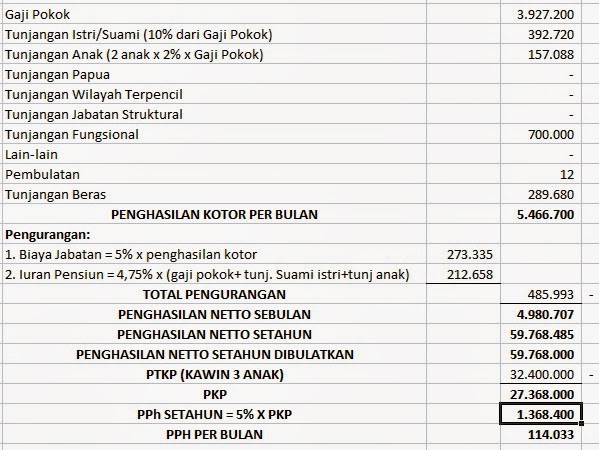

In Indonesia, the system for calculating employee income tax, or what we often refer to as "cara perhitungan pajak gaji karyawan," can seem like navigating a labyrinth. It involves understanding tax brackets, allowances, deductions, and more. But don't despair! Just like learning to ride a bike or bake a cake, it might seem daunting at first, but with a little guidance and practice, it becomes much clearer.

The Indonesian tax system operates on a self-assessment principle, implying that you, the taxpayer, are responsible for calculating and paying your own taxes. This might sound like a lot of responsibility, and it is! But it also empowers you to understand where your money is going and how to manage your finances more effectively. Plus, with digital tools and resources becoming increasingly available, staying on top of your tax obligations is simpler than ever.

Now, you might be thinking, "Why is all of this so important anyway?" Well, think of it this way: taxes are the lifeblood of any country. They fund essential services like education, healthcare, infrastructure development, and much more. When you pay your taxes correctly, you contribute to the overall well-being of society and the growth of the nation.

Furthermore, understanding how your income tax is calculated gives you a clearer picture of your financial standing. It helps you budget more effectively, plan for the future, and even explore potential tax-saving strategies. So, dive in with us as we unravel the intricacies of employee income tax calculation in Indonesia and equip you with the knowledge to navigate the Indonesian tax landscape confidently.

Advantages and Disadvantages of the Indonesian Income Tax System

Here's a table highlighting some of the advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Supports government services and national development | Can be complex for some individuals to understand |

| Promotes fairness through a progressive tax system | Potential for loopholes and tax avoidance |

| Encourages compliance through penalties for evasion | Administrative burden on employers for tax withholding |

Best Practices for Navigating Indonesian Income Tax

Let's look at some effective strategies to manage your income tax obligations smoothly:

- Keep Meticulous Records: Maintain organized records of your income, tax-related documents (NPWP, tax returns, payment receipts), and any supporting documents for deductions or allowances.

- Understand Your Tax Profile: Determine your tax residency status, applicable tax brackets, and eligible deductions based on your individual circumstances.

- Utilize Tax Calculators: Leverage online tax calculators provided by the Indonesian tax authority (DJP) or reputable financial websites to estimate your tax liability accurately.

- Explore Tax-Saving Opportunities: Research and understand potential tax-saving options, such as deductions for dependents, education, healthcare, or investments in government bonds.

- Seek Professional Advice When Needed: Don't hesitate to consult with a qualified tax advisor or accountant, especially if you have complex financial situations or require personalized guidance.

While understanding employee income tax calculation might seem like a chore initially, remember, knowledge is power! By familiarizing yourself with the Indonesian tax system, you're not just fulfilling your civic duty but also taking control of your financial well-being.

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

cara perhitungan pajak gaji karyawan | Kennecott Land

Implementasi Tarif Efektif Rata | Kennecott Land